Calling the Bottom in Gold and Silver, Forecast 2012

Commodities / Gold and Silver 2012 Jan 01, 2012 - 06:00 AM GMTBy: Adam_Brochert

Now that my subscribers and I are fully into bullish positions in the precious metals sector, I hope they won't mind me telling you that I called for the bottom in Gold stocks on Thursday morning (12/29). I believe the bottom is in for silver, Gold and their respective stocks, although the metals may need a re-test of the bottom while I think Gold or silver stocks (as sectors) will only make higher lows on any corrective action.

Now that my subscribers and I are fully into bullish positions in the precious metals sector, I hope they won't mind me telling you that I called for the bottom in Gold stocks on Thursday morning (12/29). I believe the bottom is in for silver, Gold and their respective stocks, although the metals may need a re-test of the bottom while I think Gold or silver stocks (as sectors) will only make higher lows on any corrective action.

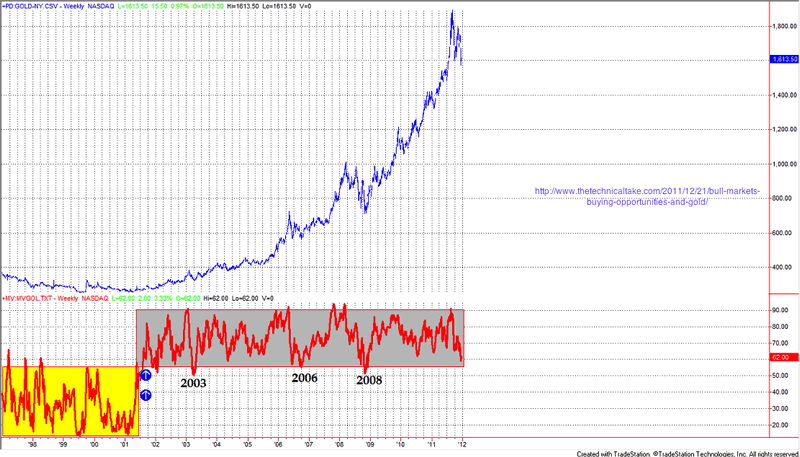

There are some major bells ringing in the sentiment department for the PM sector that should not be ignored. First up, a chart from Guy Lerner (link to article pasted onto the chart), which plots the Market Vane sentiment (i.e. percentage of bulls, bottom of chart) against the price plot of Gold:

Since this chart was published, according to Richard Russell via a blog post on King World News (I don't subscribe to Market Vane, so I'll take Sir Richard and King World News at their word), the number has dropped further down to 56%. As the chart above shows, major bottoms in Gold have been formed in the 50s range on this sentiment indicator. We are there.

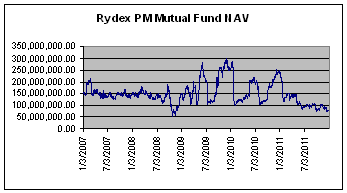

Next up, a chart I created in Excel for the Rydex Precious Metals Mutual Fund using the net asset value of the fund, which measures the flow of money into and out of the fund. When the plot in the chart covering the last 5 years below is low, the herd is bearish (i.e. bullish from a contrarian perspective):

The persistent multi-month malaise in this sentiment indicator I think is indicative of the lethargy in the Gold stock bull camp. Gold stocks have sucked over the past year or so, let's be honest. "Gold up, Gold stocks down" is not the way to build enthusiasm among Gold stock investors, to be sure. But these sentiment indicators tell us that the time to be bullish on the precious metals sector is at hand.

Furthermore, Gold and silver have complete-looking corrections to me using both time and price. The late September swoon in the metals (Gold to low 1500s and silver to low 26 level in USD terms) was enough price damage, but the current re-test satisfies a time dimension that was needed to reset the sentiment in the sector. Now that we have re-tested the lows, all the experts have intelligent and coherent reasons for why the PM sector will continue to decline. I wish them well, but I am betting against them with everything I've got. I am now 100% long Gold stocks in my trading account and my physical metal stash has been improved by some timely holiday gifts of silver from Mrs. Claus.

