Why Bernanke Can't Stop The Kress Cycle Deflation Tsunami

Economics / Deflation Nov 07, 2012 - 02:52 AM GMTBy: Clif_Droke

A question that many are asking right now is what impact the Fed's latest monetary policy action will have on the projected deflationary scenario for 2013-14. Specifically, market participants are wondering if the Fed's monetary policy action will prevent deflation from running its course.

A question that many are asking right now is what impact the Fed's latest monetary policy action will have on the projected deflationary scenario for 2013-14. Specifically, market participants are wondering if the Fed's monetary policy action will prevent deflation from running its course.

The answer to the above question holds profound implications for investors in stocks, commodities and real estate. If the Fed is serious about its commitment to stopping deflation at any cost, it could potentially put the brakes on the deleveraging process and hold off a deflationary nightmare for a few more years. The emphasis here is on the word "potentially," for it's still very much in doubt that the Fed's efforts will suffice for reasons we'll discuss here.

The long-term deflationary cycle of 120 years is just two short years from bottoming, which means the proverbial finish line is in sight. The bad news is that two years can seem like an eternity when the deflation cycle is ravaging the global economy, as it's expected to do in 2013-14. Even the slightest hesitation or deviation from the central bank's aggressively loose monetary policy would allow the floodtide of deflation to overwhelm the financial market and economy.

Next year is a critical one for the economy as it marks the start of the final "hard down" phase of the 60-year/120-year economic cycle due to bottom in late 2014. If the Fed and the other major central banks (notably the ECB) take their foot off the monetary accelerator for even a minute it will allow deflation to overspread the global economy, potentially reversing the recovery of the last four years.

It would be tempting to conclude that the Fed's commitment to stimulating the U.S. economy through its recent "quantitative easing" (QE3) effort along with the ECB's pledge to rescue the euro zone economy will keep the global economy on an even keel through the end of 2014 when deflationary risks are greatest. If China, Europe and the U.S. all shared the same commitment to fighting deflation through loose monetary policy it might be possible to engineer a soft landing for the global economy. Standing in the way of this, however, is a troubling lack of coordination on the part of the three major central banks. It's for this reason that the deflationary scenario is still likely to prevail by 2014.

Take for instance the stated intention of the European Central Bank (ECB) to stabilize the euro zone economy through large scale bond purchases. ECB President Mario Draghi recently announced the ECB would do "whatever it takes" to end the euro zone debt crisis. That announcement coincided with the launching of a $650 billion bailout fund earlier this month. But while the European Stability Mechanism, or "bazooka," as it has been nicknamed, is meant to help struggling European countries by extending loans or making bond purchases, its implementation is a far cry from what has been promised. Since EU member countries have been slow to provide start-up reserves, the fund will only have about $100 billion by 2014, according to reports. As one source pointed out, "That suggests that troubled countries like Spain may not get much help in the meantime."

Spanish Prime Minister Mariano Rajoy was elected just under a year ago on an austerity ticket. His government has signed off on a belt-tightening program worth over 60 billion euros through to the end 2014 to cut the country's deficit. But as Reuters observed, "the spending cuts have dented investment while tax rises have hit consumers' pockets and driven prices higher." Think of austerity as oxygen deprivation for a hospital patient who's in desperate need of air. By refusing the life giving oxygen to a dying patient, both Rajoy and Draghi are exposing Spain to the ravages of the 120-year cycle decline as we head closer to the fateful year 2014. While this may bode well for the gold price as investors seek out financial safe havens, it won't bode well for the euro zone economy or the people of those countries.

Shortly after ECB President Mario Draghi made his "whatever it takes to save the euro" statement, Sy Harding of Street Smart Report pointed out that "whatever it takes" didn't include cutting interest rates to also stimulate the euro zone economy. "Concerns are already rising that its announced program of unlimited bond-buying may even worsen the euro zone's recession, since the program requires governments that request the debt bailout to adopt and adhere to strict austerity measures in order to qualify for bond-buying, including reducing government spending and cutting wages, pensions, and services even further." All of these things are deflationary and will constrict the euro zone economy instead of expanding it.

