More Work Before Stock Market Intermediate Low?

Stock-Markets / Financial Markets 2012 Jun 11, 2012 - 05:07 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Very Long-term trend - The very-long-term cycles are down and, if they make their lows when expected (after this bull market is over) there will be another steep and prolonged decline into late 2014. It is probable, however, that the steep correction of 2007-2009 will have curtailed the full downward pressure potential of the 120-yr cycle.

SPX: Intermediate trend - SPX is working on an intermediate low.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Market Overview

As anticipated in last week's newsletter, which was entitled "MARKET LOW FORMING", the indices did find a low on 6/04 and have been rising since. So far, the SPX has tacked on a quick 62 points, but may find the going a little tougher from this point on. Although Friday's session was positive, the action looked tentative, cautious, as if the main players were sitting on the side lines ahead of the week-end. That could mean that they are expecting some news which may affect the market adversely. However, unless we see some significant weakness develop, this could turn out to be part of the consolidation which started on 6/09 and, when it's over, we could go on to reach our intended target for this rally.

There are three potential projections. The most conservative is 1333. The next, which is moderate, is 1343. And there is an optimistic target of 1353. Since all of them exceed the high of 1329 which has already been reached, the odds favor a move past that level with the SPX deciding which target it wants to honor.

It is also possible that 1329 was "it" for now! At best, the SPX has only made a short-term low and it will have to do more work to turn it into an intermediate uptrend. This could entail expanding the current base, either by re-testing the former low of 1267, or even going beyond. Remember that there are still some unfilled projections from the top distribution pattern which call for potential lower targets -- perhaps as low as 1233. And since the daily indicators have not yet given a credible buy signal, the danger of exceeding the former low still exists. The near-term fate of the market should make itself known as early as at the opening, on Monday.

Chart analysis

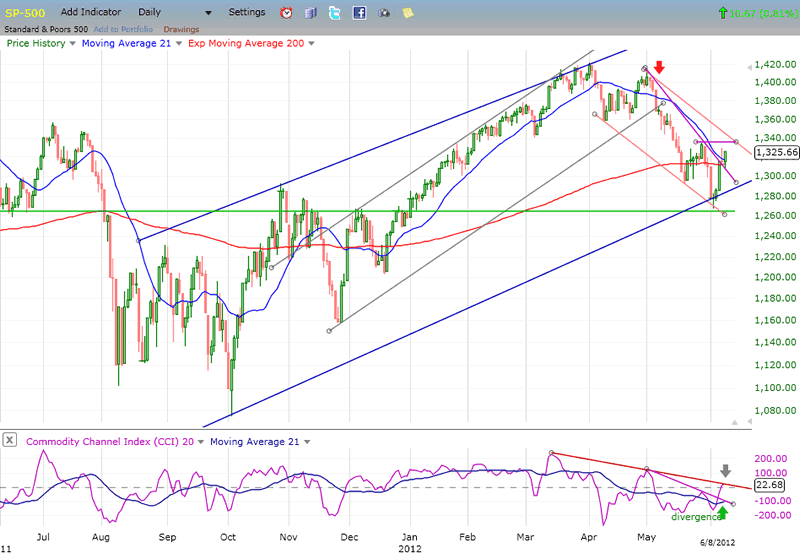

As we do the majority of the time, we'll start with the Daily Chart of the SPX. It's easy to read and it gives us a good perspective on the market position. After correcting for a couple of months, the SPX found combined support from the lower channel line of the larger (blue) channel, the green line drawn across previous tops, and the bottom line of its short-term corrective (red) channel. That, in connection with the bottoming of several cycles pretty much ensured a rally.

However, there are remaining conditions which this rally will have to fulfill to continue. First, the SPX will have to overcome its previous high of 1335 and, although it has breached the decline's short-term down-trend line, it will have to get out of the red channel before we can declare that a reversal has taken place. And there is something more subtle which suggests that this is more of an oversold bounce than a bona fide reversal. There is no visible deceleration in the decline! On its last down leg, the index went all the way to the bottom of the channel. My guess is that we will have to re-test that low and perhaps even go lower until some deceleration appears by its staying away from the lower line of the red channel. Until we see that, the odds that the market has made a low are questionable.

This analysis of the price action is borne out by the indicators. There was some divergence, which meant that a bounce was coming (we knew that cycles were bottoming in this time frame), but the oscillator has not yet been able to go through the longer trend line as well as becoming positive. It stopped fractionally above the zero line. The fact that it went past the former top is a positive, and the odds favor an extension of the rally whether or not there is a pull-back - unless the pull-back is so severe that it significantly alters the near-term price action. This is why next week is so important!

