What I Wish Ben Bernanke Knew About Japan's Economic and Debt Crisis

Interest-Rates / Global Debt Crisis 2012 Jul 06, 2012 - 05:48 AM GMTBy: Money_Morning

I've called Japan my "other" home since 1989 and in that time I've seen it change in ways that ought to scare the pants off you.

I've called Japan my "other" home since 1989 and in that time I've seen it change in ways that ought to scare the pants off you.

I say that not to ruin your day, but because I fear we are headed down the same exact road as long as Ben Bernanke and his central banking buddies think it's easier to print money than actually stimulate real growth.

In doing so, they are re-creating Japan's "Lost Decades" here at home with years of smoldering, piss-poor growth as our destiny.

Yet it doesn't have to be that way. We can still choose a different path.

Here are 10 lessons from Japan I would share with Chairman Bernanke right now if I sat down with him:

1) All the cheap money in the world won't matter if banks hoard it and customers don't want it. You could lower interest rates to zero and it won't make a difference. Japan tried this to no avail. At this point, low rates are hardwired into the Japanese business system to the extent that any increase whatsoever is likely to cause a massive wave of corporate and personal bankruptcies. Don't let that happen here. You still have a chance to prevent this.

2) At some point somebody has to take the loss. You cannot pretend that the debt you've advanced is performing any more than the Japanese have. No matter how much money you inject into the system, the deleveraging process will continue until excess credit is bled out of the system one way or another. Defaults happened with alarming regularity before Central Banks tried to stave them off. There have been literally hundreds in Eastern Europe, Africa, Asia, and Latin America over the centuries. Spain and France failed six and eight times each in the 16th century alone.

3) Trying to manage any singular crisis will only result in a much bigger one down the road. The longer you prop things up, the worse they're going to get and the more consolidation you will see. Five of the 10 largest banks in the world were Japanese in 1990. Today the only bank to make the cut is 5th on the list (the Japan Post Bank Co. Ltd according to Bankers Accuity).

4) When politicians find it easier to borrow money than make hard policy decisions, they will because they prefer their short term re-election prospects over the long-term economic interests of the country. Japan has had 15 Prime Ministers in the last 12 years. Granted, their system works a little differently than ours, but continual reshuffling diminishes the effectiveness of any solution. Take advantage of the situation and act decisively before our elections risk a reset. You're supposedly apolitical. Prove it by acting with conviction instead of giving us more FedSpeak.

5) Cheaper capital actually means fewer jobs. Businessmen will always substitute money for labor when the cost of money is too low versus inflation. They know that creating jobs when you can borrow at real negative rates is a losing proposition. Japan has lost a generation to part time work so far and is losing more of its middle class every day. We're on the same track here in the U.S. as middle class families -- and young families in particular -- fall even further behind just as they have in Japan as full-time employment is eliminated and jobs are consolidated.

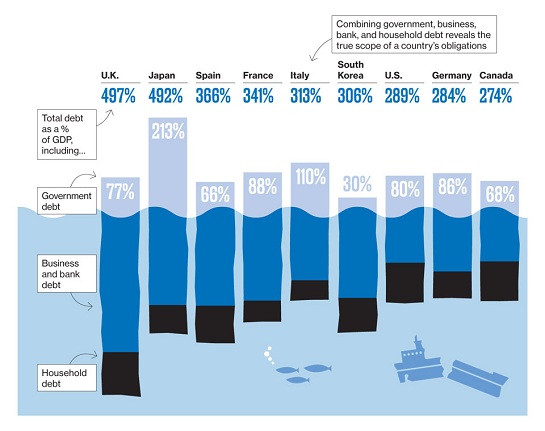

6) When the cost of money is low, governments will waste it and businessmen will not invest. Make it profitable for them to do so, and they will. Lending money to the government cuts twice. Once because it's an implied tax that robs the private sector of the wealth needed for innovation and growth. And twice, because the dollar gets debased. Japan now carries total debt to GDP of nearly 500%.

Figure 1: Source MOF/Goldman Sachs/Zerohedge

7) High interest rates do not preclude investment but taxes and spending do. When money is cheap, productivity falls as do margins even though overall business activity expands for a time. High interest rates force efficient capital allocation and cause businessmen to make decisions based on what they must have versus what's nice to have (just as individuals do).

