Market Bubbles and the Titanic Betrayal of Public Trust

Stock-Markets / Liquidity Bubble Jul 29, 2012 - 05:56 AM GMTBy: Raul_I_Meijer

Robert Shiller, co-creator of the Case-Shiller index for US housing and author of Irrational Exuberance, has an interesting perspective on markets. Unlike the vast majority of economists, he recognizes both the role of speculative fervour in driving prices to over-reach themselves as a bubble develops and the fact that bubbles and their aftermath are swings of positive feedback inherently grounded in ponzi dynamics. As such, his position has considerable overlap with ours at The Automatic Earth:

Robert Shiller, co-creator of the Case-Shiller index for US housing and author of Irrational Exuberance, has an interesting perspective on markets. Unlike the vast majority of economists, he recognizes both the role of speculative fervour in driving prices to over-reach themselves as a bubble develops and the fact that bubbles and their aftermath are swings of positive feedback inherently grounded in ponzi dynamics. As such, his position has considerable overlap with ours at The Automatic Earth:

Markets and the Lemming Factor (2008)

Markets and the Lemming Factor (2008)

Some trends are persistent enough that they eventually attract a very wide pool of participants, as apparent gains amongst one's peers eventually overcome the caution even of many inherently skeptical people. When they last long enough to overcome the caution of bankers, the result is easy credit to fuel the fire, and a blatant disregard for systemic risk. This is how the largest speculative bandwagons are formed - the ones that become manias and eventually lead to ruin for a large percentage of the population.

Prices are continually pushed up, irrespective of any reasonable objective measure of value, by those who think that it does not matter how much they pay for something if there will always be a Greater Fool who will pay even more. The evidence of pyramid dynamics where insiders and early movers benefit at the expense of later generations destined to become empty-bag holders - should be abundantly clear. The pool of Greater Fools is not limitless.

In our view, major bubbles, of which there are many examples in history, represent a highly contagious collective taking leave of the senses. Over time, as they develop, the largest bubbles come to encompass and to drive much of the way in which a given society functions. The trend that takes hold, and which is destined to over-reach itself, becomes the defining the zeitgeist of an era, before reversing sharply with devastating effect.

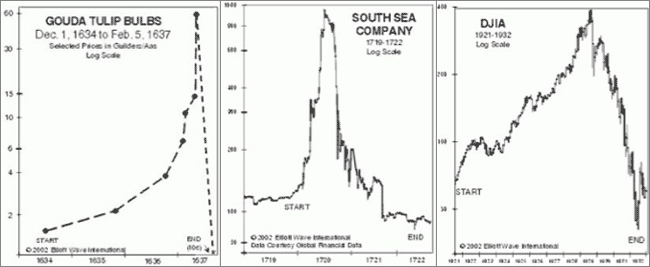

The best known examples can be clearly seen in financial charts that allow the progression of the phenomenon to be quantified. This is possible when the infectious idea manifests as a parabolic increase, and subsequent implosion, in value of something that has become a focus of speculation.

However, speculative bubbles that manifest financially, and therefore lend themselves to quantification, represent only a subset of socioeconomic or sociopolitical swings that can spread exponentially within societies and come to define certain periods of their history. This broader category of transformative social movements that come to capture the collective imagination, and often later deliver the reigns of power into the hands of extremists, is also subject to over-reach and reversal.

The fundamental point is that Ponzi dynamics do not have to be quantifiable for their essential nature to drive cycles of expansion and retrenchment. Mr Shiller recognizes this point, and recently wrote a piece comparing what he calls "social epidemics" that occur within the context of market economies with those that do not.

A speculative bubble is a social epidemic whose contagion is mediated by price movements. News of price increase enriches the early investors, creating word-of-mouth stories about their successes, which stir envy and interest. The excitement then lures more and more people into the market, which causes prices to increase further, attracting yet more people and fuelling “new era” stories, and so on, in successive feedback loops as the bubble grows. After the bubble bursts, the same contagion fuels a precipitous collapse, as falling prices cause more and more people to exit the market, and to magnify negative stories about the economy.

But, before we conclude that we should now, after the crisis, pursue policies to rein in the markets, we need to consider the alternative. In fact, speculative bubbles are just one example of social epidemics, which can be even worse in the absence of financial markets. In a speculative bubble, the contagion is amplified by people’s reaction to price movements, but social epidemics do not need markets or prices to get public attention and spread quickly.

