Gold Cycles Bulllish Gold Price Forecast 2013

Commodities / Gold and Silver 2013 Nov 11, 2012 - 12:30 PM GMTBy: GoldSilverWorlds

Financial Tap writes: Gold is off to a flying start in this new Daily Cycle and it’s exactly what we expected and hoped for. If this is the first Daily Cycle, then we should see a consistent and grinding move higher from this point forward. The first Cycle has a habit of relentlessly grinding higher, much to the chagrin of investors who continue to wait for a pullback to buy into this new rally. Investors who missed the ICL will often look at the final ICL price compared to the quick $50 rally of a new cycle and find it difficult to buy. As the Cycle gathers momentum, a sense of panic buying begins to unfold.

Financial Tap writes: Gold is off to a flying start in this new Daily Cycle and it’s exactly what we expected and hoped for. If this is the first Daily Cycle, then we should see a consistent and grinding move higher from this point forward. The first Cycle has a habit of relentlessly grinding higher, much to the chagrin of investors who continue to wait for a pullback to buy into this new rally. Investors who missed the ICL will often look at the final ICL price compared to the quick $50 rally of a new cycle and find it difficult to buy. As the Cycle gathers momentum, a sense of panic buying begins to unfold.

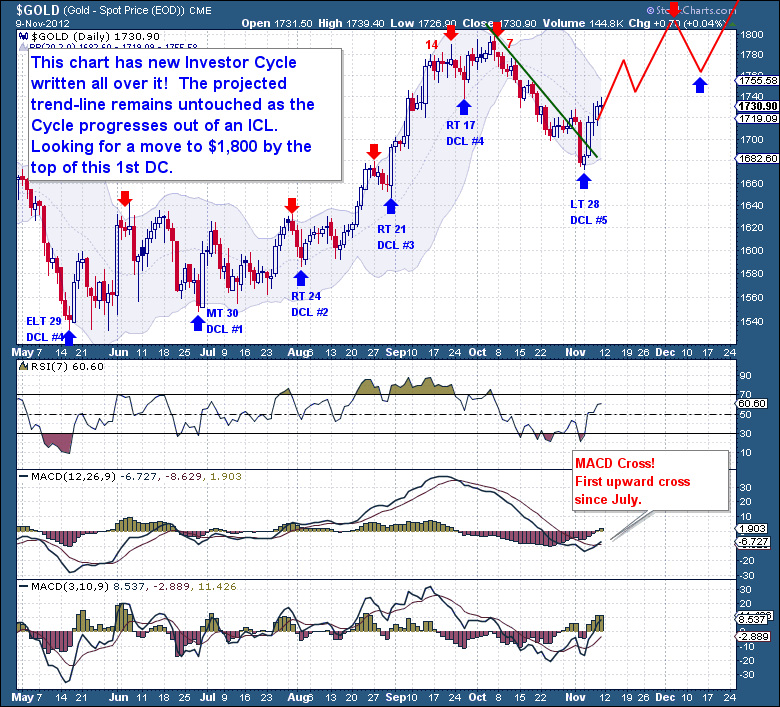

Looking at the chart with just a naked eye screams new Investor Cycle to me. You just don’t see a 5 day $70 move off deeply sold levels unless you’re in a new Investor Cycle. We’ve left the old declining trend-line behind and now have a positive cross of the MACD. These technical indicators will very rarely crossover in a last Daily Cycle, seeing it here almost guarantees we’re indeed in a new Investor Cycle. Our RSI indicator is quickly making its way up to the 70 (overbought) levels, again the type of relative strength that you see out of a 1st, not a 4th, 5th, or 6th Daily Cycle.

