Gold Testing Support At $1,700 And Gains in XAU and HUI Are Positive

Commodities / Gold and Silver 2012 Feb 17, 2012 - 06:37 AM GMTBy: GoldCore

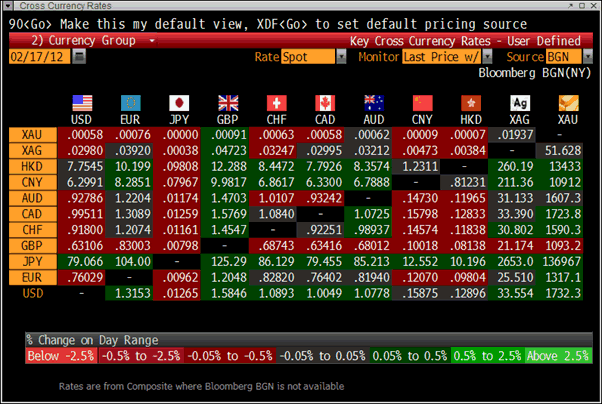

Gold’s London AM fix this morning was USD 1,732, EUR 1,316.51, and GBP 1,093.09 per ounce.

Gold’s London AM fix this morning was USD 1,732, EUR 1,316.51, and GBP 1,093.09 per ounce.

Yesterday's AM fix was USD 1,716, EUR 1,320.51, and GBP 1,094.74 per ounce.

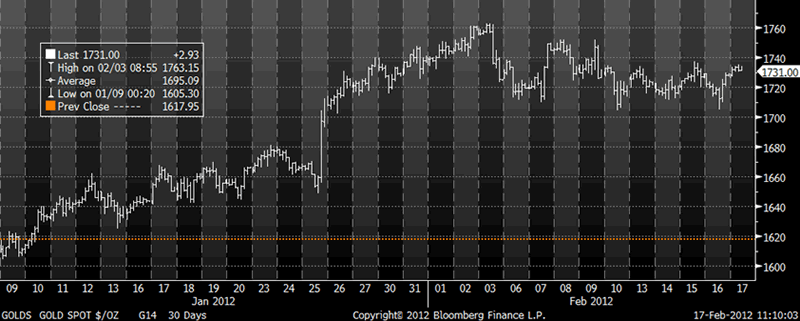

Gold fell $23.50 to as low as $1,705.80/oz by about 1200 GMT, but then rose strongly for most of the trading session and closed near high of $1729.91/oz - for a loss of just 0.05%. Gold ticked higher in Asian trade touching $1,735.18/oz and is marginally lower in Europe.

Gold testing support at $1,700/oz and then the sharp turn around seen yesterday is indicative of a market that is consolidating and soon to go higher. The price action seen in the gold mining shares, with both the XAU and HUI indices surging nearly 3% on the day, is also indicative of a market that wants to go higher.

Gold is 0.7% higher for the week and a higher weekly close would be the first higher weekly close after 2 weeks of falls. This would be important technically and would embolden traders to again go long gold more aggressively.

It may also reassure western physical buyers who have been dormant in recent days with experience and reports of subdued physical demand in the US and EU.

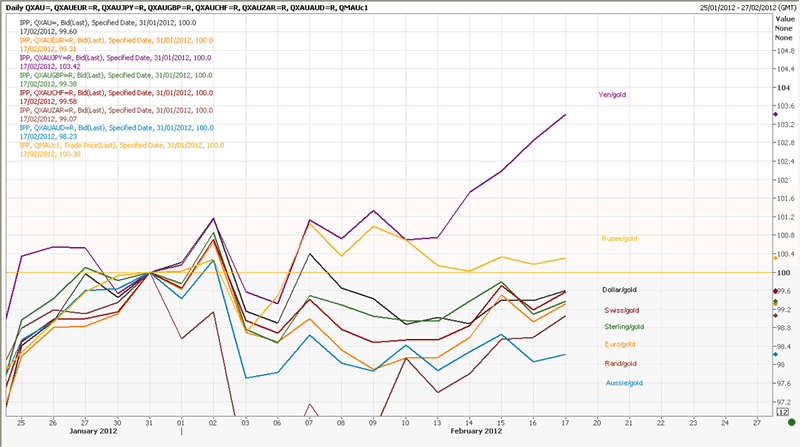

Euro gold fell to about €1,312.50/oz prior to recouping some of its losses but the euro has fallen 2% against gold so far this week.

