Credit Card Balance Transfers – Not What They Used to be

Personal_Finance / Credit Cards & Scoring Feb 19, 2008 - 09:14 AM GMTBy: MoneyFacts

Samantha Owens, Head of Personal Finance at Moneyfacts.co.uk, comments on the 0% balance transfer deals and how this market has changed: “It was way back in 2004 when balance transfer fees first started to raise their ugly heads on 0% credit card deals. However with increasing levels of personal debt, the market for transferring balances has become more competitive, but for the consumer it has become harder to get these deals.

Samantha Owens, Head of Personal Finance at Moneyfacts.co.uk, comments on the 0% balance transfer deals and how this market has changed: “It was way back in 2004 when balance transfer fees first started to raise their ugly heads on 0% credit card deals. However with increasing levels of personal debt, the market for transferring balances has become more competitive, but for the consumer it has become harder to get these deals.

“Over the last few years we have seen the length of balance transfer deals increase. Two years ago cards offering 0% for 12 months were top of the best buy tables, with the majority trying to tempt us with 0% for 9 months. Now the top card offers 0% for 15 months, with many other best buys offering 13 months’ interest free.

“Whilst this increase in the length of balance transfer offer appears good news for financially stretched consumers, the reality is somewhat different than a few years ago.

“The downside is that balance transfer fees have increased with many being uncapped, lenders have tightened up their credit scoring criteria, so you need an almost spotless credit history to get your hands on one of these deals. If you do, the interest free limits will be far smaller than they used to be.

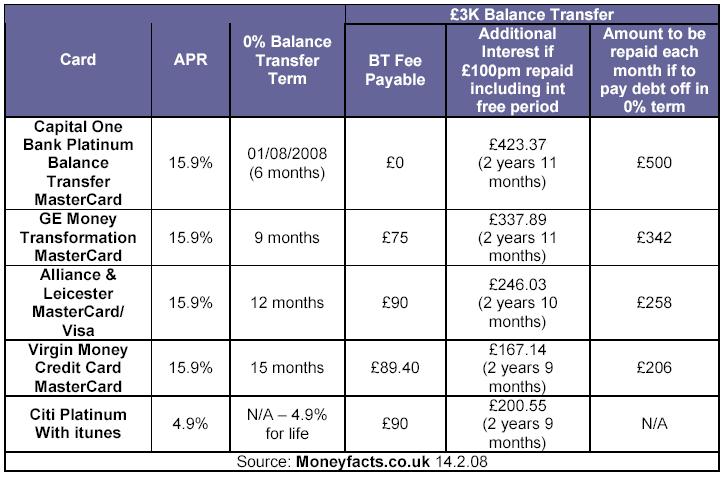

“Capital One Bank has bucked the trend and recently launched a credit card offering balance transfers without a balance transfer fee. But as with everything there is a downside: the card offers 0% until 1 August 08, meaning that the length of the 0% term is nine months less than the market leading card from Virgin Money. That said, the lack of fee will make this a good option for anyone who can afford to repay the debt over the short term of six months.

“However, if you transfer a £3,000 balance to the card, you will need to repay £500 per month in order to clear the debt in the six months introductory period. This is likely to be too much to ask for the average consumer.

“Lenders recoup their costs and start to make their money once the card reverts to the standard purchase rate after the introductory balance transfer term has ended, so you need to be aware of the ‘revert to’ interest rate, as some of these can really hit your wallet hard.

“For anyone not wanting the hassle of constantly moving the debt a life of balance card may be the best option. Transferring £3,000 to the Citi Platinum with itunes Rewards MasterCard which offers 4.9% for the life of the balance will see you repaying £200.55 in interest and take 2 years and 9 months to repay.

Moneyfacts.co.uk is the UK's leading independent provider of personal finance information. For the last 20 years, Moneyfacts' information has been the key driver behind many personal finance decisions, from the Treasury to the high street.

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.