Laissez-faire: The Best Fed Policy Is To Stand Pat

Interest-Rates / Central Banks Nov 06, 2011 - 05:49 AM GMTBy: EconMatters

Operation Twist through 2012, and keeping the benchmark interest rate near zero to at least mid-2013.

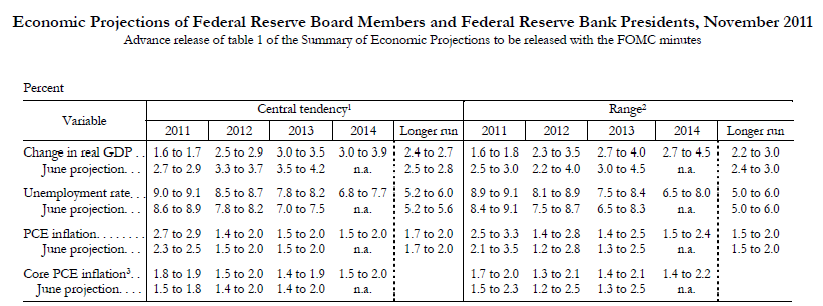

Nevertheless, the more important (albeit coded) message is how much more pessimistic the Fed has gotten just within the past five months. Below are the table from the Fed latest November economic forecast with the prior projection issued in June.

As the table illustrates, the Committee has significantly downshifted the GDP growth outlook, which suggests the Fed is as usual a step behind reality reacting to the summer market sell-off and the weak part of the year that started after Fed's June guidance.

The problem is that by equating past market performance to the real economy, the Fed is once again risking doing too much, too quickly, at the wrong time, as in the case of QE2. Just think about how much better the economy would have been without the QE2-inflated high energy, and commodity prices? (For more detail analysis, see QE2: An Unmitigated Disaster?)

Moreover, Fed's inflation projection, in our opinion, is too optimistic--with a deflationary bias--given the global synchronized liquidity injection since the 2008 crisis, and the robust emerging markets future demand outlook.

The U.S. Consumer Price Index (CPI), including food and energy, already jumped 3.9% year-over-year in September, while the wholesale PPI (Producer Price Index) also surged 7% year-over-year. Moreover, most of the recent economic indicators including trade and freight data are pointing to an increasing risk of inflation or stagflation, instead of deflation. (On a side note, we never get the rationale behind Fed's focus on the "core" consumer inflation, i.e., excluding food and energy, since these are necessities that consumers have to pay on a daily basis.)

Moreover, we are also alarmed by the shifting dynamics within the FOMC members which would suggest an increasing likelihood of another QE2-like disaster. The behind-the-scene story inside the Committee is the emergence of one FOMC dissent--Chicago Fed President Charles Evans-- in favor of further policy easing. Chief Economist of JPM, Bruce Kasman, noted in a Bloomberg interview that Evans' dissent probably reflects the concerns of at least three or four other members on the committee.

After the summer doldrums, the Q3 2011 GDP number is already starting to turn around, jobs numbers are getting better, and there are other signs that the economy is on the mend as well. So the best policies right now for the economy are ironically

- Gridlock at U.S. Congress, which means nothing would get passed or implemented, and

- The Federal Reserve standing pat.

These need to take place so to give business as well as consumers a break from the continuing legislative burden, and the artificially inflated food, energy, commodity input costs courtesy of Fed's two rounds of QE.

Laissez-faire, literally means "leave it along", is probably a hard concept for the U.S. Keynesian policy makers to swallow, but since nothing else seems to have worked out as planned, now would be a good time to try something different for the greater good of the real consumer economy vs. the Wall Street "trader economy".

Albert Einstein once said "Insanity: doing the same thing over and over again and expecting different results." QE3, if disbursed with the same methodology as QE2, would be exactly that--Insanity.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.