Gold Moves Higher For No Particular Reason Yet Seen

Commodities / Gold and Silver 2012 Apr 10, 2012 - 09:37 AM GMTBy: Jesse

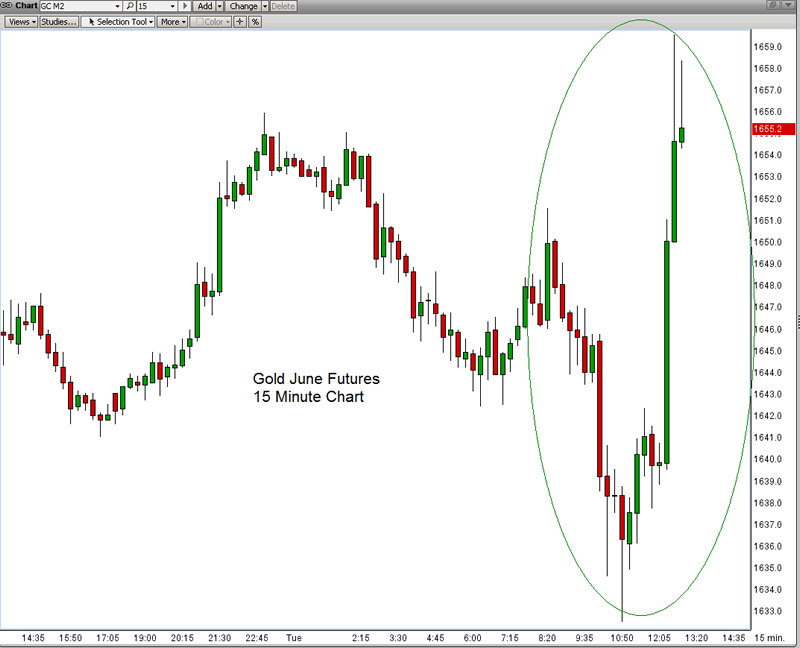

I am checking various rumours, but so far nothing in the news can explain this remarkable short term rally in gold.

This is a significant divergence from the equity markets. Silver also has lagged a bit.

I would not chase it at this point, although that is easier to say as I did some additional buying earlier today and then went out for a walk and some light reading on the patio. Spring is in the air.

Did some news leak out to the trading desks? Or is this a TBTF trading desk running the metal up in a cynical rally before hitting it with another bear raid, 'London Whale-style.' If that is the case, then I would like to think that even the CFTC would be shamed into action.

It could even be the technical exhaustion of a selling program. But the divergence is highly remarkable.

The noticeable artificiality of big money moving prices around in the short term is what makes these light volume markets so difficult to trade in the short term. That, and that they are rather corrupt. Almost shamefully so in New York and London.

But still gold and silver look like good long term holdings. But even they are only material things, and while they might help keep us alive, yet they cannot give us happiness and lasting life. They are things we are granted, like all material things and talents, and at the end our return to the master will be weighed, and hopefully, not found wanting.

Here is what I had been reading after my walk today. How kind is God, and strange his gentle mercies.

"Life passes, riches fly away, popularity is fickle, the senses decay, the world changes, friends die. One alone is constant; One alone is true to us; One alone can be true; One alone can be all things to us; One alone can supply our needs; One alone can train us up to our full perfection; One alone can give a meaning to our complex and intricate nature; One alone can give us tune and harmony..."

John Henry Newman

By Jesse

http://jessescrossroadscafe.blogspot.comWelcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2012 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.