Fireworks in Europe Confirm that Gold and Silver are Still the Safe Havens

Commodities / Gold and Silver 2011 Oct 26, 2011 - 06:01 AM GMTBy: George_Maniere

Expecting good news from Europe today? Guess again. The market seemed to price in what they expect to hear tomorrow as the Dow fell 207 points to close at 11706, the S&P fell 25.14 points and closed at 1229.05 and the NASDAQ fell 61.02 points to close at 2638.42. While this seems like a drastic sell off we must remember that it was only one month ago that the S&P was putting in a bottom at 1100.

Expecting good news from Europe today? Guess again. The market seemed to price in what they expect to hear tomorrow as the Dow fell 207 points to close at 11706, the S&P fell 25.14 points and closed at 1229.05 and the NASDAQ fell 61.02 points to close at 2638.42. While this seems like a drastic sell off we must remember that it was only one month ago that the S&P was putting in a bottom at 1100.

Gold blew past $1,700 today on a slew of grim U.S. economic data and deepening concerns over the European sovereign-debt crisis. The dollar got weaker against the Euro but most important was the uncertainty from the meetings tomorrow in Europe which I conclude were the main factor in this market selloff. Confusion reigned in Europe over whether a key meeting of finance officials to resolve the debt morass Wednesday had been canceled. By the end of the day it was reported in the Wall Street Journal that this was not a rumor. The finance ministers had cancelled their meeting. The meeting of the Heads of State of the 17 Euro countries will be held and everyone has promised to bring their fireworks.

The European Union is doomed to fail because the divide between the northern and southern countries is just too great. At the outset of the creation of the euro in 1999, it was expected that the southern Eurozone economies would behave like those in the north; the Italians would behave like Germans. They didn’t. Instead, northern Europe fell into subsidizing southern Europe’s excess consumption or its current account deficits.

I predict that as the south's fiscal crisis deepens, the flow of goods from the north will stop altogether and southern Europe's standard of living will go down. The effect of the divergent cultures in the Eurozone has been grossly underestimated. The only way to have several currencies from divergent nations lumped together is if they are culturally close, such as Germany, the Netherlands and Austria. If they aren’t, it simply can’t continue to work.

This is so pathetic. They are talking as if the question is do you want the rescue check in the blue envelope or the green envelope? There is no rescue check. Unless they start getting one of Dr. Bernanke's helicopters, we may have a problem. So let's pretend there is a real problem tomorrow, nothing firm, not even agreement in principle. Something messier than the market wants, how many points come out? That begs the question how does it happen? The European politicians are acting as if this is a rational process but this can turn irrational very rapidly. If they accidentally have one misstep they could have a situation that creates a firestorm. Then it could be ugly. You could give back more than half of what we gained since the October lows.

If you thought silver and gold were not safe havens anymore – think again. Gold closed at 1706. Silver closed at 33.05.The safe havens of gold and silver are alive and well. I was particularly amazed at the response to my newsletter today “silver waits to breakout.” I received 39 comments on the post and to my surprise most of them were about silver as a safe haven currency. It made me think my prediction of $50.00 silver by year’s end was not that far off.

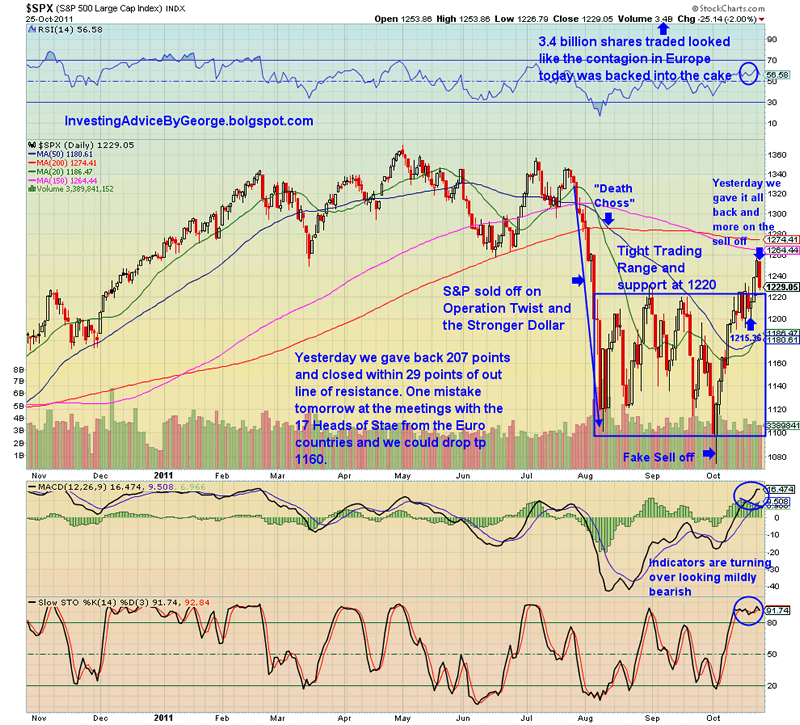

So how do we trade this economic tsunami? Let’s take a look at the chart below.

As you can see we gave back 207 points and closed the day just 29 points from our level of resistance that had taken since August to break through.

I added GLD, IAU, SLV and PSLV to my already overweight positions. I then added DZZ and ZSL as a hedge against them for some protection. Yesterday I had the good fortune to load the boat with SPXU and it moved up 6% on rumors. Tomorrow will be the real rest. If there is no consensus from the meeting tomorrow in Europe we could be at 1160 in a day.

In conclusion, on Monday when the S&P bounced off of the 100 day moving average and I knew that Europe was two days away I loaded the boat with gold, silver and SPXU. These are the only speculative stocks I own. I think we will see a major selloff on Wednesday and Thursday. We will then see a day of consolidation on Friday and next week if Europe can come to some sort of agreement we will see the market rally to the end of the year.

Enjoy the ride!

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.