With Rising Wages, Will China Remain a Manufacturing Hub?

Economics / China Economy Nov 29, 2011 - 03:31 AM GMTBy: Frank_Holmes

Earlier this month, I spent a few days at the CLSA AsiaUSA Forum in San Francisco, which offered a geopolitical and economic intellectual feast for global investors. The research firm gathered a well-rounded cast of engaging speakers that included Republican Presidential candidate Herman Cain, Hall of Fame quarterback Steve Young, Pollster extraordinaire Frank Luntz and renowned physicist Dr. Michio Kaku. Here's a photo I snapped during a Q&A session with former U.S. Vice President Dick Cheney.

Earlier this month, I spent a few days at the CLSA AsiaUSA Forum in San Francisco, which offered a geopolitical and economic intellectual feast for global investors. The research firm gathered a well-rounded cast of engaging speakers that included Republican Presidential candidate Herman Cain, Hall of Fame quarterback Steve Young, Pollster extraordinaire Frank Luntz and renowned physicist Dr. Michio Kaku. Here's a photo I snapped during a Q&A session with former U.S. Vice President Dick Cheney.

Year-after-year I make it a point to attend this conference because of the comprehensive examination CLSA puts together on the factors affecting global markets. To gather its exclusive knowledge of Asia, the research firm posts its analysts in the U.S. and many Asian countries, including China, Indonesia and the Philippines.

CLSA often discusses the numerous opportunities for U.S. businesses in China because of the rise of the Asian middle class, an increasing urbanization rate, and additional disposable income. The latter has been partially spurred by recent increases in wages. In fact, many people in China saw their wages rise 20 to 30 percent last year.

However, while these wage increases have been positive to the Chinese consumer and the companies which sell the goods, they have prompted many people to ask me how rising wages affect China's status as a low-cost manufacturing hub for the world. Does this reduce the profitability of companies that expect to continue to benefit from the country?

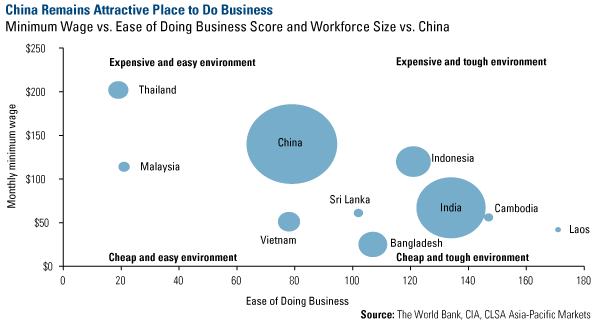

This is where CLSA's more balanced view of China's business landscape is not only helpful, but essential. It is not enough to look at rising wages to appreciate how attractive China is for businesses. To get a better understanding, let's compare three factors--the World Bank's Ease of Doing Business score, minimum wage and workforce size--across several Asian markets. The World Bank annually analyzes regulations that either enhance or constrain business activity among 183 economies. For a business that wants to expand into different markets, this report is helpful in determining the ease or difficulty in obtaining construction permits, electricity and credit, as well as hiring workers and trading across borders.

On the World Bank's scale, the business environment is easier in Thailand and Malaysia than in China and Vietnam, and companies would find it even more difficult to expand their businesses into Indonesia, India and Cambodia. However, Indonesia, India and Cambodia have cheaper labor markets than China or Thailand. But of all of these countries, China offers the largest labor market. CLSA says China makes for an "appealing hub for manufacturing" when you evaluate its unique combination of strengths together.

In addition, China's workforce is better educated and more highly skilled compared to other Southeast Asian countries, says CLSA. China was also named the "world's most connected economy" by the United Nations Conference on Trade and Development's Liner Shipping Connectivity Index, when it comes to how integrated global shipping networks are to enable worldwide trade. The country also has superior infrastructure and trade connectivity compared to many emerging markets, "even occasionally besting developed economies," says CLSA.

In 2010, countries such as Hong Kong, Japan, South Korea and Germany depended on China for data processing, apparel, and iron and steel exports. China also happens to be America's third-largest destination for exports behind Canada and Mexico. China's largest import partners in 2010 were Japan, South Korea, the U.S., Germany and Australia, according to the CIA World Factbook.

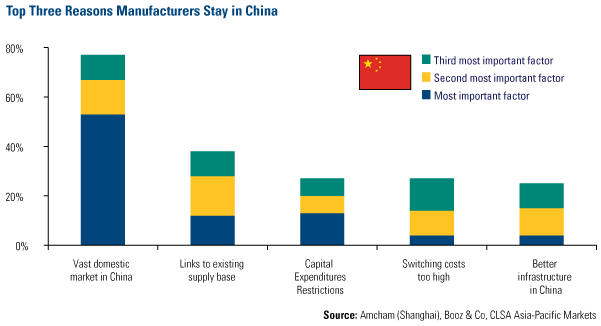

For those companies not already doing business in China, there's one dominant factor that shows they should start: the vast domestic market. Companies may be able to find a cheaper workforce in Bangladesh, India or Sri Lanka, but being located in China allows convenient access to what is rapidly becoming the world's largest consumer market.

I've discussed how many U.S.-based consumer discretionary businesses have been riding the wave of China's growth all the way to the bank. Starbucks, Coca-Cola and Kraft have expanded their operations in recent years, as they have been converting the traditional tea drinkers to consuming other beverages including coffee, juice and carbonated drinks. (Read it now: China's Rising Imports of American Goods.)

In American Classic Finds New Life in China, I talked about how American car company General Motors (GM), along with Toyota, Audi and BMW, is also experiencing growth in Asia as Chinese consumers look to purchase their first automobile. According to the China Passenger Car Association, Shanghai-GM topped October's list of the top ten largest automakers in China. In 2010, GM sold nearly 550,000 cars in China, and expects its global sales to expand by as much as 10 percent in 2012, says Bloomberg.

These are only a few examples of American companies benefiting from the rise of China. Have you positioned your portfolio to do the same?

For more updates on global investing from Frank and the rest of the U.S. Global Investors team, follow us on Twitter at www.twitter.com/USFunds or like us on Facebook at www.facebook.com/USFunds. You can also watch exclusive videos on what our research overseas has turned up on our YouTube channel at www.youtube.com/USFunds.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.