Why the Gold Price is Ripe for a HUGE Rally Soon

Commodities / Gold and Silver 2011 Oct 24, 2011 - 02:44 AM GMTBy: Sam_Chee_Kong

For centuries, gold has been recognized as one of the best way to preserve one’s wealth and maintaining its purchasing power. Even in ancient times during the Egyptians and Greeks rule, gold has served its purpose for not only for its beauty but also for the function being a means of exchange and also its power to change one’s life. As with anything that has any value attached to it, there will always be ups and downs in its price discovery mechanism.

For centuries, gold has been recognized as one of the best way to preserve one’s wealth and maintaining its purchasing power. Even in ancient times during the Egyptians and Greeks rule, gold has served its purpose for not only for its beauty but also for the function being a means of exchange and also its power to change one’s life. As with anything that has any value attached to it, there will always be ups and downs in its price discovery mechanism.

The Gold market has been relatively stable since it retraced from its recent high in August of $1927 and a low of $1529 on September 16th. Volatility of the VIX indicator has somewhat stabilized. On our previous article, we have recommended a sell order in August after a mini parabolic run in the Gold price. So where to now?

In view of both political and economic developments throughout the world, we have come to the conclusion that it is about time to be bullish on Gold again. There are both fundamental and technical reasons to be bullish on Gold at this moment in time.

Fundamentally, there are various reasons why Gold price is about to head north soon.

FIRST, the demand for Gold in Asia will soon take off for the reasons that it is approaching end of year festivities for various communities. As for the Indians, the festival of lights or ‘Deepavali’ , is going to fall on the 26th October. Traditionally, during such festivals the Indian communities will buy gold jewelry either for themselves or as a gift for their relatives and hence the demand for gold will soar. According to Srivanesan, an official from the Indian Gold Dealer Association, the demand for Gold during such festive seasons, normally ‘will increase by more than 30%’.

Come November and December, it will be the wedding season in Asia. The Muslim communities in South East Asia will normally held their weddings during school holidays and it could not be better timing other than the end of year long school holidays. Unlike the Chinese and Indians where they choose their wedding dates using Feng Shui and Vaastu Sastra (Indian version of Feng Shui), the Muslim communities tends to have their weddings during holidays because it is the time where everyone is free and relatives will be able to give a helping hand.

On top of that, with the coming of the Lunar Chinese New Year also provide another reason for the increase demand for gold. Traditionally Chinese families will buy gold either for themselves or as a gift to their close ones during this festive season. Goldsmiths will also churn out special editions or collectibles according to the zodiac sign of that particular year. Moreover, the month of December and January are also considered as auspicious months for getting married for the Chinese and hence the demand for Gold.

SECOND, making gold as an investment is now considered trendy among the younger generations. Gold again is the choice for jewelry instead of diamonds and precious stones like ruby, emerald and etc due to the value that is attached to gold. Moreover due to persistent marketing and educating efforts by the governments in Asia, investment in physical gold through the gold bullion coins had increased by multiple folds. A check on several banks here in Malaysia showed that the Kijang Gold coin is unavailable due to excessive demand.

Across the South China Sea, China has installed its first Gold Vending machine on the 1st week of October, to join other countries such as USA, Germany, Italy and the United Arab Emirates in hosting an ATM machine that dispenses Gold coins and bullion. The public can now purchase certified gold coins with credit cards and cash through such machines. The Chinese government is keen to promote the sales of gold in the country and its effort has seen an increase in demand for gold by 27% last year. In order to accommodate the increased demand for gold, the Chinese government plan to install 2000 more ATM gold vending machines throughout China by next year.

A report by World Gold Council in May this year showed that China has taken over India as the world’s largest gold consumer, consuming about 91 tons which translates to about an increase of about 21% year on year.

THIRD, the ratio of Gold to Foreign exchange in Asian countries is very low compared to Western countries. If you look at the World Gold Council’s Dec,2010 chart for Gold/Forex reserves, the biggest holder of gold/forex are the Eurozone countries and US.

You also notice that Asian countries are having the lowest Gold/Forex ratio even though China, India and Japan have one of the largest tonnage of gold in its reserve. What does it tells us? It simply tells us that Central Banks in Asia is about to go for a spending spree in gold buying in order to increase its ratio of Gold/Forex. With China’s forex reserves standing at $3.2 trillion, Japan’s $1.1 trillion and India’s $311 billion, there will be a lot of gold buying among them in the coming months and years. When Central Banks starts ramping up their purchase of gold, it might create a panic buying in gold and thus will push up its price ‘fast and furious’. Gold price discovery can happen in days unlike in housing where it may take months and years.

The figures supplied by the WGC might not reflect the true holdings of Gold by the Central Banks of the world. China might be holding much more than the reported 1053 tons because there have been a significant drop in Gold exports from China in recent years.

For all you know, Central Banks are the ones that are controlling the gold trade all this while. They have been manipulating the gold market through tactics like ‘Pump and Dump’ and also controlling the gold price through exchanges like SGE and CME by increasing the margins. When the price collapse, they will be quietly collecting gold to replenish their vaults like what is happening now. As for the Western countries like USA and Europe, if the ‘Empty Vault’ theory holds true then they might be holding much less gold than reported and heck all hell will break loose on the price of gold.

