Why Rising Debt Will Lead to $10,000 Gold

Commodities / Gold and Silver 2012 Jan 07, 2012 - 06:55 AM GMTBy: Nick_Barisheff

Good afternoon, it's a pleasure to speak about gold at this Outlook for 2012.

Good afternoon, it's a pleasure to speak about gold at this Outlook for 2012.

Today, I'd like to focus on one important idea: the direct relationship between the rising price of gold and the rising levels of government debt that result in currency debasement. Since we measure investment performance in currencies a clear understanding of the outlook for currencies is critical.

In order to understand gold's relationship, it's important to understand that gold is money. It is not simply an industrial commodity like copper, or zinc. It trades on the currency desks of most major banks--not on their commodities desks. The turnover at the London Bullion Market Association is over $37 billion per day, and volume is estimated at 5- 7 times that amount - clearly, this is not jewellery demand.

The world's central banks know gold is money: after decades of modest sales they have become net buyers since 2009. This trend strengthened in 2010 and gained momentum in 2011. They are buying gold as a counterbalance to their devaluing currencies.

As money, gold has provided the most stable form of wealth preservation for over three thousand years - it still does today. Gold has outperformed all other asset classes since 2002.

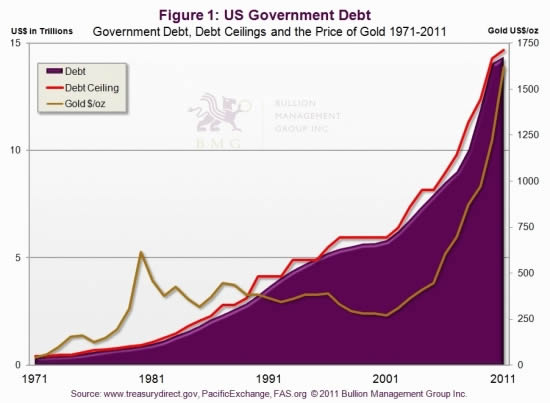

This chart clearly shows that US federal debt (purple) and the price of gold (gold) are now moving in lockstep. This correlation will likely continue for the foreseeable future. The red line represents the repeatedly violated government debt ceilings.

Based on official estimates, America's debt is projected to reach $23 trillion in 2015 and, if the correlation remains the same, the indicated gold price would be $2,600 per ounce. However, if history is any example, it's a safe bet that government expenditure estimates will be greatly exceeded, and the gold price will therefore be much higher.

And it's not just the US. Most Western economies have reached unsustainable levels of debt that will be impossible to pay off. It's worth noting that the US Federal Reserve, unlike the European Central Bank, can create currency without restriction. The US dollar has been the de facto world reserve currency for over half a century; the rest of the world's currencies are essentially its derivatives. Whether global debt is in euros or Special Drawing Rights issued by the IMF, the Fed, and thus indirectly the US taxpayer, may become the lender of last resort.

There are four possible ways to reduce government debt:

-

One: Grow out of it through increased productivity and increased exports. This is highly unlikely, as Western economies, and even China, are poised for recession.

-

Two: Introduce strict austerity measures to reduce spending. This has the unwanted shortterm effect of increasing unemployment and reducing GDP, resulting in even higher deficits.

-

Three: Default on the debt. This will make it difficult to raise future bond issues.

-

Four: Issue even more debt, and have the central bank in question simply create whatever amount of currency is needed.

Most politicians will select option four, since few have the political will to choose austerity, cutbacks and full economic accountability over simply creating more and more currency. Almost inevitably, they will choose to postpone the problem and leave it for someone else to deal with in the future.

Last August, the world watched as the US government struggled to come to an agreement on raising the debt ceiling, and was forced to compromise and delegate the final solution to a "super committee". Its lack of political will earned the country an immediate downgrade from the S&P. Then, the hastily convened "super-committee" failed to reach a solution.

In Europe, matters were even worse. Greece did try to write off half its debt, but Germany and France reminded the Greeks that, if they did, no one would buy their bonds. The British and Irish implemented austerity measures that raised unemployment and reduced GDP, resulting in even higher deficits. The Italians watched their bond yields rise to 7 percent. While the tsunami and related nuclear incident deflected attention from Japan's financial problems, it is a temporary lull, because Japan has the highest debt to GDP ratio of any of the developed countries.

In order to compensate for slowing growth, governments attempt to devalue their currencies and thus improve export competitiveness. This can lead to a global currency war that author and Wall Street/Washington insider James Rickards discusses in his bestselling new book, Currency Wars. This process is now well underway.

