European Central Bank: "Great White Fear" Takes A Bite Out of Recovery

Interest-Rates / Eurozone Debt Crisis Apr 24, 2012 - 08:49 AM GMTBy: EWI

It's been over two years since the European Central Bank began its open-heart surgery of the eurozone's anemic economy. So far, the procedure has included an unprecedented $3 trillion-plus in bailouts, monetary transfusions, AND toxic debt transplants.

It's been over two years since the European Central Bank began its open-heart surgery of the eurozone's anemic economy. So far, the procedure has included an unprecedented $3 trillion-plus in bailouts, monetary transfusions, AND toxic debt transplants.

Yet, according to a recent slew of discomforting news reports, the economies across the pond would still flatline in seconds without constant life support. Here, an April 18, 2012, Wall Street Journal writes:

"Europe Hemorrhages through Refinancing Operation Band-Aid" and reveals that Europe's banking sector has wolfed down three years of Long Term Refinancing Operations (LTROs) in under four months.

The question is -- what went wrong?

Well, to answer this, we have to go back to the drawing board to mid-2010. It was then that the European Central Bank and company released the rescue-package Kraken via a $1 trillion bailout of Greece and a full-fledged initiation of its LTRO.

And, as the following May 10, 2010, news items make plain, this credit-reflating beast was set to tear Europe's economic bear to shreds:

- "This is shock-and-awe, part II, in 3D, with a much bigger budget and more impressive array of special effects. The EU package eliminates the danger that Greece's debt woes will ricochet through Europe's banks." (USA Today)

- "This is a truly overwhelming force and should be more than sufficient to stabilize markets, prevent panic and contain the risk of contagion." (Bloomberg Businessweek)

In the July 2010 Global Market Perspective, however, our analysts foresaw a fatal flaw in the plan. The first part was fine: The European Central Bank (ECB) bought packages of debt and resold them to smaller banks at a historically low interest rate.

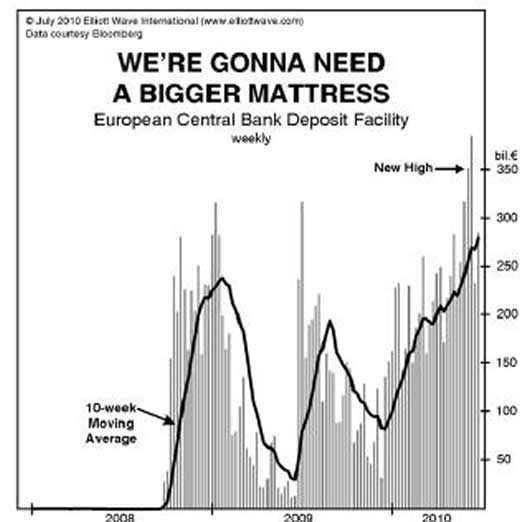

BUT the second part didn't work out: Instead of rebundling those loans and passing them on to small businesses to stimulate investment, THOSE banks redeposited the funds with the ECB. Riffing off the famous "Jaws" quote ("We're gonna need a bigger boat"), the July 2010 Global Market Perspective captured the great-white fear circling the lending sector via the following chart of commercial banks' usage of the ECB's Deposit Facility and wrote:

"The chart roughly indicates the degree to which banks fear for the insolvency of one another. Banks receive below-market interest rates on their ECB deposits, so they're generally loathe to hold significant funds there. As anxiety grows, however, so do banks' deposits in the Facility, mainly because their desire for adequate interest gives way to their more essential need to safeguard principal ... Because the [economic downturn] is still young, deposits at the ECB will likely keep rising. Like stocks, the casual approach to banking that existed up until now is in for a massive shift."

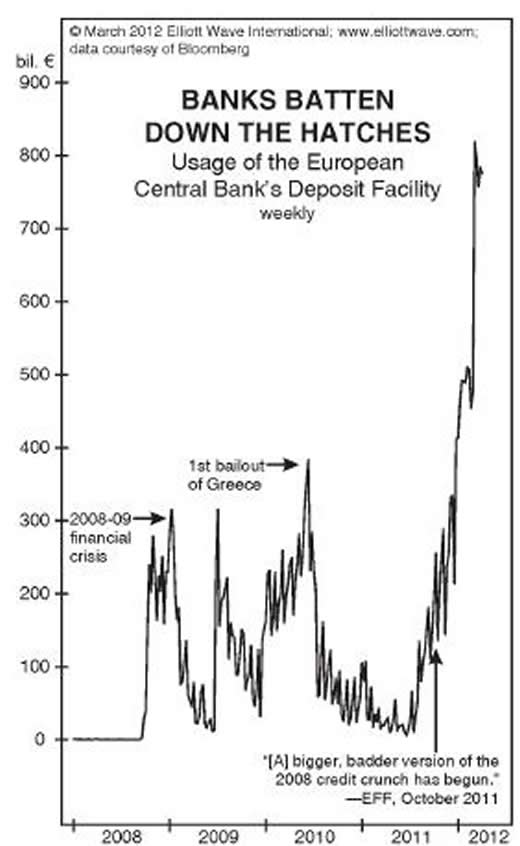

Flash two years ahead. The April 2012 Global Market Perspective's updated chart below shows that usage of the ECB's Deposit Facility has indeed risen, nay doubled, since the original forecast.

The question now is not whether monetary policy will save Europe's economy, but whether the one precondition for recovery -- confidence -- will return to lenders.

What the European Debt Crisis Could Mean for YOUR Investments The European Debt Crisis is affecting investments across the globe. Gain a valuable perspective on the European debt crisis and get ahead of what is yet to come in this FREE club resource from Elliott Wave International. Read Your Free Report Now: The European Debt Crisis and Your Investments. |

This article was syndicated by Elliott Wave International and was originally published under the headline European Central Bank: "Great White Fear" Takes A Bite Out of Recovery. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.