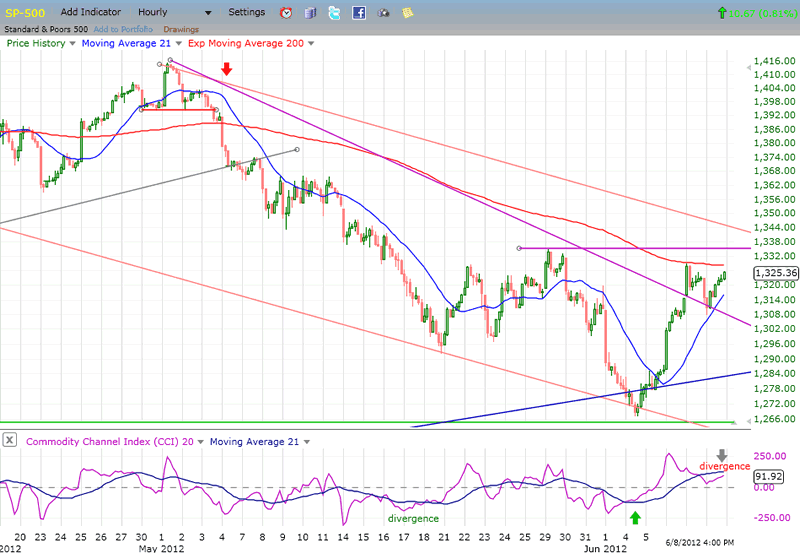

The Hourly Chart allows us to focus on the important aspects of the chart. Here, we can see that, at the low, the price actually went beyond both channels -- an indication of an oversold condition which is ripe for a rebound. Also, the indicator was showing some positive divergence (green arrow) at the same time that it was making a bullish cross of its MA.

Now, however, we have almost the same condition, but in reverse. The opening on Monday morning will make a lot of difference as to what comes next. If the market has a strong opening, it will erase the negative divergence in the indicator by moving through the 200-hr MA and probably the former short-term top of 1335 as well, and proceed to one of the projection targets indicated earlier.

If, on the other hand, there is a weak opening, then the index could re-test 1307, or even move lower before resuming the rally. Going below 1296 would be a negative, indicating that the bounce is most likely over, and that we are dropping into the cycles in the middle of the month (This is not the favored scenario).

Cycles

The cluster of cycles that we discussed last week as a potential time slot for a near-term low worked out well. And now? Have the cycles already exhausted their potential in light of what lies ahead? Perhaps not right away. There are some cycles slated for the middle of June which could turn out to be a market high, rather than a low. The real challenge for the market will probably come in early July if what I call the 2-yr cycle continues to repeat its historical pattern. If it does, this would be the best time for the SPX to secure an intermediate low.

Breadth

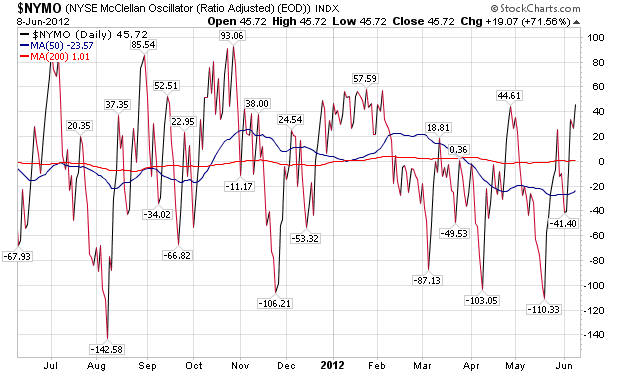

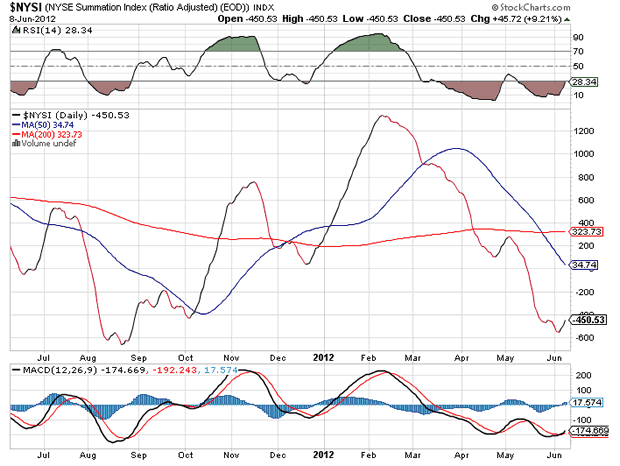

Steady improvement in market breadth has kept the NYMO above zero, and this has caused the NYSI to reverse its downtrend. The new pattern is still fragile and will most likely be tested over the next two to three weeks, when the 2-yr cycle bottoms. This test could result in producing the classic formation made by the NYSI at an intermediate market low: positive divergence, followed by a resumption of its uptrend.

