Commodities Snapshot: Oversold For Now, Dollar Holds The Key

Commodities / Commodities Trading Oct 25, 2011 - 12:55 AM GMTBy: EconMatters

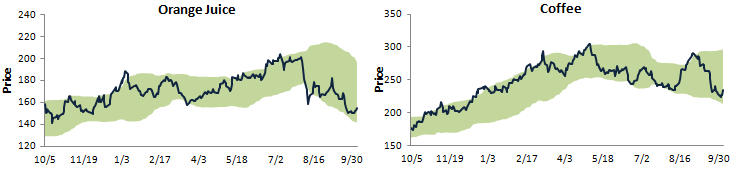

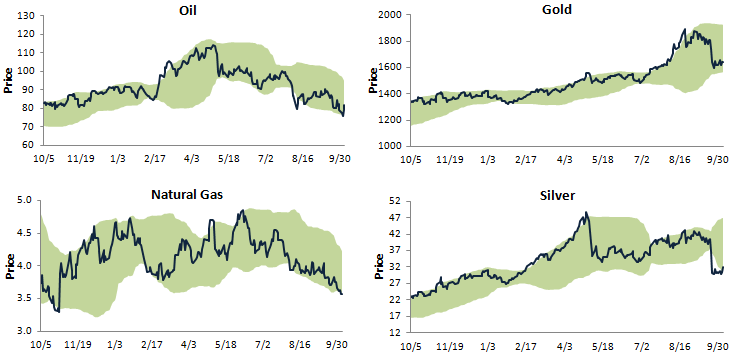

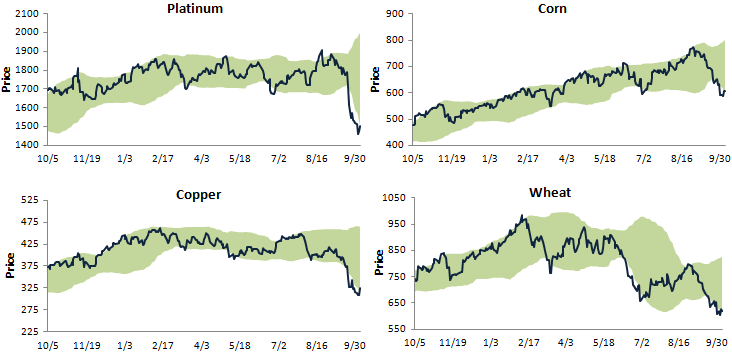

Below are trading range charts for 10 major commodities from the Bespoke Group. All 10 commodities are currently at or below the bottom of their trading ranges, which would suggest at the moment, a good opportunity to get in at oversold levels for investors looking to gain long-term exposure.

However, U.S. dollar has been strengthening as investors fled the Euro debt and financial crisis seeking safety in the dollar. Since most commodities are priced in dollar, dollar movement will have considerable impact on commodity prices. EconMatters guest author, Frank Holmes at US Global Investors, estimates that a 5% appreciation in the dollar could be associated with a 25% decline in commodity prices, based on the relationship between the CRB Index basket of 19 commodities and the Dollar Index.

So if the U.S. dollar continues to strengthen, which is quite probable with the burning Athens, and the lack of leadership and clarity in the Euro Zone, it would most likely put downward pressures on commodity prices.

But on the other hand, the U.S. Federal Reserve has already telegraphed the intention of yet another round of quantitative easing (QE3). So the effect on the dollar, and thus commodities, would depend on how QE3 is implemented. We suspect that the Fed now understands how QE2 has artificially jacked up commodity prices as well as inflaiton (although they will never admit it in public), and most likely will strive for a "commodity neutral" QE3.

However, if QE3 does translate into a similar effect to QE2, then commodities would be artificially inflated even further, which would suggest stagflation, and hyperinflation could be expected in most of the developed countries, and developing economies, respectively.

Chart Source: Bespoke Group,

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.