Position Yourself for the Rest of "Conquer the Crash"

Stock-Markets / Financial Crash May 24, 2012 - 01:44 AM GMTBy: EWI

To this day, I wonder why Robert Prechter's book Conquer the Crash has not been more widely recognized. It described in advance much of what happened in the 2008 financial crisis.

To this day, I wonder why Robert Prechter's book Conquer the Crash has not been more widely recognized. It described in advance much of what happened in the 2008 financial crisis.

Published in 2002, the book provided detailed descriptions of then-future economic scenarios. They were detailed vs. general. Prechter was specific in a way that would prove right or wrong; there was no gray.

This is from the book:

There are five major conditions in place at many banks that pose a danger: (1) low liquidity levels, (2) dangerous exposure to leveraged derivatives, (3) the optimistic safety ratings of banks' debt investments, (4) the inflated values of the property that borrowers have put up as collateral on loans and (5) the substantial size of the mortgages that their clients hold compared both to those property values and to the clients' potential inability to pay under adverse circumstances. All of these conditions compound the risk to the banking system of deflation and depression.

Conquer the Crash, second edition, (p. 179)

That's just one excerpt about one topic in a 456-page text. Perhaps you see why I believe the book deserves more credit. Yet even that one paragraph from the book turned out to be a virtual mirror of what came to pass. And much of what he predicted is unfolding today: the JPMorgan trading fiasco, massive withdrawals at Greek banks, downgrades of Italian and Spanish banks and much more. Those are just a few headlines.

The broader point is that Conquer the Crash prepared its readers. Around the time the book's second edition published in 2009, the Chicago Sun-Times remarked

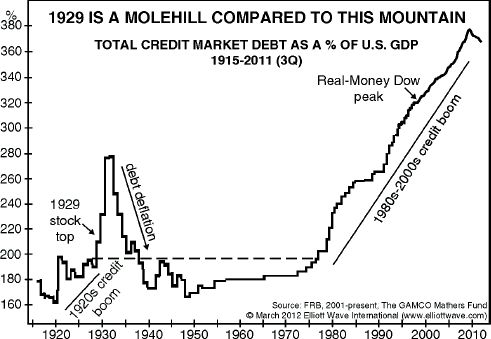

And the credit implosion is still not over. Please take a look at the chart:

In the Conquer the Crash quote in the first part of this article, you'll notice the last three words are "deflation and depression."

The world has yet to completely pass through these economic valleys.

It's not too late to prepare yourself for what's ahead Elliott Wave International is offering a special free report with 8 lessons from Conquer the Crash to help you prepare for your financial future. In this 42-page report, you'll get valuable lessons on what to do with your pension plan, what to do if you run a business, how to handle calling in loans and paying off debt, a list of imperative do's and don'ts, plus much more. |

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.