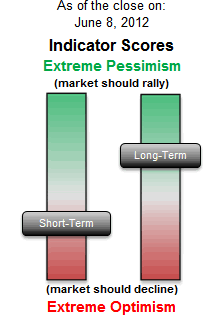

Sentiment Indicators

The SentimenTrader (courtesy of same) long-term indicator is pretty much in the same place as it was last week. Perhaps a little less bullish.

The one on which to focus right now is the short-term index, because it has moved a lot closer to giving a sell signal.

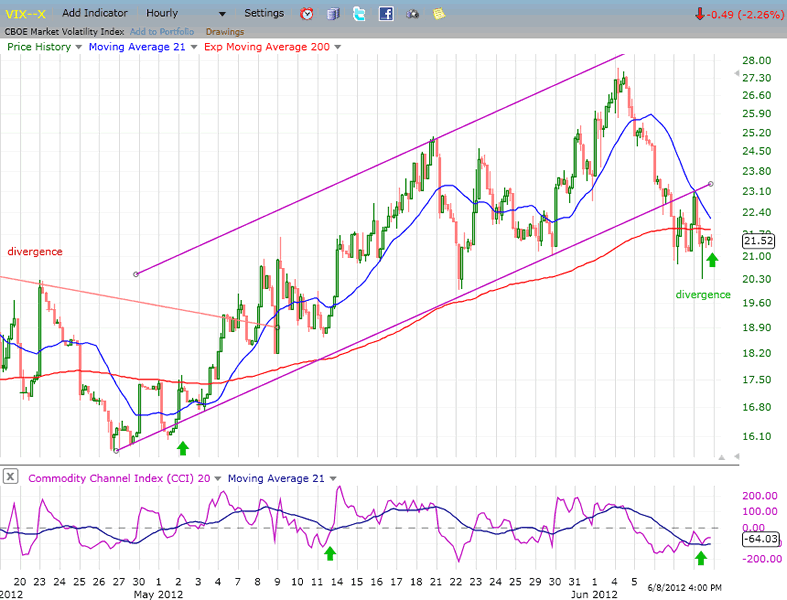

The VIX

VIX adds to the perception that we are about to get another near-term pull-back in the market. It developed some positive divergence to the SPX during the last few hours of trading on Friday. The indicator tends to confirm this.

Note, however, that the index has only broken a short-term trend line and is still in an uptrend until it moves below its former near-term low. If this does not happen shortly, it will reinforce our notion that we have not yet made an intermediate bottom.

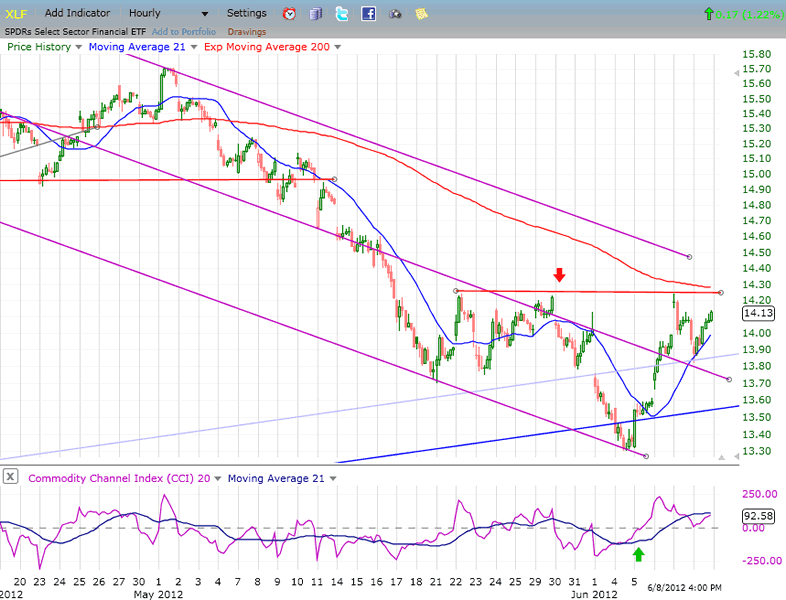

XLF (Financial SPDR)

The XLF has risen all the way to the top of the former short-term high, which makes it slightly stronger than the SPX. However, the indicator is showing some negative divergence which tells us that, unless there is some strong upside momentum at Monday's opening, it is likely to continue to consolidate along with the market.

