Dollar, Gold and Gasoline: Much Ado About Nothing

Commodities / Commodities Trading Feb 27, 2012 - 09:21 AM GMTBy: EconMatters

U.S. regular gasoline price has spiked almost 4% in one week to $3.688 a gallon as of Feb. 26, the highest level since last September, with residents in three states--Alaska, Hawaii, California-- are already seeing above $4 at the pump, based on AAA's Daily Fuel Gauge Report.

U.S. regular gasoline price has spiked almost 4% in one week to $3.688 a gallon as of Feb. 26, the highest level since last September, with residents in three states--Alaska, Hawaii, California-- are already seeing above $4 at the pump, based on AAA's Daily Fuel Gauge Report.

The current price level is roughly 11% above a year ago. Analysts estimate that every 1-cent increase in the price of gasoline costs the economy $1.4 billion. Consumers are starting to feel the pinch, and a new Associated Press-GfK poll says 7 in 10 Americans find the issue "deeply important".

Crude oil is one of the oldest and most complex commodities in the world heavily underpinned by geopolitics, and market speculation throughout its history. Now, with Iran, Israel, U.S. and Europe exchanging sanctions, threats in daily new headlines, it is hard to imagine anyone in the business world would miss the connection between surging oil, gasoline prices, and escalating tensions over Iran's nuclear program.

To our surprise, Forbes published an op-ed by Louis Woodhill dated Feb. 22 titled "Gasoline Prices Are Not Rising, the Dollar Is Falling" blaming the surging gasoline prices on the dollar depreciation, and that

"Assuming that gold prices remained at today’s $1,759.30/oz, WTI prices would have to rise by about 22%, to $128.86/bbl, in order to reach their long-term average in terms of gold.....At this point, we can be certain that, unless gold prices come down, gasoline prices are going to go up—by a lot. And, because the dollar is currently a floating, undefined, fiat currency, there is no inherent limit to how far the price of gold in dollars can rise, and therefore no ultimate ceiling on gasoline prices."

While we don't disagree that there are many moving parts that could drive oil and gasoline prices higher, but the U.S. dollar and gold are not among the deciding factors as the article asserts.

First of all, crude oil and related processing accounts for over 80% of what we pay at the gas pump (see chart below). So the short answer to the recent gasoline price spike is the surging crude oil prices, and more specifically, Brent oil marker on the ICE exchange. U.S. gasoline prices have been trending more closely with Brent since WTI has largely lost its benchmark status due to the inventory glut at the logistically-challenged Cushing, OK.

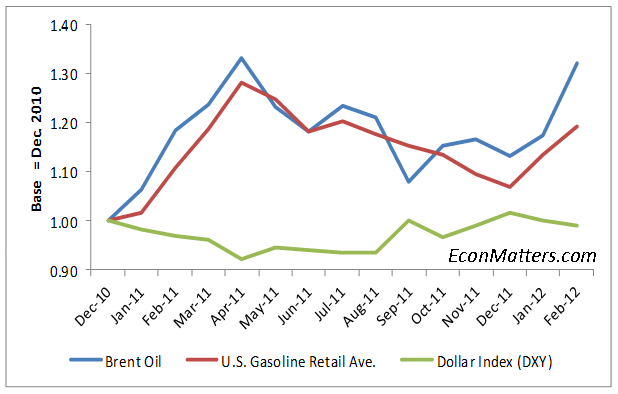

For one reason or another, crude oil seems to always have a drama each year. Last year was Libya and to some extent the Arab Spring, and this year is Iran's turn. As the chart below (indexed to Dec. 2010 as the base year) illustrates, there is some correlation between the price of Brent, average retail gasoline, and the Dollar Index (DXY) , but the direction of the dollar does not fully account for the volatile oil and gasoline.

Market fundamental factors such as dwindling "easy oil" production and reserves, and strong Asian oil demand are also part of the drivers behind strong crude and gasoline prices. However, the spike in gasoline prices this years is primarily due to the fear factor of supply shortages should Iran play hard ball (a highly unlikely scenario, see our discussion here), and speculators bidding up the price exacerbating the legitimate worries from real end users.

Gold and crude oil do sometimes move in tandem when funds flow to the direction of the age-old inflation trade - long commodities, short the dollar. Furthermore, dollar does typically have an inherent inverse relationship with commodities, since most commodities, including crude oil, gasoline and gold, are priced in dollar. Nevertheless, these are hardly the cause of the effect of "no ultimate ceiling on gasoline prices." as Woodhill concluded regarding the current run-up of gasoline prices.

Dollar debase has been going on for over a decade and in the long run most likely would continue without some fundamental fiscal reform as the U.S. debt topped the $15-trillion mark, and Federal Reserve's extraordinary measure to keep interest rate low till 2014. Fed Funds Rate has been targeted at 0%-0.25% for an unprecedented 3+ years since Jan. 2009. Most other central banks around the globe also have been on the monetary easing bandwagon since the Great Recession.

This "great punch bowl" served up by central banks would eventually come back to bite the world economy in the form of stagflation in the developed countries or hyperinflation in other higher growth regions. Nevertheless, time time around, dollar devaluation has little to do with Iran geopolitics, and speculators jacking up the oil and gasoline price right now.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2012 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.