U.S. Housing Market Improvements Keep Trickling In

Housing-Market / US Housing Sep 20, 2012 - 01:47 AM GMTBy: Asha_Bangalore

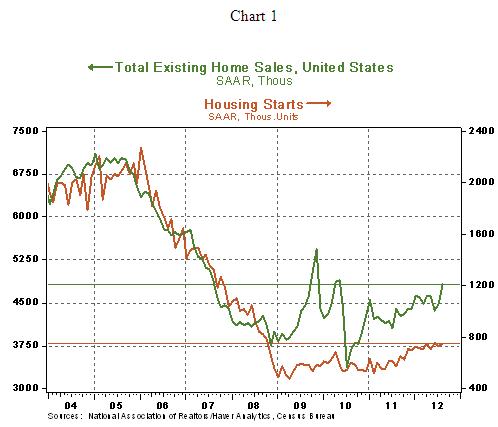

Housing market developments (starts and sales of existing homes) in August stand out amid a recent string of bearish economic reports. Builders broke ground for construction of new single-family homes at a brisk pace (+5.5%) in August. From a low of 478,000 starts in April of 2009, total housing starts have moved up 57%. Still, this is a long way from the historical high of 2.27 million units in January 2006.

Housing market developments (starts and sales of existing homes) in August stand out amid a recent string of bearish economic reports. Builders broke ground for construction of new single-family homes at a brisk pace (+5.5%) in August. From a low of 478,000 starts in April of 2009, total housing starts have moved up 57%. Still, this is a long way from the historical high of 2.27 million units in January 2006.

The September Housing Market Index of the National Association of Home Builders posted the highest reading since June of 2006, raising expectations of increased momentum in home building in the near term. But the 1.0% drop in total permit extensions and only a 0.2% gain in permits for single-family homes suggest that these expectations should be scaled back somewhat.

Sales of existing homes rose 7.8% to an annual rate of 4.82 million units in August, while sales of single-family homes were up 8.0%. Excluding the wide swings related to the first-time home buyer program, the August existing home sales mark is the best in the last five years (see chart below).

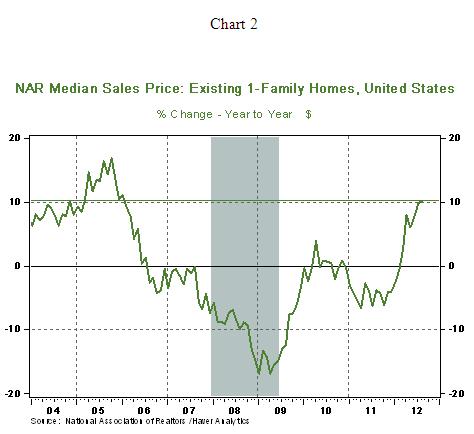

In addition to gains in sales of existing homes, the price picture is also encouraging. The median price of an existing single-family was virtually steady in August ($188,700) compared with the July reading, but has improved 10.2% from a year ago. This is another aspect of today’s report that places the housing market in positive light.

The National Association of Realtors pointed out that distressed properties (foreclosures and short sales) made up 22% of total home sales in August, down from 24% in July and a high of 49% in March 2009. The decline in distressed properties in the universe of homes for sales is not only an important support for home price improvements in the months ahead but it is also a critical factor that will enable a reduction of the number of outstanding mortgages underwater. CoreLogic has estimated that 22.3 million mortgages were underwater in the second quarter vs. 23.7 million in the first quarter of 2012. The assessment of the housing market will be complete when the new homes sales report of August is published on September 26.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.