Some examples of social epidemics unsupported by any speculative markets can be found in Charles MacKay’s 1841 best seller Memoirs of Extraordinary Popular Delusions and the Madness of Crowds. The book made some historical bubbles famous: the Mississippi bubble 1719-20, the South Sea Company Bubble 1711-20, and the tulip mania of the 1630’s. But the book contained other, non-market, examples as well.

MacKay gave examples, over the centuries, of social epidemics involving belief in alchemists, prophets of Judgment Day, fortune tellers, astrologers, physicians employing magnets, witch hunters, and crusaders. Some of these epidemics had profound economic consequences.

Mr Shiller asserts that, in the absence of quantitative feedback mechanisms, "social epidemics" can carry further into over-reach and therefore lead to worse consequences when the trend reverses.

There was no way, of course, for anyone either to invest in or to bet against the success of any of the activities promoted by the social epidemics – no professional opinion or outlet for analysts’ reports on these activities. So there was nothing to stop these social epidemics from attaining ridiculous proportions …

… China’s Great Leap Forward in 1958-61 was a market-less investment bubble. The plan involved both agricultural collectivization and aggressive promotion of industry. There were no market prices, no published profit-and-loss statements, and no independent analyses. At first, there was a lot of uninformed enthusiasm for the new plan. Steel production was promoted by primitive backyard furnaces that industry analysts would consider laughable, but people who understood that had no influence in China then. Of course, there was no way to short the Great Leap Forward. The result was that agricultural labor and resources were rapidly diverted to industry, resulting in a famine that killed tens of millions.

The Great Leap Forward had aspects of a Ponzi scheme, an investment fraud which attempts to draw in successive rounds of investors through word-of-mouth tales of outsize returns. Ponzi schemes have managed to produce great profits for their promoters, at least for a while, by encouraging a social contagion of enthusiasm.

Mao Zedong, on visiting and talking to experts at a modern steel plant in Manchuria, is reported to have lost confidence that the backyard furnaces were a good idea after all, but feared the effects of a loss of momentum. He appears to have been worried, like the manager of a Ponzi scheme, that any hint of doubt could cause the whole movement to crash. The Great Leap Forward, and the Cultural Revolution that followed it, was a calculated effort to create a social contagion of ideas.

There are many similar historical examples. While they are often known as periods of top down control, this is misleading, as Mr Shiller points out in relation to the Maoist example.

Some might object that these events were not really social epidemics like speculative bubbles, because a totalitarian government ordered them, and the resulting deaths reflect government mismanagement more than investment error. Still, they do have aspects of bubbles: collectivization was indeed a plan for prosperity with a contagion of popular excitement, however misguided it looks in retrospect.

Societal transformation is much more comprehensive when galvanizing change catches on from the bottom up, delivering an effective mandate for consolidating power around an idea into the hands of whomever can give a mass movement a focus that fits the collective mood. The personality cult of Mao Zedong was a very clear example of an idea that gripped, and temporally consumed, the social fabric of a nation (for a superb description of the era and its underpinnings in social mood contagion see Wild Swans: Three Daughters of China by Jung Chang).

Witness, for an additional historical example, the Stakhanovite movement in the early days of the former Soviet Union (1935), which celebrated heroic (and mythical) achievements in worker productivity. This initiative spread across many industries and initially inspired greater (and greater) effort over longer (and longer) working hours, leading to substantial productivity improvements 'for the glory of the socialist workers' paradise' that people felt they were engaged in building.

Unfortunately, bottom-up idealism did not deliver any such thing. Instead, people's commitment was used to set ever higher quotas that everyone was then expected to live up to, codifying these at a societal level in national five year plans. Effort initially freely given was later institutionalized as formal expectation to which bonuses and penalties were attached.

Given that the foundational claims of superhuman productivity were almost certainly fictitious, and that subsequent 'achievements' became more exaggerated over time, the burden on ordinary people increased substantially. Unachievable goals combined with strong incentives led to major divisions and resentment within the workplace, particularly between workers and managers.

This destabilization of relationships in the factory environment facilitated a divide and rule approach from the top down that played a role in the consolidation of central power under Stalin. As with Mao's China, an economic initiative for expanding prosperity based on a popular movement backfired as empowerment morphed into disempowerment, and very unpleasant consequences followed.

