Gold Bar Demand in China Surged 51% to 213.9 Tons In 2011

Commodities / Gold and Silver 2012 May 28, 2012 - 04:51 AM GMTBy: GoldCore

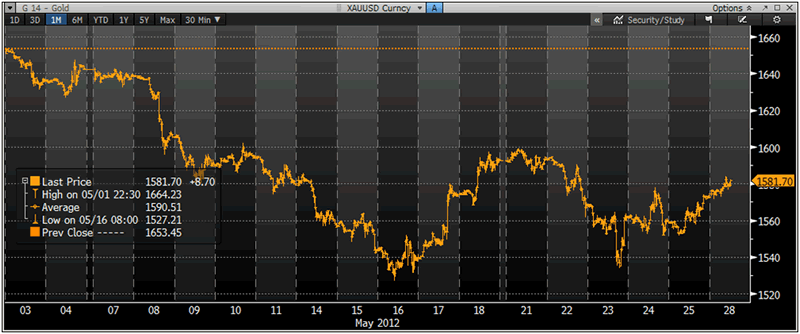

Gold’s London AM fix this morning was USD 1,579.00, EUR 1,255.67, and GBP 1,006.63 per ounce. Friday's AM fix was USD 1,560.50, EUR 1,240.66, and GBP 996.04 per ounce.

Gold’s London AM fix this morning was USD 1,579.00, EUR 1,255.67, and GBP 1,006.63 per ounce. Friday's AM fix was USD 1,560.50, EUR 1,240.66, and GBP 996.04 per ounce.

Silver is trading at $28.65/oz, €22.86/oz and £18.33/oz. Platinum is trading at $1,442.50/oz, palladium at $592.60/oz and rhodium at $1,275/oz.

Gold rose $13.30 or 0.85% in New York on Friday and closed at $1,572.80/oz. The higher close Friday was not enough to prevent a lower week for gold which was down 1.2% for the week.

Asian trading started out flat and then gold climbed to about $1,583/oz and pulled back a bit and is now trading in Europe near $1,580/oz. US markets are closed for Memorial Day today which means that volumes may be low and illiquidity could result in sharp price movements.

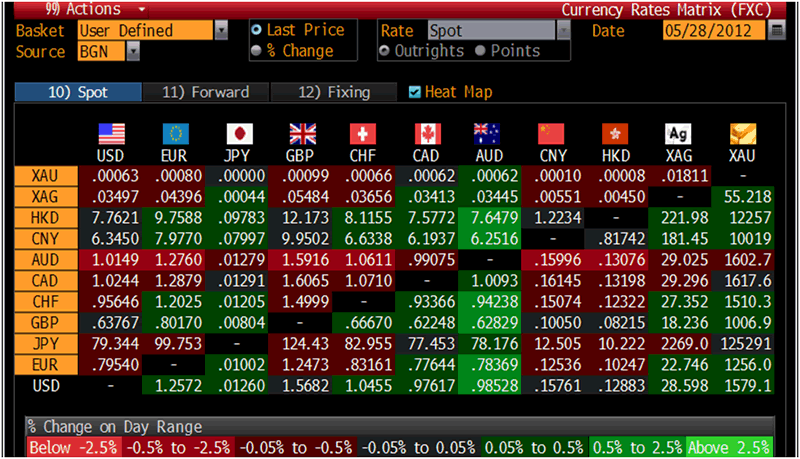

Cross Currency Table – (Bloomberg)

Gold is higher in all currencies today as some buyers view the recent price falls as overdone and are buying the dip. There is some relief that Greek opinion polls showed pro bailout conservatives in the lead for elections. This has alleviated fears of a disastrous Greek exit from the euro, but uncertainty still remains and ‘Grexit’ remains likely.

The risk of contagion in the Eurozone appears to increase by the day as the news from Spain shows that it is following fast in the footsteps of Greece and this will support gold. Bank runs in Greece and the risk of bank runs in Spain and elsewhere are a scenario which could lead to contagion.

As long as the short term panacea of using quantitative easing, the modern euphemism for the creation of trillion of units of currency (dollars, euros, pounds etc) is embraced by global policy makers – gold’s bull market is assured.

The day or reckoning has been postponed for now but economic recovery is not coming and indeed there is now the real risk of a global recession and even a global Depression – especially if there are widespread global electronic bank runs.

While gold and silver fell marginally last week, the very large weekly returns in the gold mining sector may signal we are close to a bottom. The XAU and HUI gold mining indices rose 6.8% and 7.9% respectively. Strong gains in the XAU and HUI have often preceded market bottoms for gold and silver.

This week investors will look to China’s PMI and US non-farm payrolls to gauge the health of the world’s two largest economies.

XAU/USD Currency Chart – (Bloomberg)

A reminder of the sharp increase in demand for gold and silver, particularly store of wealth demand, in recent years was seen in the figures released by the China Nonferrous Metals Industry Association in Shanghai today.

China’s gold consumption rose 33% to 761 tons in 2011 and China’s silver consumption rose 6.8% to 6,088 tons last year.

China’s gold consumption rose 190 metric tons last year to 761 tons, Wang Shengbin, China Gold Association Vice Chairman, said in a speech in Shanghai as reported by Bloomberg.

China’s jewelry consumption jumped 28 % to 456.7 tons last year, gold bar consumption surged 51% to 213.9 tons and gold coin consumption gained 25% to 20.8 tons, Wang said

China’s silver consumption, including industrial use, jewelry and coins, rose 6.8% to 6,088 metric tons last year, the vice chairman said. The amount shows a surplus given China’s output of 12,348 tons last year, which gained 6.3%, Wang said.

For the latest news and commentary on financial markets and gold please follow us on Twitter.GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.