8) Rate cuts are not short cuts to growth. They are simply more drugs for the addicts who are addicted to the fallacy of stimulus. Zero is still zero.

9) You have to let the dead actually die. The notion that we can have an "all gain no pain" recovery is asinine. Capitalism works because the assets of failed businesses are eventually reabsorbed by viable undertakings. Call me crazy but how is creating more debt that's used to pay back other debtors supposed to get us out of hock? Allen Stanford and Bernie Madoff both tried this and ended up in prison.

10) Socializing the repayment of excess debt is impossible. You have to reduce it to a level that borrowers can repay. Otherwise, the economic distortion that's caused by effectively freezing out creditworthy borrowers simply moves from one bubble to another. We've gone from Internet stocks to mortgages to bonds. Now we've moved up the ladder to sovereign debt. There's literally nowhere else to go.

How to Invest in the Face of a "Lost Decade"

For most people who are unable to reconcile the prospect of another decade of slow to no growth and mountains of debt, this is terrifying.

But you know what, that doesn't mean the next decade has to be unprofitable for us as investors:

1) Make damn certain you sit in an exit row. By this I mean make sure you have trailing stops in place that will act as built- in safety brakes if the markets roll over. Nobody knows that they will. I know a lot of people think they will, but that's no guarantee.

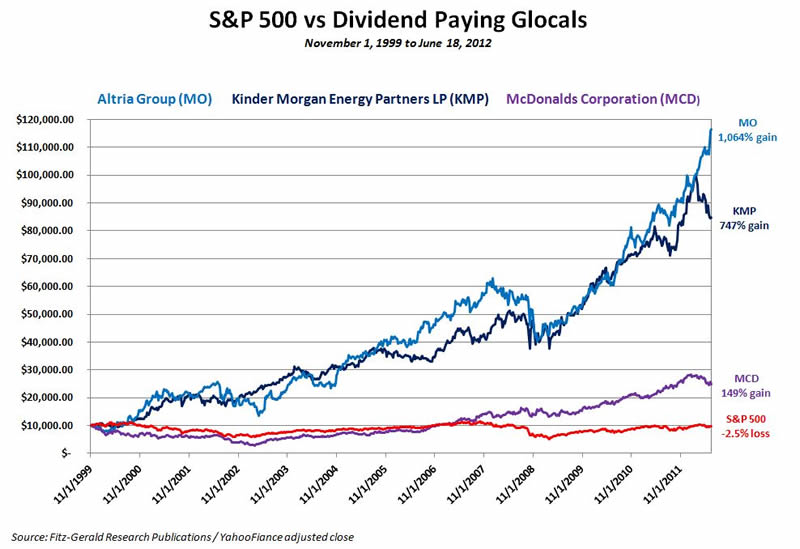

2) Continue to invest but very selectively. Put big, internationally diversified "glocal" stocks at the top of your list and concentrate on those with exposure to defense, bio tech and energy. Favor dividends over simple growth stocks. Even if the markets head sideways for years, the steadiness of international revenues and dividends offers investors stability and upside.

3) Position for fiscal intervention. Whether it's effective or not is not the question. What you can't afford to ignore is that it will happen. If Germany's Angela Merkel and other EU leaders actually succeed in firewalling bad debt off or Bernanke whips a rabbit out of his hat, we could be off to the races - for all the wrong reasons - but off to the races nonetheless. You don't want to miss that move by sitting on the sidelines.

4) Pick up the must-haves like energy, bonds, metals and biotech. As long as the euro is weak and we're hobbled by clueless leaders incapable of doing anything other than rearranging the deck chairs on the Titanic, growth will be confined to those holdings that benefit from asset protection rather than output growth.

5) Rebalance quarterly. I know conventional thinking suggests once a year but that's not wise these days. Why? From 1926 to 1999 the average holding period for an investment was 4 years. Now it's 3.2 months according to Alan Newman of Crosscurrents. Therefore, it makes sense to shore up underweighted segments of your portfolio more frequently than you might have in the past.

At the end of the day, whether or not we are turning Japanese really doesn't matter.

What matters is that you stay in the game and be prepared just in case.

Best Regards,

Keith Fitz-Gerald, Chief Investment Strategist

Money Map Press

Source :http://moneymorning.com/2012/07/06/what-i-wish-ben-bernanke-knew-about-japan/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.