Greater emphasis on interpreting the historical record in terms of cycles, whether or not they can be quantified in market terms, makes greater sense of the rise and fall of imperial structures as well as the smaller scale cycles within cycles that these examples represent. Ponzi dynamics are the underlying commonality at all degrees of trend for a fractal system based on swings of positive feedback in both directions:

From the Top of the Great Pyramid (2008)

At the largest scale, empires are also grounded in pyramid dynamics, which is why they too have a limited lifespan. They grow by assuming control, either politically or economically, of new territories, positioning themselves to cream off surpluses from an ever-expanding geographical area in a form of involuntary buy-in ...

… Wealth conveyors in favour of the economic centre, at the expense of the hinterland, are the very heart of empire, but without continual expansion to feed rapidly developing central complexity, they eventually fail, leaving the centre unable to sustain its existing complexity level. As with economic bubbles, empires hollow out in the latter stages, consuming their own substance in a catabolic manner in order to compensate for the inability to strengthen wealth conveyors sufficiently quickly to keep pace with the expanding requirements of the centre.

Where The Automatic Earth parts company with the views of Mr Shiller is in his opinion of the prospects for the bursting of our current bubble. He believes that systems which do appear to be quantifiable through market mechanisms contain sufficient control mechanisms to limit the downside:

Bubbles Without Markets (cont’d)

Modern economies have free markets, along with business analysts with their recommendations, ratings agencies with their classifications of securities, and accountants with their balance sheets and income statements. And then, too, there are auditors, lawyers and regulators.

All of these groups have their respective professional associations, which hold regular meetings and establish certification standards that keep the information up-to-date and the practitioners ethical in their work. The full development of these institutions renders really serious economic catastrophes – the kind that dwarf the 2008 crisis – virtually impossible.

From our perspective this view seems incredibly naive, especially coming from someone who sees bubbles as Ponzi schemes and should therefore understand the implications. It appears that Mr Shiller lacks an appreciation of just how large a bubble we have actually blown in the era of globalization, not to mention an understanding of just how badly the putative control mechanisms have devolved into pervasive blindness and corruption. We need only look at the extremely permissive financial regulatory framework - a result of comprehensive regulatory capture - to see where the power lies in the financial world. Most of betrayals of public trust we have seen in recent years are legal.

In our era of catabolic casino capitalism, the financial system has been hollowed out. Huge risks have been taken with other people's money for short term private profit. Reserve requirements have been whittled away to almost nothing in an attempt to maintain monetary expansion, and now there is virtually no cushion against financial crisis. The lack of capital adequacy requirements in the derivatives market has left a large construct of virtual value with toxic levels of counterparty risk, and a built-in meltdown mechanism thanks to perverse incentives to burn things down for profit.

It has been legal in places to rehypothecate collateral infinitely, meaning it is permissible to employ a small amount of collateral to underpin a vast quantity of loans, again leaving no margin for error. We have seen complex financial instruments mis-sold to municipalities all over the world, and 'assets' sold to customers then shorted by the financial institutions that sold them.

We have seen loans made to people, companies and governments that could not possibly repay them, because the sellers were able to collect their fees upfront, while selling the huge risk on to investors through securitization. Due diligence was virtually non-existent for many years, while systemic risk grew unchecked. In the USA, the mortgage securitization process broke the chain of title for property, and the banking system attempted to cover this up through fraudulent reconstruction of paperwork after the fact. Naked shorting has been used to create artificial selling pressure.

The benchmark LIBOR rate has been fiddled since its inception, creating enormous private profits at public expense. As crisis has developed as a result of these, and many other, abuses, the response has been austerity for the masses while the insiders, who should have know better, have been able to walk away from the consequences of their recklessness. The public sector is being asset-stripped as the great collateral grab gets underway.

The formal 'control' mechanisms have done nothing of substance to reign in the development of a global Ponzi structure, in fact they have more often acted to facilitate it. In reality they do little beyond lulling us into a false sense of security. The existence of an institutional framework is no guarantee of effective function. The substance is long gone, and what we are left with is a shell. The appearance of a large, robust structure is an illusion, and the risk we are facing is one of implosion. This is how all bubbles come to an end.

By way of analogy, not only has the Titanic already hit the iceberg, but most of the regulatory response constitutes rearranging the deckchairs. Most of society is still obliviously listening to the band, while the few are busy locking the third class passengers below decks. There are not enough lifeboats .....

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2012 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.