Stock Market Rally Beginning of the End

Stock-Markets / Stock Markets 2012 Apr 04, 2012 - 10:35 AM GMTBy: Toby_Connor

As convincing as this rally has been I am confident this is an ending phase and not the start a new secular bull market. Actually the bear market began last year in May but was temporarily aborted by massive Central Bank printing. Let me explain.

As convincing as this rally has been I am confident this is an ending phase and not the start a new secular bull market. Actually the bear market began last year in May but was temporarily aborted by massive Central Bank printing. Let me explain.

The last four year cycle that started in 2002 and bottomed in 2009 was the longest four year cycle in history. It was stretched to these extreme lengths by Bernanke's desperate strategy of debasing the currency to avoid the bear market that should have begun in 2006. Instead the stock market cycle stretched all the way into the spring of 2009.

I have mentioned before that often a long cycle will be followed by a short cycle. This being the case the current four year cycle should have bottomed in the fall of 2012. That process had begun last summer.

However, Central Banks around the world, in the futile attempt to avoid a global depression again cranked up the printing presses. The bear market that had begun in May was temporarily aborted. Amazingly I think we are going to see another stretched four year cycle. And this one is going to end just like the last one when the price of oil spiked far enough to collapse the global economy and create a market crash. The next economic downturn won't be a Great Recession, it will be a Great Depression.

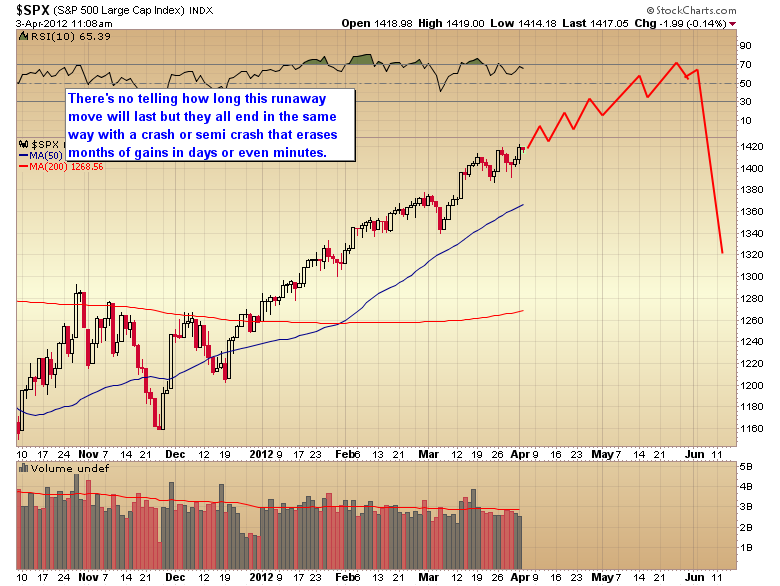

At the moment the stock market is in a runaway move very similar to what unfolded out of the summer 2006 yearly cycle low. These runaway moves are characterized by uniform mild corrections all of similar magnitude and duration. For this particular rally the corrective size has been roughly 25-35 points. This could continue for weeks or months, but all runaway moves end in the same fashion, with a crash or semi crash that wipes out months of gains in a matter of days or even minutes.

Generally speaking, once a corrective move has run 20% beyond the normal correction size that is the signal that the move is over. Unfortunately, at that point you are usually already into the 'crash day'. This is why at some point one has to say enough is enough, and stand aside, or you risk getting caught in the crash.

When this runaway move comes to an end I'm pretty sure it will signal the beginning of the end for this cyclical bull market. That doesn't mean that we won't see a test or even a marginal break to new highs but I think we are clearly in the final phase of this liquidity driven rally that began in March of 2009.

We are now at the mercy of oil and the commodity markets. Bernanke's plan to print our way to prosperity is destined to failure. Ultimately he is just going to spike inflation and collapse the global economy, resulting in a worse downturn than what we saw in 2008/09.

Whether that breaking point is at $120 oil or $160 oil is anyone's guess.

Click here to access the premium newsletter. Click here for the $10 trial subscription.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2012 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.