Bush's Election Year Tax Cut Gimmick as Wall Street Tumble Continues

Stock-Markets / Financial Markets Jan 19, 2008 - 12:39 AM GMT

The looming economic recession is getting “deer-in-the-headlights” recognition by the politicians in Washington . The unfortunate response is to offer “sound byte” solutions rather than real economic stimulus. The Bush administration and the presidential candidates are all vying for who can offer the most attractive stimulus to voters rather than offer the best solution for a healthy economy. The Wall Street Journal offers some insight into the dilemma that we face.

The looming economic recession is getting “deer-in-the-headlights” recognition by the politicians in Washington . The unfortunate response is to offer “sound byte” solutions rather than real economic stimulus. The Bush administration and the presidential candidates are all vying for who can offer the most attractive stimulus to voters rather than offer the best solution for a healthy economy. The Wall Street Journal offers some insight into the dilemma that we face.

The politicians just don't get it. They're talking about creating jobs to appeal to the middle class voters, but the business of Washington is how to spend money. Voters, watch your wallets!

If you watch where the troubled banks are raising capital for their survival, they are going anywhere but to U.S. investors. The reason is that the economy hasn't been based on real capital formation, but debt. The capital is in the hands of our trading partners. All of them have lower taxes than the U.S. In addition, they have economic policies that encourage business growth. Business growth in the U.S. is being choked off by a plethora of regulations and high tax rates. The surprising thing is that we have done so well for so long.

Oh, heavens! Don't pay off that credit card!

In his testimony to congress, Mr. Bernanke suggested that if a tax rebate is passed, it may be spent immediately. That is what consumers have done in the past, pumping up the economy and staving off recession. But history doesn't always repeat itself. A t least one economist argues that 2008 bears no resemblance to 2001 and that consumers may well act differently this time -- and keep their purse strings tightened. In other words, they will be more inclined to pay off a credit card than spend the money. That will not help jumpstart the economy this time.

What were the pollsters smoking?

WASHINGTON (MarketWatch ) -- U.S. consumer sentiment improved in January, according to the consumer sentiment survey released Friday by UMich and Reuters, though some analysts are skeptical about how good the news actually is.

I agree with the skeptics. The dramatic decline in the markets does not jive with an upbeat consumer sentiment.

Wall Street has a loss of confidence? Go figure!

“After all, how often does the average Joe get to see the masters of the universe shaking in their pinstriped suits, filing out of Mammon's New York fortresses with pink slips in their hands, brows furrowed as they calculate how long their last bonus will pay the rent on the Park Avenue duplex.” (Source: MarketWatch)

The problem is, when Wall Street is in trouble, the whole country suffers.

Treasury are still making a top.

NEW YORK ( CNNMoney.com ) -- Bond prices rose Thursday after the Philadelphia Federal Reserve said its manufacturing index unexpectedly sank 20.9 percent in January, high-lighting fears that the economy is headed for recession.

NEW YORK ( CNNMoney.com ) -- Bond prices rose Thursday after the Philadelphia Federal Reserve said its manufacturing index unexpectedly sank 20.9 percent in January, high-lighting fears that the economy is headed for recession.

The trouble is, bonds have been predicting a recession since June.

Hope springs eternal!

After rallying to $916 per ounce, gold settled back to $875-880. It is thought to be in a consolidation before attacking new highs. Factors such as high inflation expectations, global tensions and a Fed rate easing are all being considered by gold analysts as forces that will drive the price of gold higher.

After rallying to $916 per ounce, gold settled back to $875-880. It is thought to be in a consolidation before attacking new highs. Factors such as high inflation expectations, global tensions and a Fed rate easing are all being considered by gold analysts as forces that will drive the price of gold higher.

But the upward momentum may be broken. Wednesday's dramatic sell-off may have shaken up investors enough to drive them to the exits at the sign of any further weakness.

The Nikkei looks to the U.S. for guidance.

The average Japanese investor knows how dependent their economy is on the health of the U.S. consumer. That may be why they paused to see what Mr. Bush is proposing in his economic stimulus package. If the U.S. market's reaction is any guidance, they will be sorely disappointed. Traders are eager for any news that could spell relief from the technical damage that has been done to the Nikkei. Pass the Rolaids!

The average Japanese investor knows how dependent their economy is on the health of the U.S. consumer. That may be why they paused to see what Mr. Bush is proposing in his economic stimulus package. If the U.S. market's reaction is any guidance, they will be sorely disappointed. Traders are eager for any news that could spell relief from the technical damage that has been done to the Nikkei. Pass the Rolaids!

What a ride on the Shanghai Express!

It took only one week for Chinese investors' 2008 losses to catch up with those in the U.S. Now it's a race to the bottom, with the Shanghai Express gaining the lead. My forecasting model suggests the Shanghai Composite will be approaching 3000 sometime in the first half of this year.

It took only one week for Chinese investors' 2008 losses to catch up with those in the U.S. Now it's a race to the bottom, with the Shanghai Express gaining the lead. My forecasting model suggests the Shanghai Composite will be approaching 3000 sometime in the first half of this year.

One of the factors for this decline is the Central Bank of China raised interest rates another half percent. In addition, the regulators raised bank reserve requirements to 15%. That should put a chill on these lofty prices. Last week I suggested that 5000 would be a good place for a failure. I got that one right!