Like the SPX, it did not show any deceleration at the last low, which means that it will probably retest its low or make a slightly lower low before a better reversal occurs.

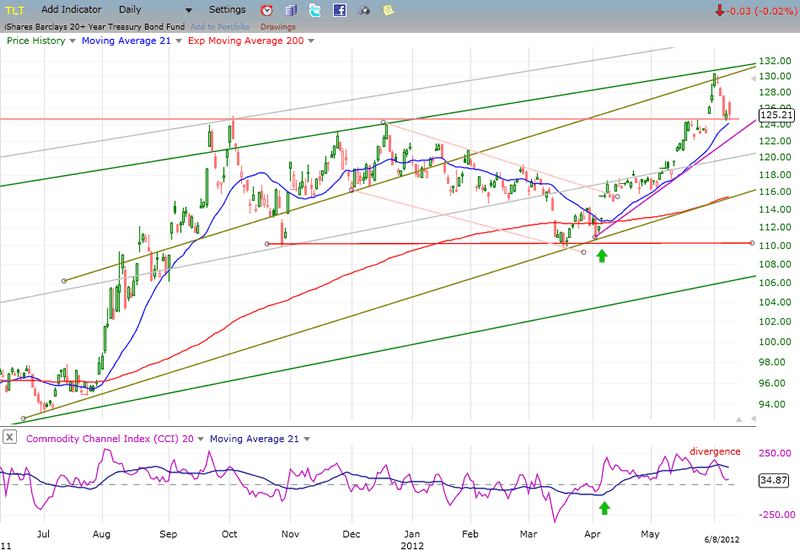

BONDS

After making a new high, TLT stopped its climb in a "blow-off" move similar to what it did when it reached its 125 projection, finding resistance at the junction of two internal trend line parallels with divergence showing on the lower indicator. All this at a time when the SPX met one of its projection levels in a semi-climactic manner, and reversed.

It is now likely that TLT will make an intermediate top at its 133-134 Point & Figure target at the same time that an intermediate bottom is being established by the SPX and other equity indices. Just as the SPX will not have a significant reversal until it breaks out of its descending correction channel, TLT will not enter into an important correction until it breaks below the rising 21-DMA and the trend line which define its uptrend. For now, its first pull-back found support at the recently penetrated 125 top.

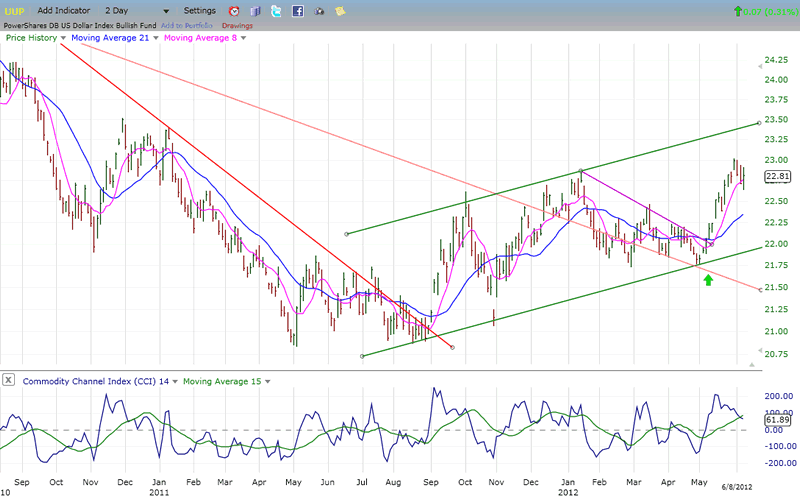

UUP (Dollar ETF) Daily Chart.

It's easy to see that UUP is in an intermediate uptrend which could be morphing into a long-term trend. After all, the index should be on its way to about 25 while the US dollar reaches its 90 base count, but don't expect this to happen over the next couple of weeks.

UUP has just met - and even exceeded - a short term projection to 22.80, which denotes that there is probably enough upside momentum to take it to its next short-term projection of 23.30 -- "coincidentally" at the top of the present channel. This could come when the SPX tries to find an intermediate low around early July.