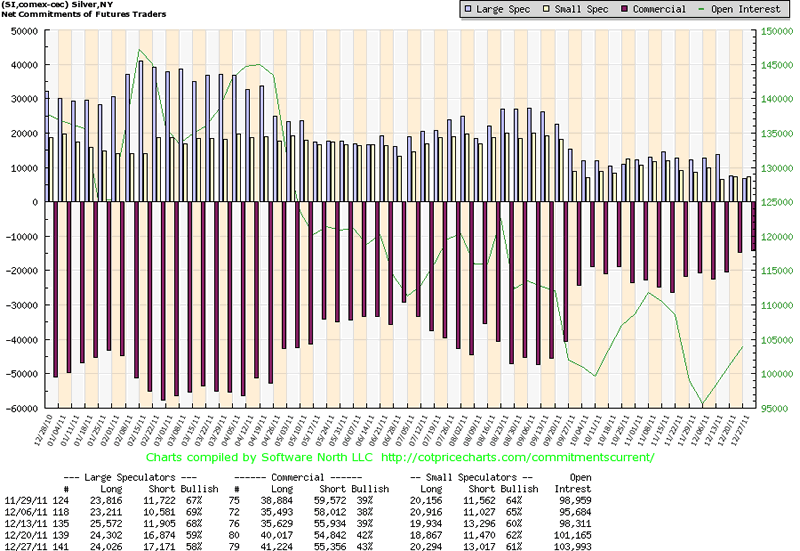

And how about that COT report for silver? It was bullish last week and this week added a sliver of further bullishness to the picture. See prior post and here's the current COT report courtesy of Software North:

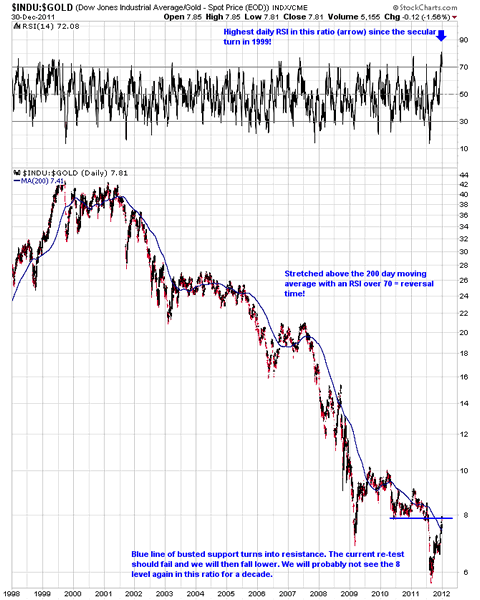

Meanwhile, the Dow to Gold ratio is stretched to the upside like it has been only a few times in the past decade (14 year log scale chart of $INDU:$GOLD follows), indicating a significant reversal has likely already begun this week:

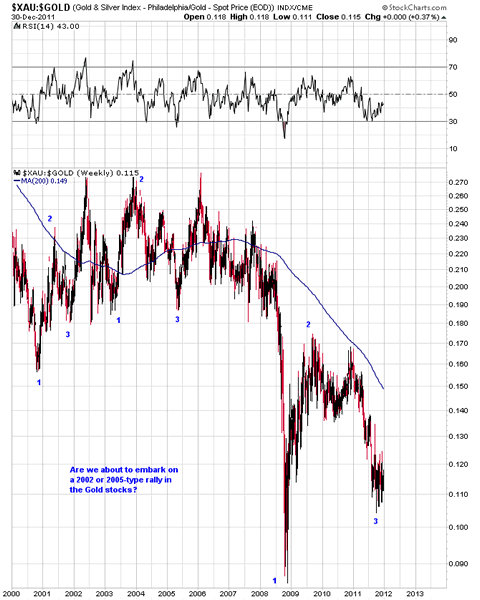

The Gold stocks tend to rise when the Dow to Gold ratio is falling (outside of meltdowns/crashes like in 2008) and who hasn't seen a chart of the Gold stocks to Gold ratio telling us that Gold stocks are cheap on a relative basis (12 year log scale chart of Philadelphia Gold and Silver Mining Index to Gold price ratio [$XAU:$GOLD]):

While others are bearish on Gold, silver and Gold and silver stocks, I am staunchly bullish here. And please keep in mind that I have been bearish on Gold stocks since August. See my late August post that elicited hate-type email from Gold stock bulls. And now that we reached the low 20s in the GDXJ ETF as predicted in late August, I am very bullish on the GDXJ ETF and all Gold stock indices.

In my subscription service, I send out weekly updates as well as interim updates when indicated and email trading alerts when I think it is time to pull the trigger on a trade. Here is the interim update I sent out to subscribers Wednesday night (12/28/11), which was followed up by an email trading alert Thursday morning advising subscribers to buy Gold stocks (as well as metal, although I think the metal stocks will outperform this cycle):

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.