Sterling has performed well this week and is flat in gold terms and the good retails sales data today saw sterling rise a further few pounds against gold.

Gold in Major Currencies in February - Reuters Global Gold Forum

The Japanese yen has come under pressure this week and has fallen 2.6% against gold due to continuing ultra loose monetary policies and yen debasement.

Gold continues to consolidate in most currencies after the strong gains of January. Dollar gold’s trading range is $1,700/oz to $1,763/oz. Gold is just 4% from resistance at the psychological $1,800/oz level and a move above $1,763/oz or higher weekly close this week should see us challenge that level.

The fundamentals of the gold market remain sound as ever what with sovereign debt crisis in the Eurozone and the risk of sovereign debt crisis in other major economies and oil prices over $102 a barrel on concerns of conflict between Israel and Iran. All of this suggests that stagflation could soon confront investors.

A regional war looks increasingly likely in this regard and should result in a period of “risk off” as seen in months prior to the war with Iraq in 2003 – which saw equities fall and oil and gold rise.

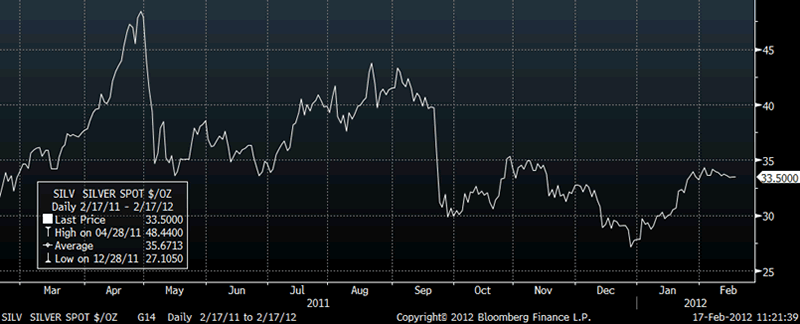

Silver slipped over 2% to as low as $32.643 before it also stormed back higher in New York and ended near its late session high of $33.548 with a gain of 0.24%.

Silver too has all the technical hallmarks of a market that wants to go higher and a breach of $35/oz could quickly see silver move to $40/oz or $45/oz.

OTHER NEWS

(Reuters Global Gold Forum) -- Singapore will exempt investment-grade gold and other precious metals from a seven percent goods and services tax to spur the development of gold trading, Finance Minister Tharman Shanmugaratnam said on Friday.

(Bloomberg) -- LME Says Silver OTC Clearing Service Will Start on April 2

The London Metal Exchange said the introduction of of its over-the-counter silver clearing service with LCH.Clearnet Ltd. will be April 2. The LME commented in an e-mail to exchange members today.

(Bloomberg) -- World’s Biggest Platinum Mine Under Police Control After Riots

Impala Platinum Holdings Ltd. said police are monitoring the world’s biggest platinum mine near Rustenburg, South Africa after violent demonstrations yesterday.

A “big police presence” has replaced troops that were sent to the mine, also known as Impala, yesterday to restore calm, he said. Today about 500 miners and unemployed people protested outside the mine, Sydwell Dokolwana, the National Union of Mineworkers’ regional secretary in Rustenburg, said. Demonstrators yesterday killed a miner who was on his way to work, he said in a phone interview.

“The situation was very, very tense in the morning,” Dokolwana said. “Because of the presence of police for now there are no road blockages. People are just singing and carrying sticks and pangas,” Dokolwana said, referring to heavy, machete-like knives usually used to clear vegetation.

Impala fired 17,200 workers at the mine, which accounts for about 12 percent of global production of platinum, two weeks ago after an illegal strike began. By Feb. 14 the disruption had delayed output of 60,000 ounces of the metal worth about 1.2 billion rand ($154 million), Impala’s Chief Executive Officer, David Brown, said yesterday.

Impala shares rose 2.51 rand, or 1.6 percent, to 160.70 rand as of 10:11 a.m. in Johannesburg after declining 4 percent yesterday. The price of platinum rose 0.9 percent to $1,639.75 an ounce as of 8:12 a.m. in London.

The union will meet Impala to try and resolve the situation at 4:30 p.m. local time in Johannesburg today, Dokolwana said. The protests were sparked by rivalry between the National Union of Mineworkers, recognized by Impala as the main labor group at the operation, and the Association of Mineworkers & Construction Union, which is trying to gain members, Brown said.

The mine was “basically quiet” overnight and this morning, the company said in an e-mailed response to questions today.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.