Perfect Storm, European Banks Heading for Chapter 11 Bankruptcy

Stock-Markets / Credit Crisis 2011 Nov 22, 2011 - 06:00 AM GMTBy: Mike_Shedlock

Panic is spreading says Steen Jakobsen, chief economist at Saxo Bank. Steen eyes the perfect storm including a potential "Chapter 11" call for European banks.

Panic is spreading says Steen Jakobsen, chief economist at Saxo Bank. Steen eyes the perfect storm including a potential "Chapter 11" call for European banks.

Via Email

This morning there is too much bad news.

US Super Committee failed to find the 1.2 trillion US Dollar needed to stop the automatic spending cuts being initiated from 2012, but the more acute problem being the expiration of the payroll tax and the emergency benefits by year-end 2011. It now looks less likely a deal can be struck as Congress now have even less incentive to find common ground ahead of next year US election.

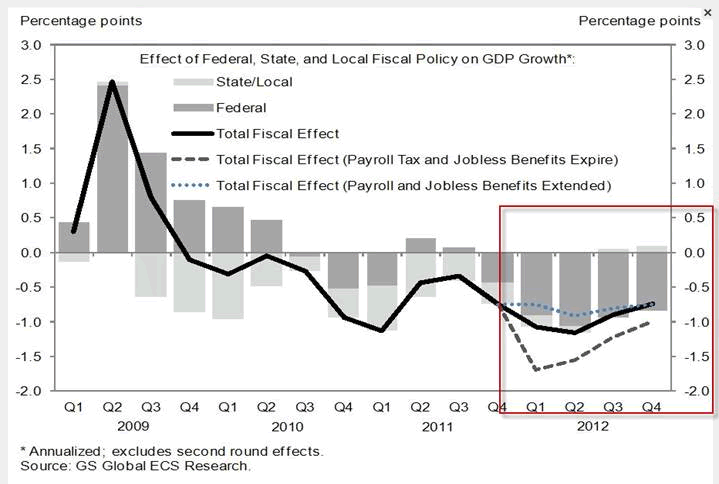

The immediate impact could be a full one percent slower growth in the US – Goldman Sachs provided this excellent graph detailing the potential negative impact: The number could be -2.0% to -0.5% in first two quarter of 2012 – again underlining our believe in an economic perfect storm as the most likely scenario:

The debt crisis is taking a new negative turn – as seen in prior liquidity crisis’ the EMG Europe bloc comes under attack and this morning there are two extreme worrisome news pieces out:

Hungary seeks Aid from EU, IMF: Hungary have submitted formal request to the EU and IMF for help. Hungary feels this is needed to secure risk-free growth for the economy – talks should be concluded in early 2012.

Austrian banks told to limit lending to the east: Basically, they need and want to protect their AAA and they seems to believe, rather naively, that the best way is to cut lending to the their EEC bloc lending. Again the credit-cake is getting smaller.

Finally, another core country Belgium may lose its caretaker PM – Belgium been without elected government since June 2010! – the political landscape in Europe getting slightly concerning:

- Greece – Technocrat – non-elected Government – Opposition still refuses to sign EU letter.

- Italy – Technocrat- non-elected

- Spain – new majority government, but on the basis of big no to austerity from prior government, not exactly vote of confidence to fiscal restraint.

- France- Election next year – Marine Le Pen could surprise in the polls, as the French election is two rounds. She is making heavy anti-EU noises and starting to raise her campaign

- Belgium – Belgian chief government negotiator asks to quit.

Keep an eye on Belgium rates today – they have risen from 3.6% in early October to now close to the magic 5.00 which spells trouble, with capital T…

Conclusion

Market bounced of the 1180-00 target for now, but a test still looks like on the down-side as 2012 more and more looks like one big perfect storm both politically and economically. This is not the time to be brave. This week will see dramatic revisions to US growth based on Super Committee failure, and same for Europe as PMI will show lacking confidence. This is now full blown “confidence crisis” – there is increasingly a need for my call for "Chapter 11" for Europe.

Safe travels,

Steen Jakobsen | Chief Economist

Chapter 11 in early 2012?

On his blog, Steen asks Is Europe set to declare a Chapter 11 in early 2012?

