Stock Market Trends for 2008

Stock-Markets / US Stock Markets Jan 01, 2008 - 06:42 PM GMTBy: Clif_Droke

The year 2007 was marked by pessimism, doom and gloom, and a never-ending fusillade of fear. The mainstream press never tired of hypnotizing into believing the stock market would collapse, a downfall which never materialized.

The year 2007 was marked by pessimism, doom and gloom, and a never-ending fusillade of fear. The mainstream press never tired of hypnotizing into believing the stock market would collapse, a downfall which never materialized.

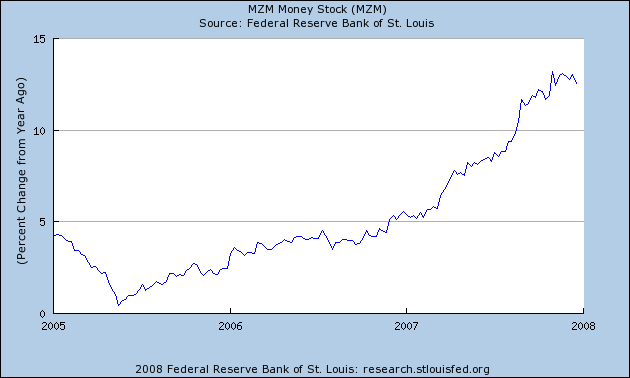

With all the talk of the weak dollar and the predictions of a worsening liquidity crisis, prognosticators have all but written off the prospects for a bullish 2008. Calls for a recession in the year ahead are also on the rise. What these analysts have failed to grasp is that there never was a liquidity crisis to begin with. By definition, tight money is reflected by rising interest rates and falling money supply indicators. Just the opposite is the case today.

Stock markets tend to suffer enormously during periods of tight money, yet the U.S. financial markets are still in good shape and ended up with a positive overall performance in 2007 (particularly the NASDAQ). Clearly, someone is lying about the so-called liquidity crisis. The question is who do you trust: the financial press, with its long and storied history of telling lies? Or do you trust the market tape, which never lies and tells all?

Here's a profound quote from George Friedman, writing in the Dec. 18 Stratfor.com newswire: “The markets should be selling off like crazy, given the financial problems. They are not. They keep bouncing back, no matter how hard they are driven down. That money is not coming from the financial institutions and hedge funds that got ripped on mortgages. But it is coming from somewhere. We think that somewhere is the land of $90-per-barrel crude and really cheap toys.”

Let's look briefly at the trend for gold and commodities. Since 1972 there have only been three out of nine election years in which the price of gold was up for the year: 1972, 1980 and 2004. For the stock market, only two years – 1984 and 2000 – were losers in an election year.

This year could potentially buck the election year tendency since we have an incumbent president and vice-president, neither of whom are running for re-election. There's also the matter of the 6-year cycle bottom (see bottom section of this commentary). Nonetheless, the odds favor another up year for the stock market in 2008 based primarily on the super-undervaluation based on IBES and the continued flow of Chinese and Arabian petrodollars into U.S. equities.

Gold has a disadvantage based on the election year pattern alone, although this is counteracted to an extent by the “fear premium” that gold will have in 2008 based on the lingering headline fear from 2007 not to mention the political and economic uncertainty heading into the election.

The other decided advantage that gold has heading into 2008 is a Federal Reserve that appears committed to keeping commodity prices and consumer price inflation at the high levels of recent years by way of its interest rate policy. By refusing to drop rates substantially the Fed assures that the trend of high prices will continue. Increased war spending will also keep this trend intact.

Market psychology outlook for 2008

At the start of every New Year, one of the most popular games among amateurs and professionals alike is to offer predictions for the coming year. When it comes to the financial markets I don't believe anyone can offer more than a best “guesstimate” for what the market will look like 12 months from now. What interests me more is what will the market's psychological composite look like in the months ahead?

The past year was marked by the incessant outcropping of fear as the mainstream press unleashed one super negative news headline after another. The year 2007 started with sub-prime crisis headlines and finished with negative news about the economy. In between was a host of worries big enough to satisfy even the most die-hard doom-and-gloomers. Looking back, 2007 can definitely be described as a “Year of Fear.”

