Gold and Silver Investors Rotating Into Undervalued Junior Explorers

Commodities / Gold & Silver Stocks Jul 18, 2012 - 03:17 AM GMTBy: Jeb_Handwerger

The rule of the casino emphasizes that in order for one to be right in the market, the consensus has to believe that you are wrong. The majority goes home empty handed while the few emerge winners. Today there is extreme volatility, nevertheless the few players emerge as winners despite the daily ups and downs.

The rule of the casino emphasizes that in order for one to be right in the market, the consensus has to believe that you are wrong. The majority goes home empty handed while the few emerge winners. Today there is extreme volatility, nevertheless the few players emerge as winners despite the daily ups and downs.

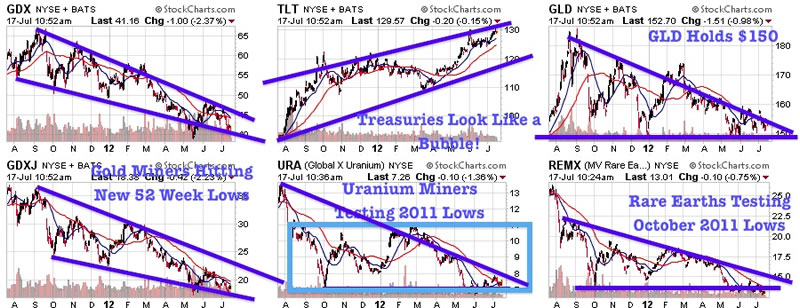

In fact, our wealth in the earth charts appear to show a transient pullback in an upward long term trajectory, whereby wealth in the ground advances in a major rally as positions mount from bullion (GLD) to miners (GDX). The treasuries (TLT) are trading like a dot-com stock moving exponentially higher and the U.S. dollar (UUP) is reaching long term resistance at overbought conditions. We may be witnessing the 12 month rally in U.S. treasuries and the U.S. dollar coming near an interim top.

We have long maintained that capital will move from fiat currency to conservative bullion to productive miners then to explorers that will significantly outperform the staid metal. Overtime, the mining stocks have eventually outperformed bullion, which is the sector well chosen to provide jobs and major, upward moves for investors. Thus we are looking at this as a transitory pullback in miners and precious metals in the historic move upward which will eventually continue.

Wealth in the ground chosen carefully in friendly mining jurisdictions has outperformed and risen from cautiously chosen bullion to geometric profits in miners. We continue to believe in the motherlode miners as they continue to produce many times the value of bullion. However, we are witnessing the major miners dealing with declining production and are having difficulty replacing ounces in the ground. We have predicted for some time a rise in resource nationalism which both Freeport Mcmoran (FCX) is dealing with in Indonesia and Goldcorp (GG) who recently acquired for a large premium Andean Resources in mining hostile Argentina. We recently saw Yamana Gold (AUY) acquire Extorre Gold (XG) for pennies on the dollar in Argentina as Extorre's price was hammered down by the fears of new taxes and royalties by the government. This is nothing new the majors must acquire the quality juniors (GDXJ).

The major gold stocks continue to seek well chosen explorers in order to provide a continual increasing source of growth, quarter to quarter and year to year. Capital has to continually rise year to year and quarter to quarter. The majors have historically exploded upward in time and advance to many times the value of hard metal. It is only a matter of time, when the giants will move into well-chosen and professionally operated explorers trading for pennies on the dollar.

We expect a solid rally in the miners as the bullion prices make its next move higher. While many analysts will join little half-chick in crying, "Dear Me, The Sky is falling!" and panic into U.S. dollars and treasuries, we reiterate that not only are the heavens not falling, but wealth in the earth continues to be the place to be and this could be the worst time holding treasuries and the dollar which are trading in overbought territory.

Our selections contain choices in well chosen mining equities not only in gold and silver, but in rare earths (REMX), uranium (URA), graphite and ferroalloys which will soar in a hyper-reflationary environment. We must include other valuable commodities just mentioned.

Meanwhile, the economies of the Western nations including U.S., Germany and France are in financial danger, unless necessary strict austerity measures are adopted. This is unlikely as it is a political nightmare and unpopular among the masses. There is the possibility that the Federal Reserve Bank of the United States will have to come out of the closet and take a firm hand to correct the European vacillation and global slowdown as the malaise is spreading to the United States with the bankruptcy of MF Global and the major trading loss at Dimon's JP Morgan. Thus, the ordeal continues to play out helter-skelter before the eyes of the world.

There is a battle going on between the fears of the European leaders to institute needed, radical measures in the face of citizen revolt to give up "La Dolce Vita". Regardless of recent hectic flights into treasuries and dollars, it represents a desperate place to hide and a snare. Lest we forget it was only in late 2011 that the global banks headed by the Federal Reserve introduced liquid dollars into the Eurozone.

In the face of such pandemonium, the question arises as to where capital can turn? Where are the safe havens? We are one of the lone voices in the wilderness that continues in the belief in our selected wealth in the earth equities in precious metals, uranium and rare earths.

Europe and the United States are not the beginning and end of the world. Nations are arising in Asia, even while investors are concentrating on the European and U.S. bedlam, which require precious metals and natural resources. Fasten your seat belts for this economic roller coaster between deflation and inflation and stay tuned by subscribing to my free newsletter.

By Jeb Handwerger

© 2012 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.