Manipulation of US Employment Statistics - Revision Higher Next Month?

Stock-Markets / Financial Markets Feb 02, 2008 - 08:56 PM GMT Minimizing the (un)employment report - The Bureau of Labor Statistics released its January Employment Situation Report. According to the BLS, the employment situation was “essentially unchanged.” Buried in the report was the offhand mention that we had “a small January movement in nonfarm payroll employment (-17,000).” Small movement? The expectations were for a 70,000 increase!

Minimizing the (un)employment report - The Bureau of Labor Statistics released its January Employment Situation Report. According to the BLS, the employment situation was “essentially unchanged.” Buried in the report was the offhand mention that we had “a small January movement in nonfarm payroll employment (-17,000).” Small movement? The expectations were for a 70,000 increase!

Omitted from the report was the CES Birth/Death Model , which normally puts a positive spin on the employment report. Not this time! According to this model, all sectors of the economy suffered losses, with the grand total 378,000 jobs lost in January. Maybe this is a statistical fluke, but you can imagine some bureaucrat storming into the statisticians' offices and saying, “Fix it!” There will be revisions in next month's report.

You may ask why the employment figures seem worse than reported. The fact is your perceptions are closer to the truth than the reported figures. The reasons are several. First, service jobs in restaurants and checkout lanes in grocery stores have the same weight as manufacturing and construction jobs, which pay much more. Second, once unemployment benefits run out, those persons fall off the statistical survey. Another possible reason is that the length of unemployment between jobs is growing. And finally, the CES Birth/Death model has been applied in the past to provide “statistical smoothing” of the (un)employment figures, in order to give the appearance of incrementally smaller changes.

What are they thinking?

WASHINGTON ( MarketWatch ) -- U.S. consumer sentiment rose in January but is "significantly" below last year's levels, and "the risk that a recession develops remains uncomfortably high," according to the consumer-sentiment survey released Friday by University of Michigan and Reuters.

"There was little comfort in the fact that consumer confidence increased slightly in the January survey since the largest proportion of consumers in nearly two decades reported financial distress, especially households with incomes below $75,000," according to Richard Curtin, director of the Reuters/University of Michigan Surveys of Consumers.

This reminds me of an overheard conversation during lunch, in which one of the diners commented, “It appears that Wall Street forgot there is a recession.”

Window dressing is over.

Usually window dressing is reserved for the quarter end, when reports are sent by brokerages and mutual funds to their clients. However, the month of January has special significance, since it is closely monitored by Wall Street for the January Barometer . Devised by Yale Hirsch in 1972, the January Barometer states simply, “As the S&P 500 Index goes in January, so goes the rest of the year.” This phenomenon has an astounding 91.1% accuracy, registering only five errors, since 1950. I have submitted yet another analysis at Planet Yelnick . Prepare yourself!

Usually window dressing is reserved for the quarter end, when reports are sent by brokerages and mutual funds to their clients. However, the month of January has special significance, since it is closely monitored by Wall Street for the January Barometer . Devised by Yale Hirsch in 1972, the January Barometer states simply, “As the S&P 500 Index goes in January, so goes the rest of the year.” This phenomenon has an astounding 91.1% accuracy, registering only five errors, since 1950. I have submitted yet another analysis at Planet Yelnick . Prepare yourself!

Are bonds getting more volatile?

According to MarketWatch , treasury bonds are gyrating quite a bit today, as the market gives mixed signals. First, the employment report gave rise to the sentiment that the economy may be tanking, which is good for bonds. Then the Institute for Supply Management's report suggests a rise in manufacturing in January. Who can we believe? In any event, volatility is not good for the outlook in bonds.

According to MarketWatch , treasury bonds are gyrating quite a bit today, as the market gives mixed signals. First, the employment report gave rise to the sentiment that the economy may be tanking, which is good for bonds. Then the Institute for Supply Management's report suggests a rise in manufacturing in January. Who can we believe? In any event, volatility is not good for the outlook in bonds.

A hedge fund sells its gold position. Should you?

It "looks like a huge sale by a possibly European fund has emerged," said Jon Nadler, senior analyst at Kitco Bullion Dealers. This is "profit-taking in the wake of the failure to follow through on the jobs news at the $938 area." (Source: MarketWatch )

It "looks like a huge sale by a possibly European fund has emerged," said Jon Nadler, senior analyst at Kitco Bullion Dealers. This is "profit-taking in the wake of the failure to follow through on the jobs news at the $938 area." (Source: MarketWatch )

Some look for fundamental reasons for buying and selling, as we can see above. Others look for technical signs of the market nearing a top. Can you see one here?