How many ways do you spell recovery?

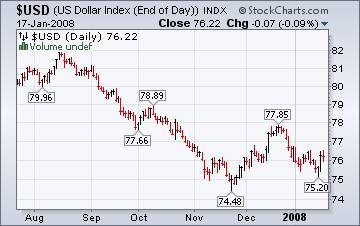

The dollar is strengthening against the yen today. The article that I have linked suggests the rising dollar is due to short covering and the unwinding of some carry trades. The carry trade is based on borrowing yen and buying U.S. assets. However, the carry trade has run into losses recently since the yen has risen from 81 to 93 in the past six months. This has put many hedge funds at a double loss, since the U.S. stock market has also declined in the past three weeks. This is causing a mass exit from yen-based loans and a return to the U.S. dollar as a safer haven.

The dollar is strengthening against the yen today. The article that I have linked suggests the rising dollar is due to short covering and the unwinding of some carry trades. The carry trade is based on borrowing yen and buying U.S. assets. However, the carry trade has run into losses recently since the yen has risen from 81 to 93 in the past six months. This has put many hedge funds at a double loss, since the U.S. stock market has also declined in the past three weeks. This is causing a mass exit from yen-based loans and a return to the U.S. dollar as a safer haven.

Renters have a leg up over owners.

The New York Times is now profiling the ideal home buyer as a young professional not burdened by home ownership. Such a buyer will need a cash down payment and an income high enough to support monthly payments, including any potential increases at reset time. Not having a home is now an “asset,” since so many homes are under water and any attempt to buy a new home is just too complicated for many who thought they would “step up” into a nicer home.

The New York Times is now profiling the ideal home buyer as a young professional not burdened by home ownership. Such a buyer will need a cash down payment and an income high enough to support monthly payments, including any potential increases at reset time. Not having a home is now an “asset,” since so many homes are under water and any attempt to buy a new home is just too complicated for many who thought they would “step up” into a nicer home.

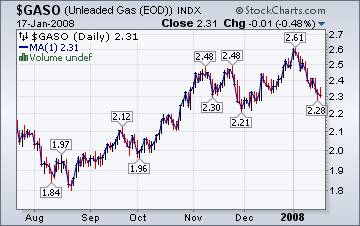

Gasoline prices lower in real and inflation-adjusted dollars.

The Energy Information's Weekly Report does an interesting comparison of how fuel prices have affected the average consumer's monthly budget. Despite record high prices in fuel, the average consumer spends 2.5% less of their monthly budget today as he did in 1981. During the third quarter of 2007, consumers spent 5.7% of their monthly budget on fuel, compared to 8.2% of their monthly budget in 1981. Small consolation, but an interesting observation, nonetheless.

The Energy Information's Weekly Report does an interesting comparison of how fuel prices have affected the average consumer's monthly budget. Despite record high prices in fuel, the average consumer spends 2.5% less of their monthly budget today as he did in 1981. During the third quarter of 2007, consumers spent 5.7% of their monthly budget on fuel, compared to 8.2% of their monthly budget in 1981. Small consolation, but an interesting observation, nonetheless.

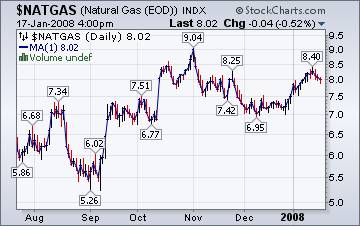

Prices for natural gas remain flat.

The Natural Gas Weekly Update suggests that higher prices for natural gas are weather-dependent, with the highest prices in the Northeast, which just experienced a severe winter storm. Drawdowns of natural gas in storage, however, are only moderate, so the long-term outlook still looks positive for natural gas users. It is claimed that a proposed LNG facility off Long Island Sound may bring lower prices to the New York City area.

The Natural Gas Weekly Update suggests that higher prices for natural gas are weather-dependent, with the highest prices in the Northeast, which just experienced a severe winter storm. Drawdowns of natural gas in storage, however, are only moderate, so the long-term outlook still looks positive for natural gas users. It is claimed that a proposed LNG facility off Long Island Sound may bring lower prices to the New York City area.

When the Levee Breaks…

…is a song written by Kansas Joe McCoy and Memphis Minnie in 1929, commemorating the Great Mississippi Flood of 1927. Interestingly, it was famously re-worked by English rock group Led Zeppelin as the last song on their fourth album , released in 1971 . The lyrics in Led Zeppelin's version were based on the original recording.

Doug Wakefield and Ben Hill wrote a piece in a similar vein entitled “ Are the Levees Starting to Break?”

“I have often stopped to ponder our human condition – specifically, our uncanny ability to dismiss the seriousness of an event beforehand and to lament our lack of preparation after it has happened. How many New Orleans residents stated, in some form or fashion, that they never expected the storm to break the levees? But, it's easy to see the rational behind their unresponsiveness. They had been through countless storms since the levees were first established and nothing that dire had ever happened.” – September 2006, The Investor's Mind: Too Costly to Bear

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I pre-recorded our weekly session on Wednesday about the markets. It was shockingly prescient. You will be able to access the interview by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.