FOURTH, Gold price will always be supported as long as debts are monetized and inflation remains high. According to the GAO, so far the FED has provided more than $16 trillion of bailout money to banks. It is universally known that you can’t fight debt with more debts and by printing more money to bailout ‘too big to fail’ banks will only result in further inflation of the prices of goods and services.

With the rate of inflation running at 9% in India and 6% in China and food inflation running at more than 10%, there is no reason why the price of gold should go down any further. This is because gold will always be a hedge against inflation and the demand will always be there during bad times.

FIFTH, it’s the China factor. China has been quietly accumulating gold for the past few years. According to Wikileaks :

"China increases its gold reserves in order to kill two birds with one stone"

"The China Radio International sponsored newspaper World News Journal (Shijie Xinwenbao)(04/28): "According to China's National Foreign Exchanges Administration China 's gold reserves have recently increased. Currently, the majority of its gold reserves have been located in the U.S. and European countries. The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold's function as an international reserve currency. They don't want to see other countries turning to gold reserves instead of the U.S. dollar or Euro. Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar's role as the international reserve currency. China's increased gold reserves will thus act as a model and lead other countries towards reserving more gold. Large gold reserves are also beneficial in promoting the internationalization of the RMB."

So, no doubt there will be continuous demand for gold from the Chinese Authorities in the coming months and years and hence provide a support for gold price.

SIXTH, another group of investors that we have overlooked is the funds industry. The funds industry controls most of the wealth around the world, be it hedge funds, sovereign wealth, insurance companies, mutual funds, pension funds and etc. It is estimated that they control about $31 trillion worth of assets which is more than double the GDP of U.S which is about $14 trillion. It is estimated that the funds industry holds less than 0.15% of their assets in gold which translates to about $46.5 billion.

What will happen when the fund industry realized that they are currently underinvested in gold and if the ongoing financial crisis in Europe making a turn for the worse, creditors are liquidating Treasuries en masse, bonds and stocks providing lower than expected returns and etc. What if they decided to increase their exposure to gold say by another 0.15%? This will represent another $46.5 billion of fresh funds available for new buying. Just imagine what impact it will have on the price of gold? I am sure in a year or two, we will be saying that gold at $2000 is cheap.

LASTLY, from a technical perspective Gold since retraced from August has been in a sideway consolidation for the past month and the market seems to be having a strong support at 1600. It is now stabilizing around the 1600-1650 level and with the tightening of the Bollinger bands, it seems like it is about to breakout from it.

Based on the peak in August 23rd ($1927) and the trough in September 26th ($1529) the total price retracement is $398. The blue line is the 50 day Moving Average, and it tracks the fading in and fading out of the markets by institutional and large funds in the market. When price breaks below the MA50 it shows that Institutional investors are getting out and vice versa.

If the price breaks above the MA50 line the chances of the market to have a full recovery of its losses ($398) will be very good. In normal conditions, the market will drop at least 2-3 times faster than it goes up. In this case it took about a month for it to drop from $1927 to $1527 and hence the time interval for a full rebound in the price will be at least 2-3 months with Volume being a constant. Hence, the earliest recovery of prices will only happen towards the end of November and December.

The immediate target will be 1527 + 199 ($398/2 or 50% rebound) = $1726. If the market is able to break the previous high of 1927, then the subsequent mid term target will be 2325 (1927+398)

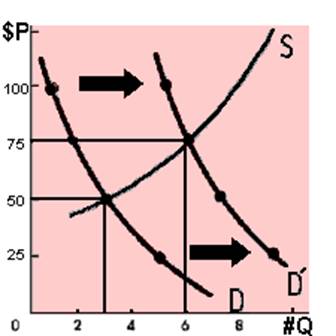

The speed of the recovery depends on the Volume. The larger the volume accumulated during the consolidation phase the faster the recovery. This is because the bigger volume indicates that the market participants are more bullish and hence will attract more buyers even though price may go up during the accumulation phase. This will result in an outward shift in the demand curve from its current position and a new equilibrium in the price discovery will be achieved.

The following figure shows you the effect of a shift in the demand curve to the right which may be due to the following reasons:

- increase in expectation towards the particular goods

- changes in the taste and preference

- an increase in the risk appetite towards gold because alternative investments like stocks ,bonds, terms deposits and etc seems more risky now.

- an increase in the income either through the sale of assets or investments like stocks, bonds or an increase in your pay.

In this case the old equilibrium is achieved where price and quantity is $50 and 3 respectively. However due to factors above, it enabled the demand curve to shift to the right and hence the new equilibrium is $75 and 6. Even though the price increased to $75 but the quantity demand also went up in this case to 6.

In other words, an upward rise in prices from any investment will only happen when there is MORE BUYING THAN SELLING.

So, in the SHORT TERM with both technical and fundamental factors pointing towards a bullish bias for gold, there is no reason why we shouldn’t be long on gold in the coming days and weeks. As they said “Don’t let a good crisis go to waste”.

by Sam Chee Kong

cheekongsam@yahoo.com

© 2011 Copyright Sam Chee Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.