A recent Congressional Budget Office report predicted the US federal government's publicly held debt would top an unsustainable 101 percent of GDP by 2021. Currently, the official US debt is an astronomical $15 trillion.

Yet this is only the current debt. If the US government used the same accrual accounting principles that public companies must use, unfunded liabilities like Social Security and Medicare make the real debt more than $120 trillion. This represents over $1 million per taxpayer. Obviously, this amount is impossible to repay.

It's interesting to note that in almost every recorded case of hyperinflation, the point where inflation exceeds 50 percent a month was caused by governments trying to compensate for slowing growth through fullthrottle currency creation. This is exactly what we are seeing today.

These events gave me the confidence to title my new book $10,000 Gold. The book connects the many trends that will be directly and indirectly responsible for both the rising debt and the rising gold price over the next five years. It will be published this year.

To make matters worse, the irreversible macro trends I discussed in last year's Empire Club speech are still very much in place today. These include the added costs of retiring baby boomers, systemic unemployment due to outsourcing of Western jobs through globalization and rising oil prices due to peak oil.

These irreversible trends will increase unemployment, lower GDP, reduce tax revenues, increase deficits further and force governments to borrow even greater amounts.

Governments find themselves between the proverbial rock and a hard place, as even austerity measures tend to negatively impact GDP. As GDP falls and debt increases, credit downgrades are likely to follow, resulting in higher bond yields followed by even greater deficits. This becomes an unstoppable descending spiral.

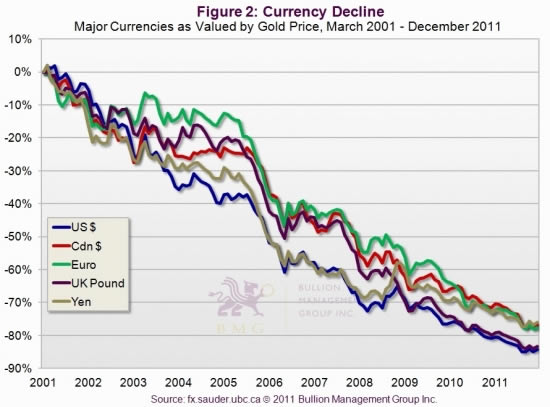

Loss of purchasing power against gold continued unabated last year. The US dollar and the British pound have lost over 80 percent of their purchasing power against gold over the past decade, and the yen, the euro and the Canadian dollar have lost over 70 percent.

As we remind our clients this is not a typical bull market. Gold is not rising in value, currencies are losing purchasing power against gold, and therefore gold can rise as high as currencies can fall. Since currencies are falling because of increasing debt, gold can rise as high as government debt can grow.

The sovereign wealth funds as well as the more conservative central banks will have little choice but to re-allocate to gold in order to outpace currency depreciation. This is why some central banks, particularly those of China and India, accelerated their gold buying in 2011, for a third year in a row, to nearly 500 tonnes--about onefifth of annual mine production.

While central banks have been net purchasers of gold since 2009, the real game changers will be the pension funds and insurance funds, which at this point hold only 0.3 percent of their vast assets in gold and mining shares. Continuing losses and growing pension deficits will make it mandatory for them to eventually include gold-- the one asset class that is negatively correlated to financial assets such as stocks and bonds. When this happens, there will be a massive shift from over $200-trillion of global financial assets to the less than $2 trillion of privately held bullion.

In considering where gold will be at the end of 2012, I looked back to my first Empire Club talk of 2005. I said then that it didn't really matter whether gold closed the year at $400 or $500 an ounce--the trends were in place to ensure it had much further to rise. Seven years later, we can say the same thing. It doesn't matter whether gold ends 2012 at $2,000 or $2,500, because gold's final destination will make today's price seem insignificant.

These can be frightening times, but gold always offers hope. We may not be able to heal the global economic problems of government debt, but individuals can protect and even increase their wealth through gold ownership. Gold bullion ownership, not mining shares, ETFs or other paper proxy forms of ownership, is an insurance policy against accelerating currency debasement. We use the analogy that - In the case of fire, would you rather have a real fire extinguisher or a picture of one? A number of people have approached me recently and said they wished they had listened five years ago. They feel they have missed the boat, that it's too late to buy gold. For those who feel that way, let me close with a Chinese proverb I discovered last year:

The best time to plant a tree is 20 years ago. The second best time is today.

By Nick Barisheff

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

© 2012 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.