Why Gold Stocks are Set for a Big 2012

Commodities / Gold & Silver Stocks Oct 31, 2011 - 05:16 PM GMTBy: Jordan_Roy_Byrne

Last week we discussed the concept of relative strength. Again, relative strength is the measuring of one market against another. There are perhaps 1000 mining companies and maybe 5% of them are worthy of your research and investment. Fundamental analysis should lead you to the best companies while technical analysis (relative strength analysis in this case) can generate a precise list of top prospects. Today we are focusing on relative strength in a larger context and will then apply it to the gold stocks.

Last week we discussed the concept of relative strength. Again, relative strength is the measuring of one market against another. There are perhaps 1000 mining companies and maybe 5% of them are worthy of your research and investment. Fundamental analysis should lead you to the best companies while technical analysis (relative strength analysis in this case) can generate a precise list of top prospects. Today we are focusing on relative strength in a larger context and will then apply it to the gold stocks.

One of the best times to use relative strength is during or after a strong market selloff or panic. After 2008, I was most bullish on Gold and Agriculture for the simple fact that both didn't have the long-term technical damage that occurred in most markets. Most markets plunged below 2005 lows. Markets that escaped that fate and held up reasonably well would make new highs first and well ahead of global stock indices (which have yet to make new highs).

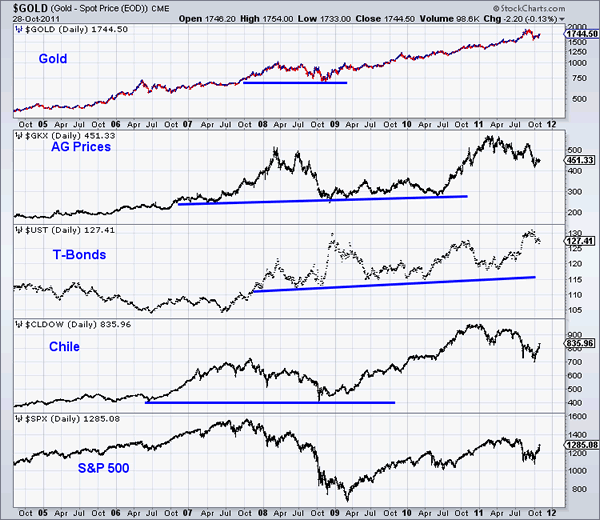

In the chart below we show various markets (Gold, AGs, T-Bonds, Chile, S&P). Gold bottomed in late 2008 above its summer low in 2007. Agriculture prices bottomed slightly ahead of their bottom in spring 2007. Bonds maintained their uptrend in 2008 and beyond. Chile has been one of the strongest markets (held above 2006 lows) and surged to new highs while the S&P is nowhere close to a new high. The other four markets had the best relative strength in 2008 and thus performed the best from 2009-2010.

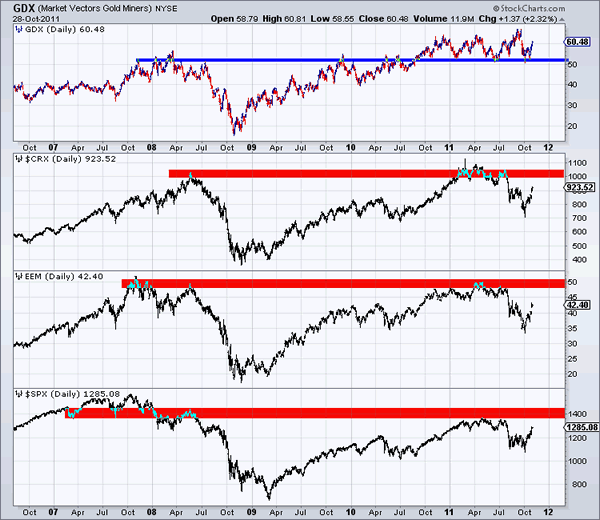

So how does that history apply to today? We just had a mini-panic or a mini-2008. The stock market likely put in an intermediate bottom. This doesn't mean it will breakout but it means the lows are safe for a while. Now its time to spot the relative strength leader which will be a leader in the immediate future. In the chart below we compare gold stocks to commodity stocks, emerging markets and the S&P 500.

While emerging markets and commodity shares are in structural bull markets, both will soon meet multi-year resistance. Also, both broke their previous 2011 lows. Essentially, both have short-term technical damage to repair and long-term resistance to overcome. Meanwhile, the gold stocks have been in a consolidation for 12 months and held above their summer low during the mini-panic. We see a combination of relative strength and very limited overhead resistance.

A weekly close above $67 in GDX should usher in the beginning of a true bull market move in the gold stocks. After viewing these charts one can visualize the gold stocks galloping higher in 2012 while their commodity and emerging market counterparts encounter multi-year resistance. The reasons do go beyond technical. We've written about the low valuations, lack of ownership and the bull market moving towards its recognition point. The recent double bottom in GDX should make one feel more comfortable. Their relative strength in 2011 indicates leadership and potential for a major move higher in 2012. If you'd like professional guidance in navigating this bull market and finding the best performing stocks then we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.