Stock Momentum Reversal Trading Method

InvestorEducation / Learn to Trade Apr 02, 2012 - 01:42 AM GMTBy: David_Banister

After a few years of testing with both ETF’s and then individual stocks, we rolled out our MRM (momentum reversal method) platform at my ATP subscription service in November 2011. This is now beginning to get alot of attention in the trading community as in addition to the ATP service, I have shared some of the real time MRM type plays online with some very top notch traders.

After a few years of testing with both ETF’s and then individual stocks, we rolled out our MRM (momentum reversal method) platform at my ATP subscription service in November 2011. This is now beginning to get alot of attention in the trading community as in addition to the ATP service, I have shared some of the real time MRM type plays online with some very top notch traders.

In essence, my work revolves around crowd psychology or what I call “Crowd Behavior”. If there is one thing in the stock markets that never changes, it’s how crowds react to news, events, and also how they over-react more importantly. My MRM system helps to define where the crowd may be over-reacting on the upside and also obviously the downside of a move in a security. Knowing roughly where that upside and downside exhaustion point may be, can obviously be a huge tool in a traders tool box.

Let’s be honest, the Holy Grail of investing and or position trading would be to buy low and sell high as often as possible with as few mistakes as possible right? The ATP MRM crowd based timing method is what that aims to do, a lofty goal but one we feel we are achieving on a regular basis. The major problem most investors have is selling out of a position at the extreme areas of “Pain”, where your emotions take over and you cant take the paper loss any longer and you sell. The other issue is chasing stocks higher because the adrenaline and excitement of owning a stock that is rushing higher is too hard to pass up.

Both of those investor psychology based decisions are made in panic buy and panic sell modes. That leads to a recipe for disaster for a trading account over time. Instead, what we want to do is the opposite right? We want to calmly buy shares in a stock that has become oversold due to emotional responses from the crowd, and sell into a huge rally where the crowd has become overly exuberant. What if you could do that on a regular basis all the time with cool and calm nerves of steel?

Our MRM trading system at ATP allows us as best as we can to cooly and calmly enter into oversold stocks right near the apex of the lows, and then quietly exit into the rush as the stock reverses back to the upside.

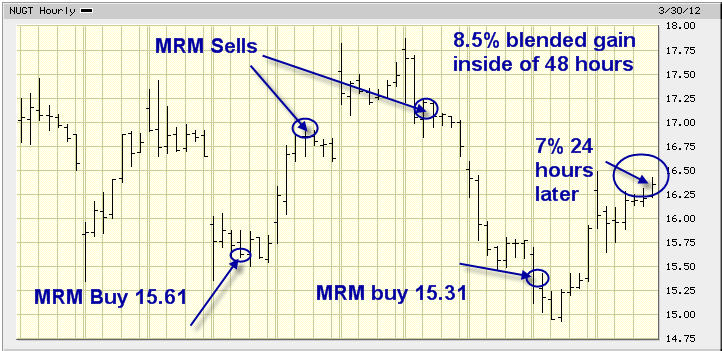

Recent examples include the ETF NUGT. This is a 300% leveraged ETF to the Gold Stock Index. Now we all know the Gold Stocks have been under severe pressure of late as the GDX ETF has cratered from its highs over the last many months. My MRM system though kept us out of the gold stocks, until very recently when we saw the idea entry point for a swing. Based on the GDX falling into the 49 and below level, my MRM targets said we were at an extreme emotional bottom using my 1 day, 3 day, and weekly crowd indicators. We therefore entered calmly into NUGT at 15.61, and within 48 hours we saw that ETF rally to 17.81! We sold at 16.80 and 17.10 for 1/2 and 1/2 tranches to pocket 7-10% gains inside of 2 days. The move from 15.61 to 17.81 was a 14% move inside of 48 hours!! We also knew to sell into that rally because just a few short days later the NUGT had fallen all the way back to 15.30 per share. My MRM method then said 15.31 was another entry buy, and 24 hours later NUGT was up another 7%! So in the span of 6 trading days, MRM gave out an 8.5% blended return, and then followed it up with another 7% return. Thats 15.5% of return with low downside risk in 6 trading days on just one ETF position!

We usually apply this type of work to MRM Positions that we actually intend to position ourselves in weeks not days. However, if we do get extreme moves in a short period of time, we always look to trim back some of those profits in the position. The samples above are what I call “Active Trades” at my ATP service, these are intended to days not weeks in holding period. Keep in mind alot of our work is in an Active MRM portfolio where again, we are holding swing positions for weeks and not days, so it does not require as much daily work by our partners.

Some additional recent samples include CVV which we entered twice for profits inside of a few months. We banked 13-16% gains on one swing, waited weeks and entered again. The stock actually dropped below our MRM entry and we held on knowing that it was likely bottoming out amidst panic emotional selling at 10.66 per share. A few weeks later our patience paid off as the stock rose to 13.80 per share. Most traders would have taken the loss below $11 per share, and missed the reversal back up for 25% or more. When you take a loss that way, you must then replace that position with another trade that gains 25% or more in this case. MRM helps to avoid panic selling, and often to take advantage of panic drops in a stock to buy more.

Consider joining us for 90 days trial period and play along. We provide all the alerts in real time via Email and internet posting. We provide daily updates on all positions and 24/7 Email access to me for any questions.Learn more and sign up at www.activetradingpartners.com/mrm

Dave Banister

CIO-Founder

Active Trading Partners, LLC

www.ActiveTradingPartners.com

TheMarketTrendForecast.com

Dave Banister is the Chief Investment Strategist and commentator for ActiveTradingPartners.com. David has written numerous market forecast articles on various sites (MarketOracle.co.uk, 321Gold.com, Gold-Eagle.com, TheStreet.Com etc. ) that have proven to be extremely accurate at major junctures.

© 2010 Copyright Dave Banister- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.