Is It Time to Load up on Gold Stocks?

Commodities / Gold & Silver Stocks Oct 14, 2011 - 01:47 PM GMTBy: Jeff_Clark

Jeff Clark, Casey Research writes: By almost any measure, gold stocks are undervalued. Should we load up?

Jeff Clark, Casey Research writes: By almost any measure, gold stocks are undervalued. Should we load up?

After completing my research on this question, I’m convinced more than ever that we at Casey Research are in the right place. See if you agree…

Let’s first get a handle on the degree of undervaluation. The more undervalued, the lower the buying risk. A fairly valued stock, on the other hand, requires added caution.

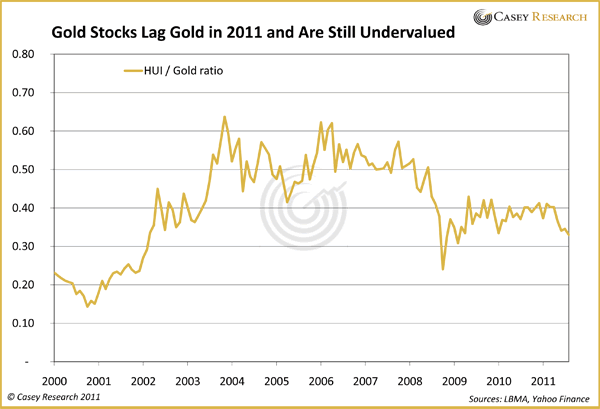

Gold accelerated higher last month, peaking around $1,900/ounce, while gold stocks lagged. Here’s a chart of the HUI-to-gold ratio (HGR). In a rising gold environment, a climbing HGR indicates that gold stocks are outperforming the metal; a falling HGR means they’re trailing gold.

Today’s 0.33 HGR means gold stocks as a group have not been this cheap, relative to their underlying metal, since January 2010. And a lower ratio hasn’t been seen since February 2009, when recovering from the 2008 global meltdown.

Also consider that the GDX (Gold Miners ETF) is about the same price as last December, while gold is up 30%.

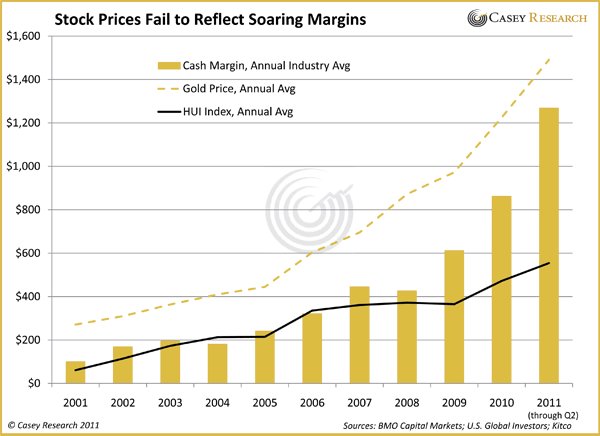

I think there’s a more compelling situation that demonstrates the undervalued nature of gold stocks. It’s hard to read a mining company’s quarterly report these days without hearing about “growing margins.” The gold price has risen faster than operating costs across our industry and lifted profit margins of the better-run producers.

Higher margins are key to growing earnings and cash flow, which in turn lead to rising stock prices. Have gold mining equities kept pace with ever-increasing margins?

Gold mining companies are earning record margins, averaging a whopping $1,268 per ounce last quarter. In both nominal dollars and percentage above costs, margins have never been this high for the gold producers. Stock prices, however, have not responded in similar fashion.

This is a potentially significant point, because margins of this magnitude will be ignored only so long. When the broader investing community begins to take notice, investors will snap up these highly profitable stocks and push prices higher. The “catch up” in gold stocks could be tremendous.

The conclusions from these data seem clear: Gold stocks, as a group, are undervalued. The incredible profit margins generated by our sector will attract investors – sooner or later. And picking the better stocks, like most of those in BIG GOLD, is more profitable than buying a gold stock fund.

We’re in the right place.

The question, of course, is timing. We don’t know when gold stocks will begin to catch up. And the data don’t suggest they must rise right now or that they’ve hit bottom. Contributing to their price weakness is concern that the recent surge in the gold price isn’t sustainable. I can also tell you that the “Casey consensus” sees the risk of another significant decline in the broader markets as a distinct possibility, and if one materializes, gold stocks could undergo a temporary swoon.

We’re convinced they’ll someday hit lofty levels, but for now we maintain the same refrain: keep one-third of assets in cash. This reduces risk and gives us a nice pile of funds to deploy during any selloffs.

In the big picture, gold has ratcheted steadily higher throughout the rallies and corrections, a trend we’re confident will continue for some time. As the price sets new highs and margins remain robust, our sector will attract more attention. We must patiently stay the course until those new realities begin to set in.

Make sure you have exposure to gold stocks, but it’s not yet time to jump in, yelling “Geronimo!”

[As fiat currencies accelerate their inevitable paths to eventual destruction, gold will ascend. How far and how fast remain to be seen, but you can get insights and actionable advice on gold and gold stocks – and much, much more – from the recently held Casey Research/Sprott Summit, When Money Dies. You can learn what legendary investors like Rick Rule and Doug Casey are doing and recommending… get invaluable insights from analysts including Adam Fergusson and Lew Rockwell… from audio recordings of the entire event that are available to order now.]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.