Will Currency Devaluation Fix the Eurozone?

Currencies / Euro Feb 09, 2012 - 11:21 AM GMTBy: Frank_Shostak

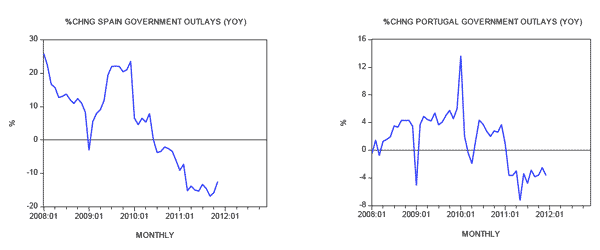

The NYU professor of economics Nouriel Roubini said in Davos, Switzerland, on January 25, 2012, that tight policies are making the recession in the eurozone worse. According to Roubini what Europe needs is less austerity and more growth. In particular, the NYU professor is concerned about the deep recession in the eurozone's peripheral countries: Spain, Portugal, Greece — all are on a strict regime of austerity. For instance, in Spain the yearly rate of growth of government outlays stood at minus 12.4 percent in November against minus 15.7 percent in the month before. In Portugal the yearly rate of growth stood at minus 3.6 percent in December against minus 2.5 percent in November. In Greece the yearly rate of growth fell to 2.9 percent in December from 6.2 percent in the prior month.

The NYU professor of economics Nouriel Roubini said in Davos, Switzerland, on January 25, 2012, that tight policies are making the recession in the eurozone worse. According to Roubini what Europe needs is less austerity and more growth. In particular, the NYU professor is concerned about the deep recession in the eurozone's peripheral countries: Spain, Portugal, Greece — all are on a strict regime of austerity. For instance, in Spain the yearly rate of growth of government outlays stood at minus 12.4 percent in November against minus 15.7 percent in the month before. In Portugal the yearly rate of growth stood at minus 3.6 percent in December against minus 2.5 percent in November. In Greece the yearly rate of growth fell to 2.9 percent in December from 6.2 percent in the prior month.

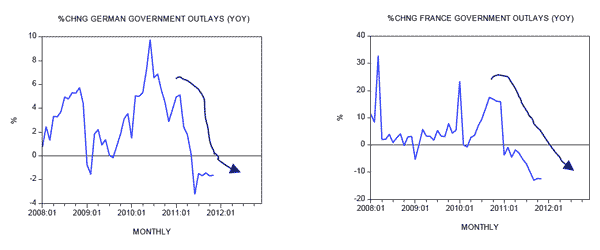

A visible tightening is also observed in the two major European economies of Germany and France. Year-on-year government outlays in Germany stood at minus 1.6 percent in November versus minus 1.7 percent in October. In France the yearly rate of growth stood at minus 12.4 percent in November against minus 12.3 percent in the prior month.

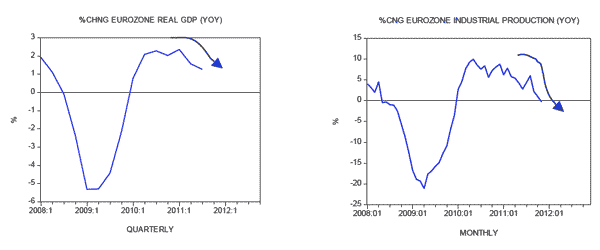

According to Roubini and other experts, a tighter stance undermines already-depressed eurozone economic activity. The yearly rate of growth of real GDP eased to 1.3 percent in Q3 from 1.6 percent in Q2 and 2.3 percent in Q3 in 2010. Also the growth momentum of industrial production displays softening. Year on year, the rate of growth fell to minus 0.3 percent in November from 1 percent in the month before and 8.1 percent in November 2010.

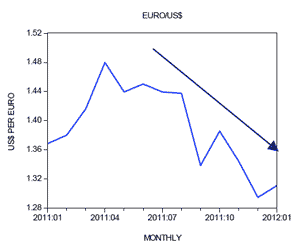

Roubini is making the point that austerity won't let eurozone countries grow their way out of their predicament. What is now urgently required to improve the eurozone's economic situation is to devalue the euro by 30 percent, argues Roubini. Note that the price of the euro in terms of US dollars fell from 1.48 in April last year to 1.29 in December — a fall of 12.8 percent. Yet despite this depreciation of the euro, the yearly rate of growth of industrial production has fallen from 5.4 percent in April to minus 0.3 percent in November. So why then should a depreciation of 30 percent as suggested by Roubini revive the economy?

According to popular thinking the key to economic growth is demand for goods and services. It is held that increases or decreases in demand for goods and services are behind rises and declines in the economy's production of goods. Hence, in order to keep the economy going, economic policies must pay close attention to overall demand.

Now, part of the demand for domestic products emanates from overseas. The accommodation of this demand is labeled exports. Likewise, local residents exercise demand for goods and services produced overseas, which are labeled imports. Observe that while an increase in exports implies an increase in the demand for domestic output, an increase in imports weakens the demand. Hence exports, according to this way of thinking, are a factor that contributes to economic growth, while imports are a factor that detracts from the growth of the economy.