The Kress 120-year cycle due to bottom in late 2014 is the nemesis of central banker. Although bankers like Draghi and Bernanke instinctively recognized the deflationary undercurrents of the times, their reactions in trying to stop deflation are becoming increasingly ineffective. As David Knox Barker put it in a recent issue of his Long Wave Dynamics Letter, "It is the mandate of the central banks to maintain price stability and maximum employment. The problem of course is that by pursuing these mandates with monetary policies, coupled with fiscal policies, the problems of price instability and unemployment are exacerbated."

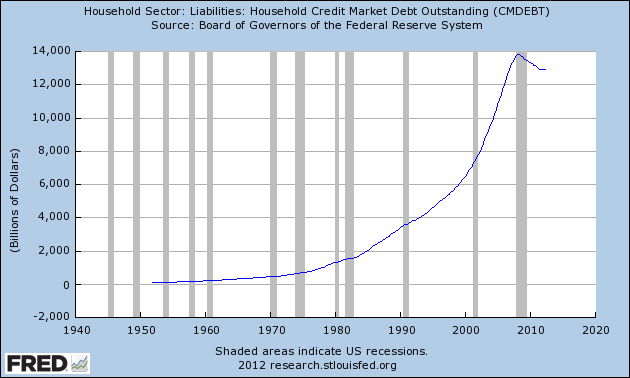

Barker also points out that central bankers are engaged in a potentially lethal balancing act between private sector deleveraging (i.e. deflation), monetary stimulus and austerity. An example of consumer deleveraging can be seen in the following chart. After the 2008 credit crisis, U.S. households cut their debt down to pre-recession levels as of late 2012. Home mortgages, credit card debt, and most other consumer liabilities have drifted back to 2006 levels, according to Moody's. But as Bob Prechter of Elliott Wave International has said, credit contraction is ultimately the "kiss of death" for a consumer based economy like the U.S. Barker also notes that without central bank intervention, private sector deleveraging would have been much more profound.

While many economists tried to put a positive spin on the reduction of private sector debt, others are more skeptical. Kenneth Rogoff of Harvard University Nathan Sheets of Citigroup say the deleveraging process still has years to run. They note that while debt as a share of income is down, the second quarter's 113 percent was above the 94 percent average since 1980. Sheets says the ratio will likely fall "some years" to about 100 percent.

As for the extensive stimulus measures of the Fed, central bankers are perplexed why this historic money creation hasn't resulted in inflation. The reason is simple: the main force of long-term deflation as governed by the 120-year cycle is still in play and is acting as a massive counterweight to bankers' attempts at re-inflating the credit balloon.

"In the U.S. the austerity comes in 2013," writes Barker. "It could tip the apple cart." The evidence strongly suggests that the crashing wave of the Kress 120-year cycle in 2013-2014 will do just that.

One more factor in our analysis of the debt/deflation cycle should be mentioned: China. Bloomberg Businessweek magazine reported that Chinese factories are now experiencing wholesale-cost deflation for the first time since 2009. Bloomberg also reported that Song Guoquig, an adviser to the Peoples Bank of China, says deflation is a real possibility for China in 2013.

Writing in Reuters, Andy Mukherjee recently observed concerning China: "In an excessively leveraged economy, even small price decreases can cause large increases in bad loans and financial stress." This assessment can be equally applied to the U.S. and explains why the Fed is so eager to pump liquidity in the face of Kress cycle deflationary pressures.

The ultimate failure of the Fed's response to global deflation will likely be caused by the lack of cohesion and coordination among the monetary policies of the world's largest central banks. Between Europe's bank pushing for greater austerity measures and the U.S. hoping to avoid the same, it's clear that the bankers are no longer on the same page. This confusing mixture of deflationary and inflationary monetary policies will only exacerbate the final "hard down" leg of the Kress mega cycle into 2014.

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at: http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.