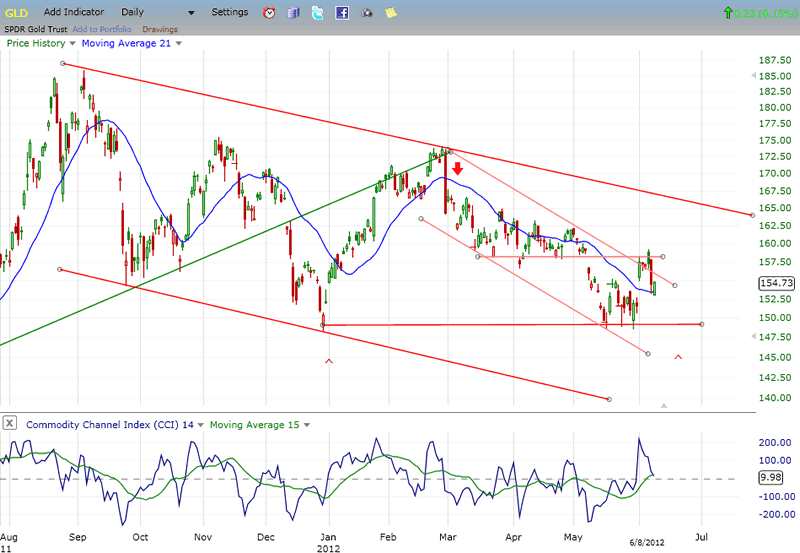

GLD (ETF for gold)

GLD may be in the process of completing an intermediate correction that has been in process for ten months. Its next low is expected to be in mid-June in conjunction with the 25-wk low. If it holds the 149 level, it will have built a base which may allow it to challenge the top of its declining channel. This could be the resumption of its long-term uptrend, but it will not be confirmed until it has risen above 174 -- the top of the February high.

A break-out into a new long-term uptrend does not appear to be right around the corner. The index will first have to build a P&F base large enough to reach its long-term projection of 233. There is still more work to do!

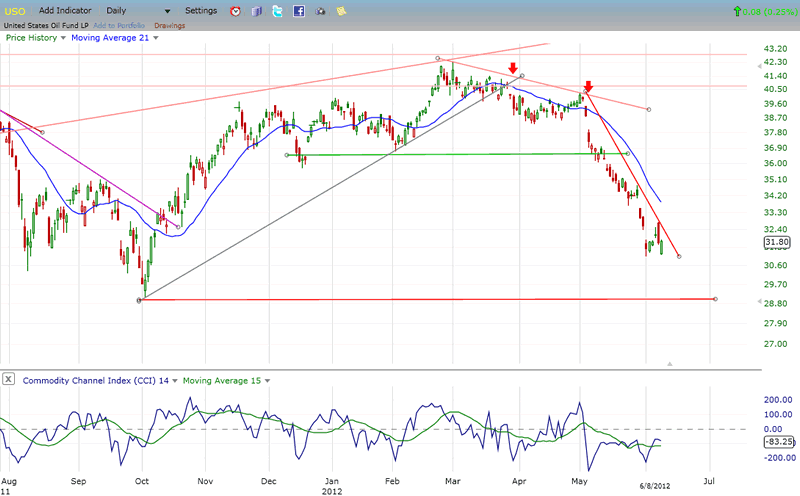

OIL (USO)

USO has been in a steep correction that has shaved off 25% of its value over the past three months with most of it occurring in the last month. But this should be coming to an end. The index had a projection of 30.50/31.00 and, with a low of 31.03 about a week ago, it should now begin to build either a base or a re-distribution phase which could take some time to complete.

The current count comes only from the distribution phase at the right of the top. If we extend the count across the entire area above the green line, we arrive at a projection which is 10 points lower. That would clip off another 25 percent from the top for a total of 50 percent. But this does not sound extreme considering that there is nothing bullish about the long-term chart. From its high of 119 in June of 2008, the stock dropped straight down to 23 in February 2009 and has gone essentially sideways since. The highest retracement it has been able to achieve was when it rallied to 45 in April of last year. That represented a rebound of exactly 23.6% of its total drop.

USO is very likely to break its 23 low and eventually end up somewhere around 8. But this projection, if correct, will only be reached in the Fall of 2014 when the next bear market comes to an end.

Summary

The SPX may be ready to extend its near-term correction before moving higher and completing its rally from 1267. The top is expected to be around 1343 and come in mid-June. After that, an additional decline should take hold which could lead to a marginal new low.

It is possible that 1329 will turn out to be the top of the rally, but it's not the preferred scenario. Whether the index extends is correction or moves higher right away will be decided first thing Monday morning.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.