Gold and Silver Speculators Have Left the Building

Commodities / Gold and Silver 2011 Oct 04, 2011 - 02:22 AM GMTBy: Jordan_Roy_Byrne

We use a combination of sentiment analysis and technical analysis in market timing which often gets a bad name courtesy of mainstream retail nonsense. The dumb money tries to time the market while the smart money utilizes market timing to weigh risk and reward. It's rather simple when you acquire the skills and helps you understand markets. Recently we had been quite bullish on precious metals but thought we were in a small corrective period. We were wrong as the sector has suffered from Europe's version of 2008. The good news is, our market timing work leads us to believe that the worst is soon to be over and this is an opportunity on the long side for those who have a twelve month time horizon.

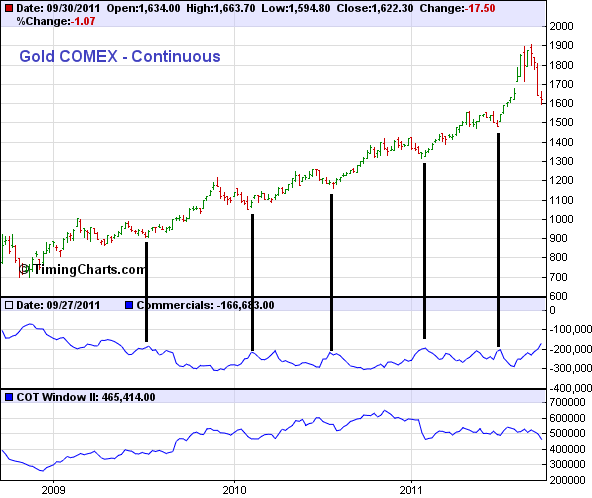

Below is the Commitment of Traders (COT) for Gold. The data is as of last Tuesday. The commercial short position has dropped nearly 50% in the last few months. The commercials (the smart money, the end users and producers) are positioned more bullish than any other time in the past two years. This is another way of saying the speculative long position is at a two year low. Meanwhile, open interest is 28% off its high and close to a two year low.

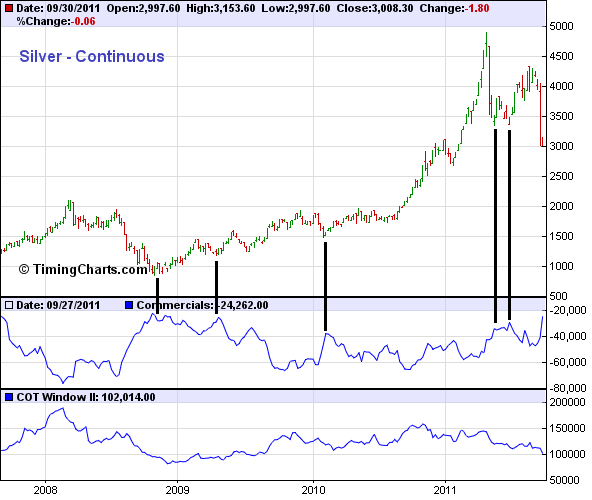

In Silver, we see that the commercials are are net short only 24K contracts. This is the lowest since December 2008. Open interest is 35% off its high and at its lowest point since the end of summer 2009.

In addition, the latest public opinion report from sentimentrader.com (as of last Tuesday) shows 58% bulls on Gold and 31% bulls on Silver. Any further drop in Gold would mark a three-year low while the public is its most bearish on Silver since September 2008.

Even one month ago the speculative money was not so involved in precious metals. The recent carnage in equities and in Europe precipitated the selloff in precious metals which has caused all the remaining speculators to exit the market. Sure, we could see the metals move a bit lower and have sentiment turn even more bearish. It's not impossible. However, Gold and Silver are rallying today and will soon begin a bottoming process. Sentiment tells us a bottom is very likely. Now we need the price action to confirm.

If you’d be interested in professional guidance then we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.