ECB Capping Rates on PIIGS? Wait Till Traders Call Its Bluff

Interest-Rates / Eurozone Debt Crisis Aug 20, 2012 - 12:56 PM GMTBy: EconMatters

The big buzz about the debt-embattled Euro Zone on an otherwise quiet Sunday came from German news magazine Der Spiegel that ECB is considering measures to cap the borrowing costs of the crisis-central PIIGS countries. According to Bloomberg,

The big buzz about the debt-embattled Euro Zone on an otherwise quiet Sunday came from German news magazine Der Spiegel that ECB is considering measures to cap the borrowing costs of the crisis-central PIIGS countries. According to Bloomberg,

The European Central Bank is considering setting limits on yields of euro area sovereign debt by pledging unlimited bond purchases, Germany’s Spiegel magazine reported without saying where it obtained the information. The policy will be decided at the September meeting of the ECB’s governing council, Spiegel said.

Earlier this month, U.S. Treasury Secretary Geithner has already put on the pressure saying "the eurozone must take steps including bringing down interest rates in the countries that are reforming."

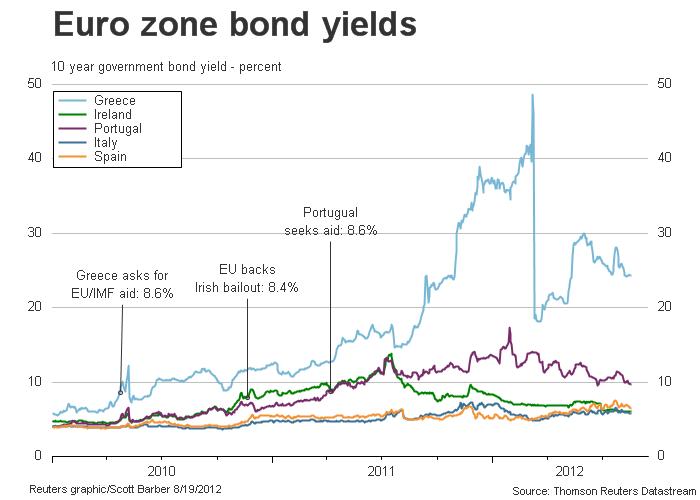

With the PIIGS sovereign bond yields rising to unsustainable levels (See Chart Below), it is understandable why ECB resorts to this "big bazooka" plan partly making good on ECB President Draghi's bold promise to do "whatever it takes" to save euro. However, it also demonstrates how the Euro Zone seems to be at its wit's end to effectively restore market confidence.

Instead of simply a problem of higher bond yield, central to this crisis is PIIGS nations have had years of excessive spending relative to revenues. If these debt-problematic countries have control of their own currency, then they might be able to follow the debt restructuring model such as Argentine to slowly dig themselves out of the hole. However, this is not the case for the Euro Zone.

This sugar-pill proposal of "unlimited bond purchases," if implemented, will most likely relieve the rate pressure in the short term, but the rudimentary issue is that the Euro Zone is nowhere near making these PIIGS countries to really commit to getting spending under control.

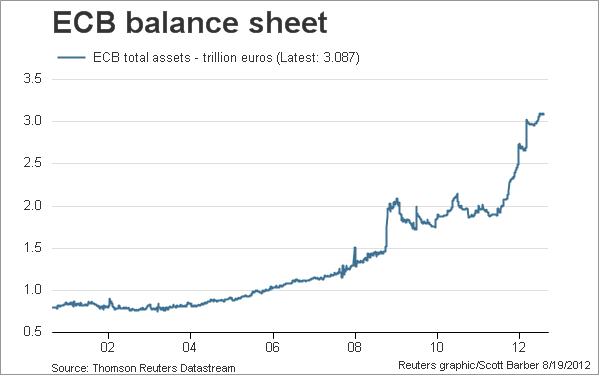

Now, ECB's balance sheet has ballooned to 3.087 trillion euros, or USD $3.8 trillion (See Chart Above), so the more important question is how much longer can ECB keep this bond buying spree?

Eventually traders and bond vigilantes will call ECB's bluff dragging down the entire Euro Zone, and here are some likely events that would follow:

- The problematic nations could continue piling on debt with ECB as the "sugar daddy."

- ECB would continue wasting good money (ultimately from the European taxpayers) on bad "solutions," instead putting into promoting GDP growth.

- Even if PIIGS countries come to agreements on austerity measures, that would still take a decade before any meaningful signs of recovery.

- Europe would be pushed deeper into a recession or even a depression.

Since the Euro Zone is bound by a single currency, the member countries in the zone sink or swim together. Market fears of the bloc's difficulties have prompted Moody's to threaten cutting the hard working and earning Germany's AAA sovereign credit rating.

For now, the Euro Zone will try to stay together for as long as they can. Kicking the can down the road is one thing world politicians love to do until it blows up in their faces, and that's when everything hits the fan-- fast and furious.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2012 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.