Case Shiller Home Price Index the Leading Indicator of Economic Downturn

Economics / US Economy Feb 07, 2008 - 01:21 PM GMTBy: Tim_Iacono

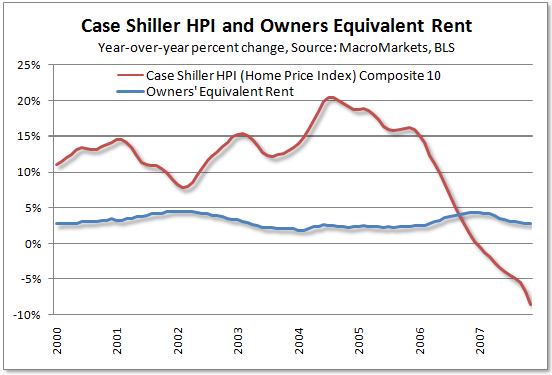

By popular demand, the collection of charts featuring the S&P Case-Shiller Home Price Index has been updated. First, the home price index versus one of stupidest things that economists have ever dreamed up - the home ownership cost substitute used in the consumer price index, otherwise known as "owners' equivalent rent".

By popular demand, the collection of charts featuring the S&P Case-Shiller Home Price Index has been updated. First, the home price index versus one of stupidest things that economists have ever dreamed up - the home ownership cost substitute used in the consumer price index, otherwise known as "owners' equivalent rent".

No, it is not being suggested that the HPI be used in place of OER in the inflation statistics because there are other factors that should be included as well - interest rates, property taxes, etc. The chart above simply demonstrates how completely different these two measures are and how disconnected OER and home prices had become.

ooo

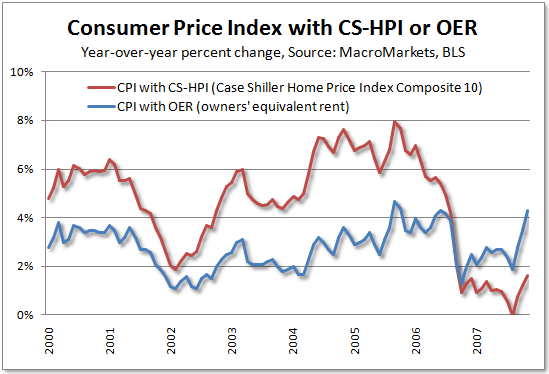

As shown below, the absence of real home prices in the Consumer Price Index is a vital ingredient in creating a really big housing bubble. No central banker in their right mind would have short-term rates at one percent, as was the case in the U.S. back in 2003 and 2004, if the inflation rate was at five or six percent.

Of course, when looking at the initial monthly mortgage payments that people were signing up to a few years back, the actual monthly costs were not rising anywhere near as fast as actual home prices. This, in itself, should have been a big red warning light that there was something wrong in the financial system rather than it being accepted as conventional wisdom at the time that a "new era" had begun and we were all getting rich.

ooo

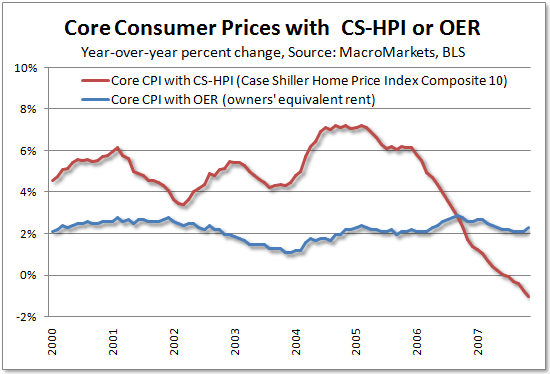

In recent months, the slide in home prices has been overwhelmed by soaring energy prices in the chart above, however, if food and energy are removed from the price index, as economists are wont to do to calculate core inflation , another big red warning light is clear to see in the chart below.

If real home prices are substituted for the almost 30 percent weighted OER component in core inflation, that important inflation statistic would now be minus one percent, and people would be talking about the dreaded "D" word that contemporary economists abhor - "Deflation".

ooo

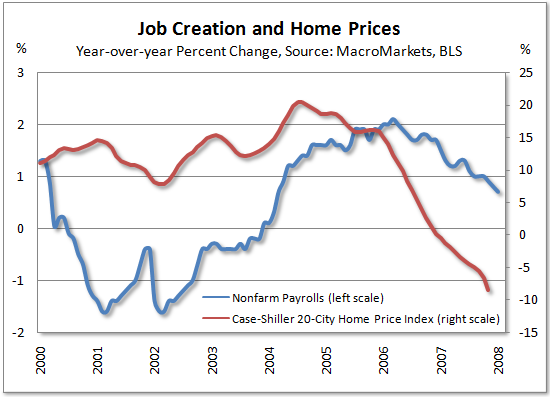

A recent addition to the known list of fun things you can do with the Case-Shiller Home Price Index is to lay it up against all sorts of other economic statistics. For example, you can put the HPI curve up against job growth as shown below and get the expected results. Housing bubbles are generally good for creating jobs - all the way up to the point when they start deflating.

Yes, breaking out some of the individual labor categories, such as residential construction and retail trade, would be the next logical step here. Maybe next time.

ooo

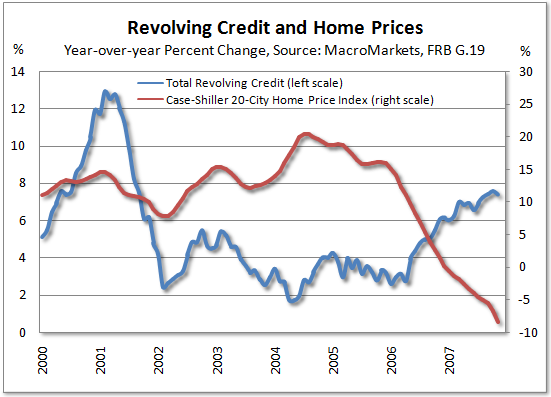

Good news for the banking industry! Credit cards are making a strong comeback now that home prices are declining and home equity ATMs are being shut down all across the country, largely due to there being little or no equity left to borrow because of that plunging red curve below.

Just last week, Countrywide Financial (NYSE: CFC ) sent out over 100,000 letters to homeowners telling them that, due to changing market conditions (i.e., plunging home prices), they could no longer "tap" as much (or, in many cases, any ) home equity. Credit card usage, the primary component in revolving debt, is soaring again.

ooo

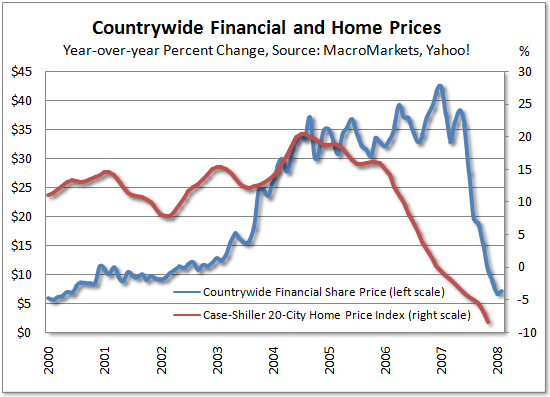

Speaking of CountryWide, it's kind of surprising to see that year-over-year home prices had to get well into negative territory before the share price of the nation's largest mortgage lender began to plunge.

Then again, the housing price data gets reported about three months after the fact, so, right around the time it became clear that home prices were going down and not up, that's when the going got rough for Angelo Mozilo and company.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2008 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.