China Ponzi Banks Duping Depositors Into Financing Busted Real Estate Projects

Stock-Markets / Credit Crisis 2012 Aug 11, 2012 - 01:04 PM GMTBy: Mike_Shedlock

Top Chinese banks are involved in Ponzi financing of investment deals, offering interest rates over 7% to depositors, to finance real estate projects gone bust and other projects whose assets are not even disclosed.

Top Chinese banks are involved in Ponzi financing of investment deals, offering interest rates over 7% to depositors, to finance real estate projects gone bust and other projects whose assets are not even disclosed.

Banks label these schemes "Wealth Management Products" (WMPs) but any individuls foolish enough to invest in them are going to lose money, perhaps all of it.

Reuters explains in a special report China's answer to subprime bets: the "Golden Elephant"

The Chinese investment vehicle known as "Golden Elephant No. 38" promises buyers a 7.2 percent return per year. That's more than double the rate offered on savings accounts nationally.

Absent from the product's prospectus is any indication of the asset underpinning Golden Elephant: a near-empty housing project in the rural town of Taihe, at the end of a dirt path amid rice fields in one of China's poorest provinces.

"They haven't even built a proper road here," said Li Chun, a car repairman, who said he lives in the project. "The local government is holding onto the flats and only wants to sell them when prices go up."

Golden Elephant No. 38 is one of thousands of "wealth-management products", instruments aimed at monied investors, which have shown phenomenal growth over the last five years. Sales of them soared 43 percent in the first half of 2012 to 12.14 trillion yuan ($1.90 trillion), according to a report by CN Benefit, a Chinese wealth-management consultancy.

They are usually created in China's "shadow banking" system - non-banking institutions that are not subject to the same regulations as banks - which has grown to account for around a fifth of all new financing in China.

Like the subprime-debt lending spree in the United States that helped spark the 2008 financial crisis, the products are often opaque, and usually dependent on high-risk underlying assets, such as the Taihe housing project.

Chinese Banks' Weapons of Mass Ponzi

Financial Times Alphaville picked up on the story in Chinese Banks' Weapons of Mass Ponzi

We wrote last week that China's shadow banking system was reflecting and, to an extent, contributing to a growing liquidity risk which in turn is being exacerbated by net capital outflows. Since then, there have been some interesting revelations on the domestic liquidity management, especially in shadow banking, and especially especially in wealth management products.

To recap, wealth management products or WMPs are a little like a term deposit, only they offer Chinese investors a more appealing rate of return than a normal bank deposit (which will deliver a negative real return) and it can be backed by assets -- effectively, an informal securitisation.

If you're wondering what sort of assets that includes, Reuters wrote up an excellent investigation of the WMP scene, beginning with the case study of "Golden Elephant no. 38" which promises a 7.5 per cent return. It shows just how illiquid some of these things are.

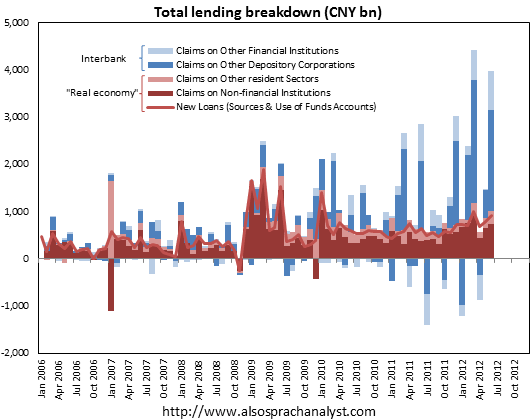

At the same time as the risks around WMP issuance are gaining attention, something else is going on in Chinese financial system: interbank assets are surging, as Also Sprach Analyst points out.

There's no knowing when, how or if some kind of liquidity crisis might happen in the Chinese banking system, but there are plenty of possible triggers to be found.

A story on Tuesday in China Daily cited a study by The Chinese Banker that found capital shortfalls among the five biggest banks would grow sharply in 2012 and 2013. The China Daily link is now broken, unfortunately, [Mish Note: the link is now working] but Chinascope Financial has a summary:

"Data from the report shows that capital shortfall in China's major five state-owned banks in 2012 will be: CNY 60.4 billion (Industrial and Commercial Bank of China), CNY 63.5 billion (Agricultural Bank of China), CNY 37.6 billion (Bank of China), CNY 35.4 billion (China Construction Bank), and CNY 47.8 billion (Bank of Communications). By the end of 2013, the capital gap of the five banks will further increase to CNY 69.1 billion, CNY 83.8 billion, CNY 78.7 billion, CNY 39.9 billion and CNY 68.7 billion, respectively."

Capital Shortfalls

Alphaville totaled the above numbers and came up with a capital shortfall of Rmb 244.7 billion for 2012 and a Rmb 340.2 billion shortfall by the end of 2013.

While converting Rmb 244.7 billion to US dollars (the answer is $72.11 billion), I accidentally stumbled across the Rmb 244.7 billion figure in KPMG China's weekly banking news summary

Better than expected profits from Chinese banks

Ten Chinese commercial banks have reported better than expected net profits of RMB 244.7 billion (USD 72.11 billion) in the first half of 2011, approximately 30 percent more than the net profits reported for the same period in 2010. The increase was boosted by strong growth in the banks' net interest income and intermediary business.

Better than expected earnings exactly match expected capital shortfalls. Fancy that.

Poway, Golden Elephants, and Pay Option ARMs

This setup sounds much like the "better than expected earnings" reports by US banks in 2006 on Pay Option ARMs. No money came in to banks but accrued interest added to the bottom line (until the deferred payment scheme on questionable assets blew sky high).

Poway vs. "Golden Elephant"

"Golden Elephant" also sounds like the Ponzi scheme in Poway, California.

Poway borrowed $105 million and will defer interest and principal payments for 20 years at which time Poway will owe $1 billion.

For further details, please see Ponzi Financing in Poway California Based on Massively Rising Property Values

Regarding Poway, I was asked "Who is dumber, the city of Poway or the bank that made the loan?"

That's a good question. Certainly the bank that originated the loan will not be paid back if they hold this loan to term. But did they keep it? Given the fiasco in Pay Option ARMs I rather doubt it.

Indeed, I highly suspect the bank that originated the deal sold the loan to some unsuspecting pension plan such as CALPers, or perhaps some plan covering Poway itself.

Read more at http://globaleconomicanalysis.blogspot.ca/2012/08/...

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.