Fractal Self-similarity and the Stock Market Crash Wave Pattern

Stock-Markets / Financial Crash Oct 19, 2011 - 04:46 AM GMT In tracking the 2007-2008 decline, I noticed that there was a certain repetition (self-similarity) in the wave structure that may also be playing out today. One of the few rules in the wave structure is that third waves are never the smallest. From there, we can use guidelines (not rules) that suggest general wave behavior.

In tracking the 2007-2008 decline, I noticed that there was a certain repetition (self-similarity) in the wave structure that may also be playing out today. One of the few rules in the wave structure is that third waves are never the smallest. From there, we can use guidelines (not rules) that suggest general wave behavior.

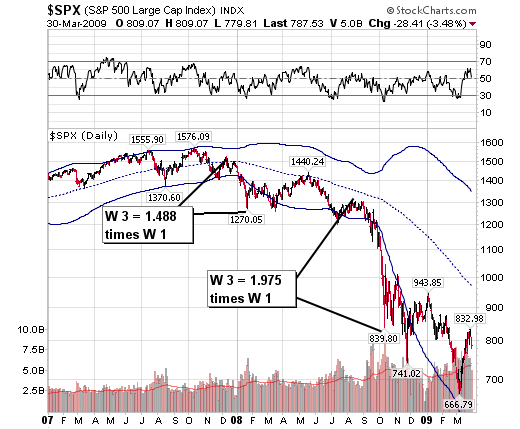

Third waves are generally the longest and strongest. Thus, it follows that a third-of-a-third wave may have the potential for the greatest destruction. For example, wave (iii) of 1 of (A) was 1.488 (1.5) times the size of its wave (i) in the same series, while wave (iii) of 3 of (A) was 1.975 (2.0) times the size of its wave (i). See the chart below.

Here’s where thing may get interesting…

Wave (iii) of 1 of (C) is 2.73 (2.75) times as large as its corresponding wave (i). Could it be that wave (iii) of 3 of (C) maintains or even expands that relationship? If the current wave (iii) of 3 remains at 2.75 time the size of wave (i) of 3, then the target could easily be 795.00 or 800.00. On the other hand, should the relationship of wave (i) to (iii) become larger, as in wave (A), then wave (iii) of 3 could expand to 3.382 or 3.618 times, which may yield targets of 697.00 (3.382 X) or even 660.00 (3.618 X).

All of these calculations are hypothetical and should be taken with a grain of salt, or two. The following is a view into what may happen going into 2012. No, it won’t be the end of civilization as we know it, but pretty daunting, nonetheless. I’ll keep this chart to see how close my calculations really are.

This isn’t pie-in-the-sky. The truth is, it may even be worse – much worse. I hope that you have prepared for this event. It may be coming sooner than you think. The good news is that the cycles suggest the final end to this decline may occur in April 2012. I’ve said my prayers and suggest you do, too.

Good luck and good trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.