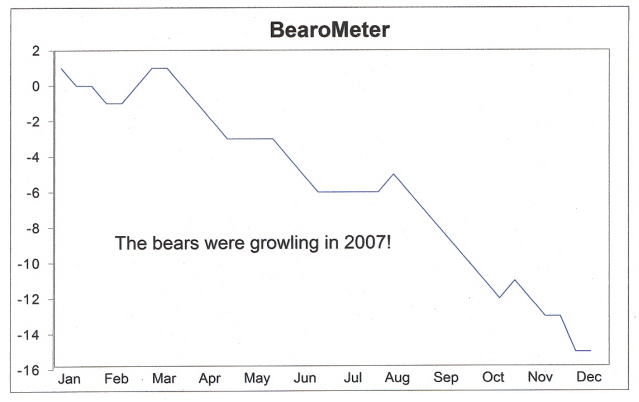

This bearish sentiment fostered by the media is plainly visible in the following graph. This shows just how bearish the retail investor was in 2007 based on investor sentiment polls.

In the 10 years I've been writing on this web site, the past year ties with 2004 in witnessing the highest amount of bearish feedback I've received from readers. In fact it might even top 2004 in terms of sheer bearish sentiment. Yet see how the above chart showing the bearish sentiment of the retail investing public compares with the charts of the NYSE Composite Index and the NASDAQ 100 for the year 2007.

Clearly the bears were misplaced in their pessimism on the stock market. I'll grant you that 2007 wasn't the best year we've seen for NYSE stocks but it certainly wasn't the worst, either. The year was far kinder for the NASDAQ, however, and from that perspective it was indeed a good year.

I've wondered constantly this year what has been the reason behind the concerted fear campaign being wages in the media and with the cooperation of our government and central bank. What has been the meaning behind it?

One obvious conclusion is that the powers-that-be, using the mouthpiece of the mainstream media, have tried to keep retail investors in a state of extreme fear so that the insiders could easily continue picking up shares as bargain prices. The sub-prime “crisis” was dramatically overstated, as was the so-called “liquidity crisis.” There is a super-abundance of liquidity with much of it relegated to the sidelines as the MZM money supply number shows. The problem facing the financial markets is not one of liquidity or infrastructural damage, but one of confidence.

Aside from keeping the average investor away from the stock market, what other reason could there be for the media-induced fear campaign? The answer becomes amazingly clear in feature article in the latest issue of Newsweek magazine. In “The Roots of Fear,” writer Sharon Begley addresses the major fear campaign of the past year in the U.S. From terrorism to immigration, from the economy to health care and crime, America has been the victim of a constant media assault of fear-invoking images.

Is it any coincidence that the year 2007 is leading into a presidential election year and that the fear campaign of the past year could be seen as laying the groundwork for the upcoming election? As Begley writes, “Fear makes people more likely to go to the polls and vote, which reflects the power of negative emotions in general. She quotes Harvard University psychology researcher Daniel Gilbert, who says, “Negative emotions such as fear, hatred and disgust tend to provoke behavior more than positive emotions such as hope and happiness do.”

Most of the economic as well as fear-related damage heading into a presidential election year are done in the year prior to the election. The odds are lower that 2008 will see a repeat of 2007 in terms of the constant barrage of negative news. During the first half of the New Year there will probably be some residual effects from the ingrained negative news and investor psychology from 2007 and the overall level of volatility is likely to remain high. The fact that the 6-year cycle is due to bottom in 2008 will likely contribute to this.

During the second half of 2008, the news media will turn its collective focus to the candidates and will spend less time focusing on financial crises as was done this year, particularly during the second half of 2007. It's very possible that the election year pattern for the stock market will repeat in 2008 (see chart below). This chart is courtesy of the Chart of the Day web site and shows how stocks tend to perform during election years.

This shows the tendency for election years to be bullish in the overall scheme of things. Year 2008 also falls within the bullish decennial tendency for the eighth year of the decade to be a winner for stocks (the “Great Eight” as it's called). The odds of a positive stock market performance in the eighth year are increased if there was considerable turmoil during the previous years (a la' 1977, 1987, 1997 and 2007).

The bottom line is that 2008 should be another favorable year for stocks based on the extremely favorable valuation of stocks and the still-strong “Wall of Worry” that is being aided and abetted by today's negative news headlines.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the three times weekly Momentum Strategies Report newsletter, published since 1997, which covers U.S. equity markets and various stock sectors, natural resources, money supply and bank credit trends, the dollar and the U.S. economy. The forecasts are made using a unique proprietary blend of analytical methods involving internal momentum and moving average systems, as well as securities lending trends. He is also the author of numerous books, including "How to Read Chart Patterns for Greater Profits." For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.