Silver and the Myth of Diminishing Returns From QE

Commodities / Gold and Silver 2012 Sep 27, 2012 - 06:03 AM GMTBy: Adam_Brochert

There is lots of talk in the financial media about how there are diminishing returns from QE (i.e. money printing) with each successive round of counterfeiting. This is only true because such commentators are stuck in paperbug world and focusing on common stocks. But common stocks are in a secular bear market, so it makes sense that there could be diminishing returns on common equities related to bailing out banks and governments by destroying the purchasing power of the currencies of the world.

There is lots of talk in the financial media about how there are diminishing returns from QE (i.e. money printing) with each successive round of counterfeiting. This is only true because such commentators are stuck in paperbug world and focusing on common stocks. But common stocks are in a secular bear market, so it makes sense that there could be diminishing returns on common equities related to bailing out banks and governments by destroying the purchasing power of the currencies of the world.

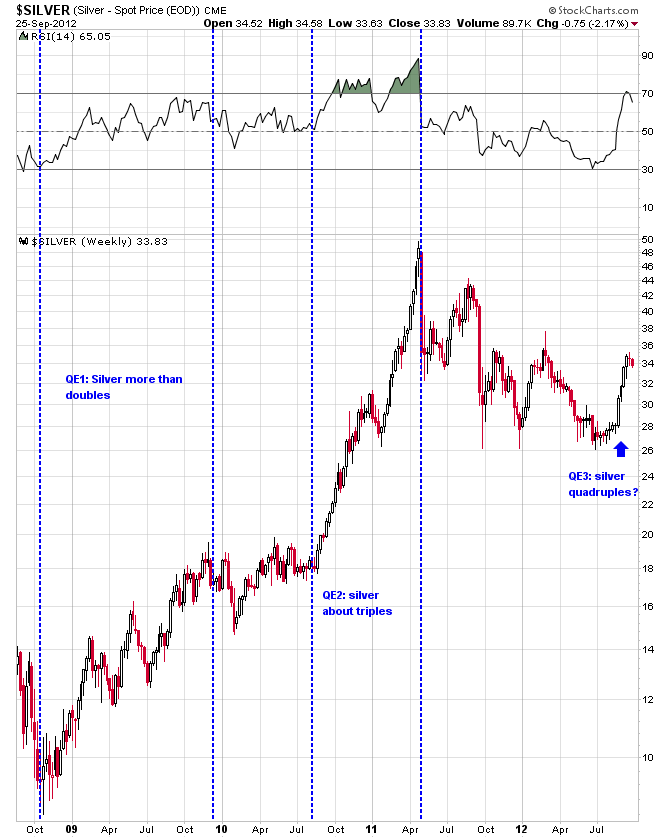

But before we dismiss money printing as ineffective, we have to view it from the perspective of the investor that holds silver instead of paper money, certificates of confiscation (government bonds) or common equities. Helicopter Ben's experiment with everyone else's savings is going quite well from the perspective of one invested in silver. Here's a 4 year weekly chart of the silver price in US Dollars to show you what I mean:

I think $100/oz. or so sounds about right for silver within the next 1-2 years. Gold and silver stocks certainly flew out of the gates to end the summer as if anticipating this kind of potential move in the metals. As secular bull markets mature, the cyclical bull moves within them get stronger and faster. We have already started a new cyclical bull market in the PM sector in my opinion.

One of the sneaky tricks about inflation is that once money is counterfeited and passed around to those with connections to the printing press, we little folks don't always know where the subsequent price inflation is going to come from. While I may be wrong in thinking the best performing asset class over the next few years will be precious metals, the precious metals sector is certainly the easiest, most conservative, no-brainer choice to put both investment and speculative money to work. The federal reserve and other central bankstaz around the world will get price inflation by creating insane amounts of money out of thin air, it just may not be price inflation in the items they want.

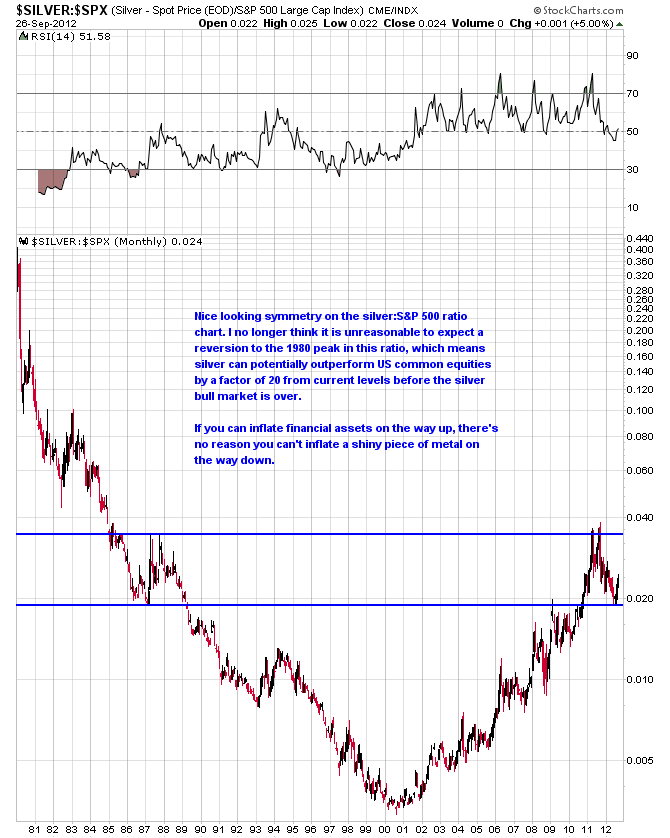

In fact, as someone who always harps on the Dow to Gold ratio, I thought the silver to S&P 500 ratio chart may offer a clue as to how much further the run in silver relative to common stocks has to go if we maintain the current course for the next several years:

If Gold is going to $3500/oz and beyond (and I wouldn't bet against Jim Sinclair even with JP Morgan's money), silver will have a price in the triple digits. It's not that I think the federal reserve (not federal and has no reserves, so I see no reason to capitalize their name) can stop another stock market crash and/or major common stock bear market from happening. But they have proven to me that they are determined to destroy what's left of the value of the US Dollar and no one with any authority is interested in stopping them. Once a few more percent of the general population catch on to this in the advanced economies of the world, which are all going thru the same escalating serial currency abuse process, critical mass will be reached and the real Gold and silver stampede will begin. We're not there yet, but it's coming...

Hold onto your Gold, silver, platinum and PM stocks. While things are a little overbought in the short-term, we're going much higher in the PM sector. I stand by my call made in May of this year that GDX is going to 80 by May of 2013 and I suspect it could go much higher (GDX will likely get to triple digits before silver will).

If this type of analysis interests you, consider a one month trial subscription - it's only $15. Hold onto your Gold and keep it away from Jon Corzine and other depraved banksta-types. Until the Dow to Gold ratio hits 2 (and we may well go below 1 this cycle), Warren Buffet and other traditional Wall Street gods will continue to under perform a shiny piece of metal.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2012 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.