U.S. Housing Market Starts, Jobless Claims, and Wholesale Price Index – Mixed Bag

Housing-Market / US Housing Feb 17, 2012 - 02:48 AM GMTBy: Asha_Bangalore

January Housing Starts: It is a Multi-Family Story

January Housing Starts: It is a Multi-Family Story

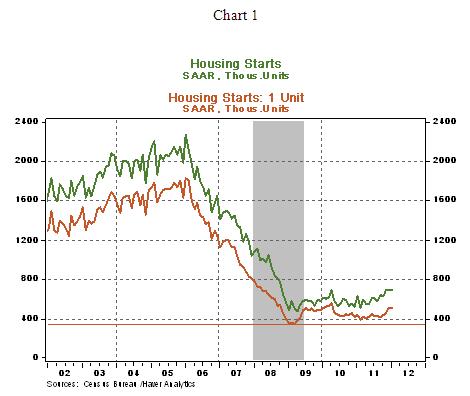

Total housing starts increased 1.5% to an annual rate of 699,000 in January. The entire gain came from an 8.5% jump in starts of multi-family units to an annual rate of 191,000. New construction of single-family units slipped 1.0% to 508,000.

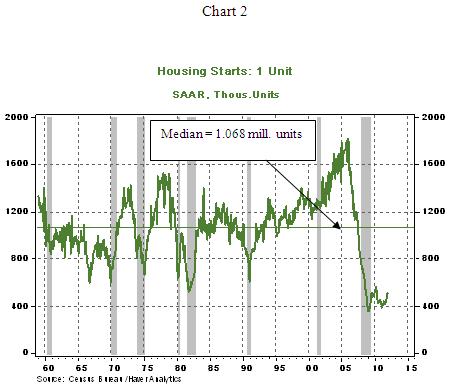

Chart 1 makes the compelling point that starts of new homes have moved up only slightly from the cycle established in March 2009. How far is new construction of single-family homes lagging behind the historical trend? The historical median of housing starts for the 40 years ended 2000 is 1.068 million units. Construction of new homes in January 2012 is roughly 53% below the historical median, implying there is a long road ahead before normality is reached.

On a regional basis, starts of new homes fell sharply in the Midwest (-40.7%) but rose in all other parts of the nation. The number of permits issued for construction of new homes moved up 0.8% to an annual rate of 676,000 in January comprising of small gains for single and multi-family units.

Jobless Claims Point to Significant Improvement in Labor Market

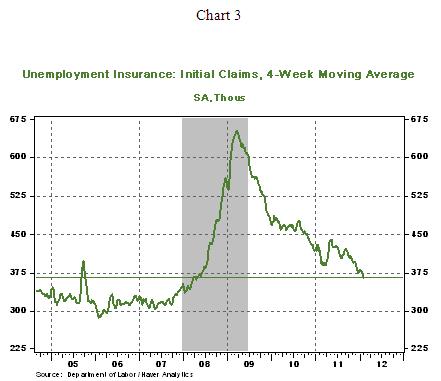

Initial jobless claims fell 13,000 to 348,000 during the week ended February 11. The four-week moving average stands at 365,250, the lowest in almost four years. Continuing claims, which lag initial jobless claims by one week, dropped 100,000 to 3.426 million, the lowest since August 2008. The message from this labor market indicator is that firms have stopped firing at a rapid pace and hiring at rapid pace is probably around the corner.

January Wholesale Prices Maintain Contained Trend

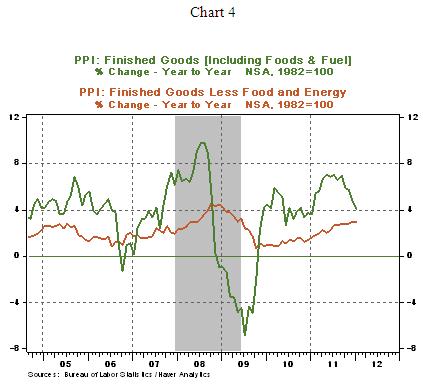

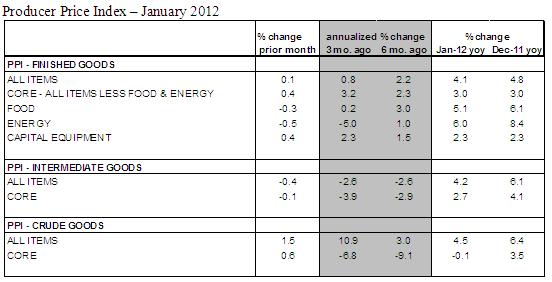

The January Producer Price Index (PPI) increased 0.1% in January, reflecting declines in prices of energy (-0.5%) and food (-0.3%). Although the price of gasoline (+2.0%) rose, the 1.7% drop in the price of electricity and lower prices for natural gas led to the decline in the energy price index. An 8.8% drop in prices of fresh fruits and vegetables accounted for the 0.3% decline of the food price index.

The core PPI, which excludes food and energy, moved up 0.4% in January. The large increase sticks out and begs an explanation. Higher prices for medicines (+2.0%) were responsible for about 40% of the increase. This is a non-repetitive annual adjustment of prices for medicines, implying that a sharp increase in core wholesale prices in the months ahead would have to be from other sources.

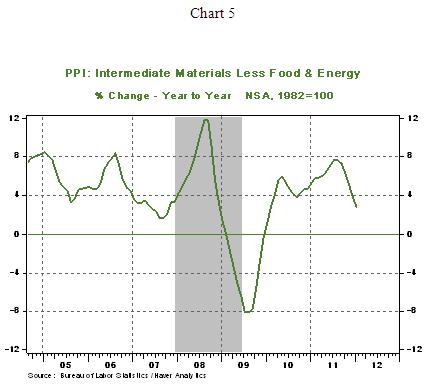

At the earlier stages of production, the intermediate goods price indexes dropped in January. In particular, the year-to-year change of the core intermediate goods price index, which excludes food and energy, shows a marked decelerating trend (see Chart 5). The main take away is that wholesale prices do not present a threat in the inflation-growth debate at FOMC meetings, for now.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.