From this way of thinking it follows that, because overseas demand for a country's goods and services is an important ingredient in setting the pace of economic growth, it makes a lot of sense to make locally produced goods and services attractive to foreigners. One of the ways to boost foreigners demand for domestically produced goods is by making the prices of these goods more attractive.

For instance, the price of an identical bag of potatoes in the United States is $10 and €10 in Europe. Also, the exchange rate between the US dollar and the euro is 1:1 (one-to-one). At the exchange rate of €1 to $1, an American can get for his $10 one European bag of potatoes.

One of the ways of boosting their competitiveness is for Europeans to depreciate the euro against the US dollar. Let us assume that, in response to the European Central Bank (ECB) announcement to loosen its monetary stance, the rate of exchange falls to 50¢ per Euro. This means that €10 is now worth $5, which in turn implies that a European bag of potatoes in the United States is offered for $5, all other things being equal. Consequently, an American can now purchase for $10 two European bags of potatoes instead of one before the depreciation of the euro. In other words, the purchasing power of Americans with respect to European potatoes has doubled.

If we apply the potato example to all goods and services, we reach the conclusion that, as a result of currency depreciation and all other things being equal, the overall demand for domestically produced goods is likely to increase. This in turn will give rise to a better balance of payments and stronger economic growth in terms of GDP.

Note that, to lift foreigners' demand, Europeans are now effectively offering two bags of potatoes for one American bag of potatoes. This also means that the price of the American bag of potatoes in Europe is now twice as much as before the depreciation of the euro. This most likely will lower Europeans' demand for American potatoes. In short, what we have here as far as Europe is concerned is more exports and fewer imports, which according to mainstream thinking is great news for economic growth.

Why a Boost in Exports on Account of Currency Depreciation Damages Wealth-Generation Process

When a central bank announces a loosening in its monetary stance, this leads to a quick response by participants in the foreign-exchange market through selling the domestic currency in favor of other currencies, thereby leading to domestic currency depreciation. In response to this, various producers now find it more attractive to boost their exports. In order to fund the increase in production, producers approach commercial banks, which, because of a rise in central-bank monetary pumping, are happy to expand their credit at lower interest rates.

By means of new credit, producers can now secure resources required to expand their production of goods in order to accommodate overseas demand. In other words, by means of newly created credit, producers divert real resources from other activities. As long as domestic prices remain intact, exporters record an increase in profits. (For a given amount of foreign money earned, they now get more in terms of domestic money.)

The so-called improved competitiveness resulting from currency depreciation in fact amounts to economic impoverishment. The "improved competitiveness" means that the citizens of a country are now getting fewer real imports for a given amount of real exports. While the country is getting rich in terms of foreign currency, it is getting poor in terms of real wealth — i.e., in terms of the goods and services required for maintaining people's lives and well-being.

As time goes by, the effects of loose monetary policy filter through a broad spectrum of prices of goods and services and ultimately undermine exporters' profits. A rise in prices puts to an end the illusory attempt to create economic prosperity out of thin air. According to Ludwig von Mises,

The much talked about advantages which devaluation secures in foreign trade and tourism, are entirely due to the fact that the adjustment of domestic prices and wage rates to the state of affairs created by devaluation requires some time. As long as this adjustment process is not yet completed, exporting is encouraged and importing is discouraged. However, this merely means that in this interval the citizens of the devaluating country are getting less for what they are selling abroad and paying more for what they are buying abroad; concomitantly they must restrict their consumption. This effect may appear as a boon in the opinion of those for whom the balance of trade is the yardstick of a nation's welfare. In plain language it is to be described in this way: The British citizen must export more British goods in order to buy that quantity of tea which he received before the devaluation for a smaller quantity of exported British goods.

Contrast the policy of currency depreciation with a conservative policy where money is not expanding. Under these conditions, when the pool of real wealth is expanding the purchasing power of money will follow suit. This, all other things being equal, leads to currency appreciation. With the expansion in the production of goods and services and the consequent falling prices and declining production costs, local producers can improve their profitability and their competitiveness in overseas markets while the currency is actually appreciating. Note that while within the framework of loose monetary policy exporters' temporary gains are at the expense of other activities in the economy, within the framework of a tight monetary stance gains come not at any one's expense but are just the outcome of the overall real-wealth expansion.

It must be appreciated that, contrary to popular thinking, both tight fiscal and monetary policies provide support to wealth generators while undermining non-wealth-generating activities. Roubini and other experts, by pleading for looser policies, are in fact asking to strengthen wealth-destructive activities and thereby recommending a prolonged economic slump.

Summary and Conclusion

According to some experts, what is required to "fix" the eurozone is not tighter fiscal policies but a strong devaluation of the euro. Commentators such as Nouriel Roubini advocate a depreciation of up to 30 percent. Between April and December last year, the euro weakened against the US dollar by almost 13 percent, yet economic activity has continued to slide. Why then should a depreciation of 30 percent revive the economy? We suggest that the recommendation for currency depreciation to fix the eurozone is based on an erroneous framework of thinking. If anything, such a policy can only make things much worse as far as eurozone economic conditions are concerned.

Frank Shostak is an adjunct scholar of the Mises Institute and a frequent contributor to Mises.org. He is chief economist of M.F. Global. Send him mail. See Frank Shostak's article archives. Comment on the blog.![]()

© 2012 Copyright Frank Shostak - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.