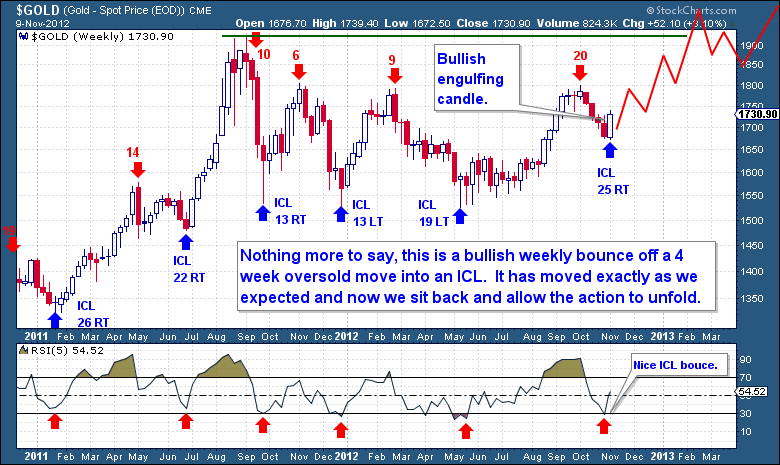

The Investor Cycle (Weekly Chart below) is also showing the signs of a new Cycle in play. A well balanced 20 weeks up, 5 Weeks down Investor Cycle that retraced more than 38.2% from the top. The Cycle Low formed after a series of capitulation (panic) days and the weekly RSI(5) bounced perfectly off the 30 level. The Cycle duration ran 25 weeks, a full and complete Cycle that met every requirement perfectly.

As the Cycle Low formed just this week, we will not begin Week 1 until next week. It’s for this reason that we cannot have a Weekly Swing Low until we make new highs next week above $1,740. Instead of a Swing Low however we are left with a very impressive bullish engulfing candle. These types of candles on the Weekly level surrounding an ICL are very good predictors of new Cycles.

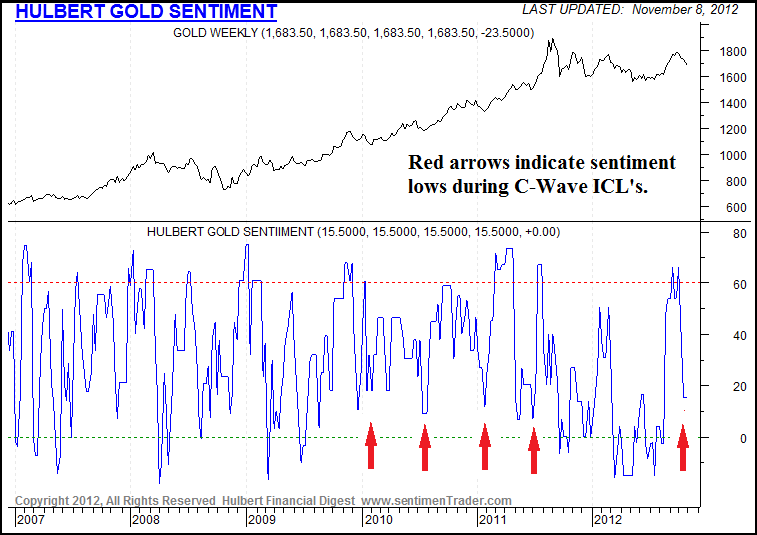

Topping off the evidence supporting our ICL indicators is the sentiment chart. Although we never got down to deeply negative sentiment, we did retrace back to the point where many past C-Wave ICL’s were made. The sentiment may have been worse as this chart incorporates a couple of the very powerful days seen earlier this week.

In summary, we’ve been tracking this Gold decline for 6 weeks now and it’s evolving almost exactly as we’ve expected. We’re at the point now where we are monitoring the action for any “curveballs” that could be thrown our way. From all the evidence at hand though, we are in a new powerful Investor Cycle and we need start focusing on how to best handle the coming gains.

This is an exclusive excerpt from The Financial Tap, who offers a FREE 15-day trial with complete access to the entire site. This as is an excerpt from this weekends update from The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly, as well as real time trade alerts to profit from market inefficiencies. They offer a FREE 15-day trial where you’ll receive complete access to the entire site. Coupon code (ZEN) saves you 15%.

Source - http://goldsilverworlds.com/gold-silver-price-news/gold-cycles-bulllish-gold-price-outlook/

© 2012 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.