Europe may need to pull a Chapter 11 – a US-style bankruptcy, which would permit a market shutdown and Euro Zone reorganization before reopening for business.

The EU desperately needs a break from market pressures in order to allow the political apparatus to really gather its forces and finally move Europe and its debt crisis ahead of the curve. Here we are just a couple of weeks after the feeble attempt to apply an EFSF plaster on the problem and we’re already back to Square One: the EU debt crisis has reached the point at which none of the readily available tools or institutions are sufficient to match the magnitude of the crisis. This dictates the need for an out-of-the-box solution.

EU policy makers played the extend and pretend game for as long as they could - but now the writing is on the wall: popular outrage is on the rise and putting increasing pressure on the political process - as we are seeing increased demonstrations and grass-root activity taking over both the political agenda and the media. And markets are now balking as empty promises and now a real lack of funds are seeing bond yields beginning to spike out of control. The self-reinforcing cycle of downgrades and austerity and recession are taking us to the very brink of a full scale Crisis 2.0.

It’s important to point out that politicians will only do something drastic in a true state of emergency, so one catalyst we’ve yet to see to prompt action is a serious drop in the stock market.

The extend-and-pretend policies that have continued through 16 EU Summits have only led us to a Catch-22 in which everything that is done with good intentions (or not) is to the detriment of something else.

So what form might a Chapter 11 for the Euro Zone take? It is increasingly likely that some kind of total “bank holiday” is enforced to put a stop to market pressures – and then to reinforce and relaunch a stricter EU Growth and Stability Pact as a price for cranking up the ECB printing presses to full speed.

Before accusing me of lunacy on my idea of a market holiday, it’s important to point out that banking holidays are not without precedent. In 1933, President Roosevelt declared a bank holiday that ran for an entire week in March of 1933, during which he passed the Emergency Banking Act and the Federal Reserve moved to supply currency to banks.

After 9/11 we also had a “forced” bank holiday. The banking panic of 1907 saw massive illiquidity and bank closings as can be seen in this excellent link. The main point for 1907 however remains: The biggest and most solvent banks survived, the small ones failed – 73 banks failed but it created a rebirth which catapulted the stock market higher.

Germany and Northern Europe understand that printing money at the ECB will not solve anything, as it would only throw more debt on an already back-breaking load. But if this bloc countries wants to buy time to implement stronger constitutional changes, the most path is a quid-pro-quo solution in which Germany gets a stronger Growth and Stability Pact implemented, not only into EU law, but also ratified as part of a new standard for restrictive fiscal policies with built-in debt breaks for all individual countries. Germany gets it “discipline leads to growth” for the long term, while the Keynesians get their “liquidity fix” from the ECB.

In short, the main issues are the following (in no particular order of prioritization):

- Time is up – the market needs solutions, not plans for plans. The timeline for Political Europe is way too slow for market comfort.

- Interbank funding is starting to freeze over. Every day sees risk factors pointing higher and a systemic liquidity crisis could develop at any time.

- Financing gap. EFSF has 440 EUR 440 billion (though it has never been funded). Some estimate that Italy and Spain need EUR 400-500 billion per year to refinance and recapitalize its banks – per year! Talk about mismatch of supply and demand.

- Lack of constitutional frame-work to establish or enact changes.

- Democratic and constitutional rights are close to being violated, if not in the letter of the law, then certainly in the eyes of the voters.

As we head into 2012, I am increasingly convinced that we have an almost perfect economic and political storm brewing on the horizon.

Germany Will Not Go Along

The obvious flaw in the idea of a Europe-wide bank holiday is Germany.

The German supreme court has ruled there must be a voter referendum for these kinds of changes. Would Merkel risk putting the German Supreme court to that test? I highly doubt it.

Individual countries, notably Greece, are another matter as I have mentioned a couple of times recently. For further discussion, please see...

- History Suggests Greece Will Freeze Bank Deposits, Exit Euro by Christmas; Spain and Portugal to Follow Next Year; What's the Rational Thing to Do?

- Eurozone Breakup Logistics (Never Believe Anything Until It's Officially Denied)

Might Italy decide on a bank holiday? Yes, that is possible too, just not as likely, at least right now. It may be a different matter after the next election.

The ideal solution would be for Germany to leave. Might that involve a Eurozone-wide bank holiday? Certainly, just not yet.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.