The Nikkei slips up on U.S. job worries.

The Nikkei 225 index closed down 95 points this morning out of concern for the jobs situation in the U.S. They have reason to be concerned, since their economy is export-driven and we are their largest customer. The rally out of the January low appears to be a counter-trend rally, so a resumption of the decline in the Nikkei would not be out of the question.

Shanghai Express down nearly 22% in three weeks!

The Shanghai Index fell to its lowest point since August and has wiped out all its gains since last May. An article in the Shanghai Daily laments that the Chinese economy may not hold up as well as expected if the United States slides into a recession. “P ower shortages are "very serious'' after the worst snowstorms "in decades'' delayed coal shipments and disrupted power production, the National Development and Reform Commission, the nation's top economic planner, said in a statement today. The shortage has affected 17 provinces, said the commission's spokesman Zhu Hongren today.”

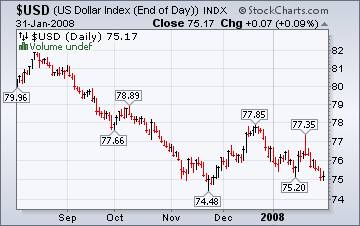

Will nothing stop the bearish Dollar trend?

The U.S. dollar dropped to 75.02 earlier today in one of the most pessimistic trading sessions since November.

The U.S. dollar dropped to 75.02 earlier today in one of the most pessimistic trading sessions since November.

The dollar dropped against most of the other major currencies in January as the central bank lowered rates twice to 3 percent to keep the world's largest economy growing. However, by the end of the day, it rallied to 75.50. Is it out of the woods yet?

Foreclosures are accelerating. Why is the market up?

An article in Business Week is worth the read, if you want to see some pretty grim statistics. Michigan ranks third in the per capita percentage of foreclosures. The swimming pools of Riverside County's abandoned homes haven't been drained, leaving the city with yet another headache…applying pesticides for mosquito control.

Countrywide just sent 122,000 home equity borrowers a letter cutting them off from tapping their credit lines. The reason? Their home equity is now under water.

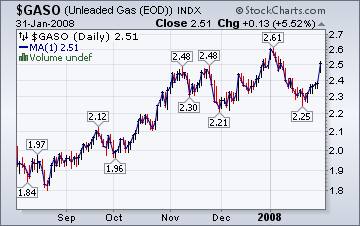

The national average of gasoline prices falls below $3.00 again.

The Energy Information's Weekly Report reports, “The U.S. average retail price for regular gasoline fell below $3.00 a gallon for the first time since December 24, 2007, to 297.7 cents per gallon as of January 28, 2008, 4 cents lower than last week but 81.2 cents above a year ago.”

However, on the day the report was released, gasoline prices rose 13 cents, putting the price per gallon back above $3.00.

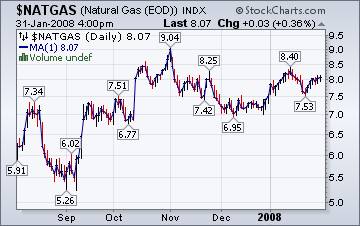

Arctic blasts put strain on natural gas.

The Natural Gas Weekly Update reports, “The previous week's severe cold through much of the country subsided this week. However, winter-like temperatures in the East (along with associated space-heating demand) remained, even as yet another Arctic front moved into the Midwest . Additionally, higher crude oil prices during the week, likely tied to perceived broad economic conditions, provided upward pressure on all energy commodities.”

The Natural Gas Weekly Update reports, “The previous week's severe cold through much of the country subsided this week. However, winter-like temperatures in the East (along with associated space-heating demand) remained, even as yet another Arctic front moved into the Midwest . Additionally, higher crude oil prices during the week, likely tied to perceived broad economic conditions, provided upward pressure on all energy commodities.”

It's going to get much worse.

Jim Rogers, famed for riding his motorcycle around the world, has been making some outstanding calls on commodities and investing in China . He was recently interviewed in Fortune Magazine . This is a must read.

"I'm extremely worried," he says. "I have been for a while, but I just see things getting much worse this time around than I expected." To Rogers, a longtime Fed critic, Bernanke's decision to ride to the market's rescue with a 75-basis-point cut in the Fed's benchmark rate only a week before its scheduled meeting (at which time they cut it another 50 basis points) is the latest sign that the central bank isn't willing to provide the fiscal discipline that he thinks the economy desperately needs.

It's not all bad. There is an opportunity coming soon that he and I both agree on.

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I pre-recorded our weekly session on Wednesday about the markets. It was shockingly prescient. You will be able to access the interview by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.