China Gold Reserves Too Small to Ensure National Economic and Financial Safety

Commodities / Gold and Silver 2012 Nov 14, 2012 - 08:29 AM GMTBy: GoldCore

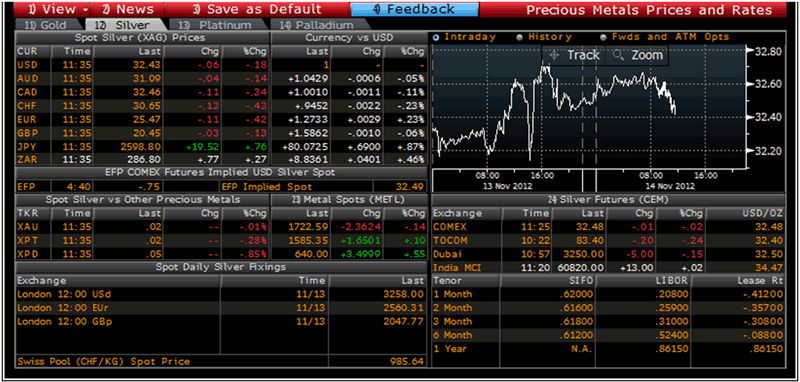

Today’s AM fix was USD 1,724.50, EUR 1,353.08, and GBP 1,085.21 per ounce.

Today’s AM fix was USD 1,724.50, EUR 1,353.08, and GBP 1,085.21 per ounce.

Yesterday’s AM fix was USD 1,724.75, EUR 1,360.86, and GBP 1,091.39 per ounce.

Silver is trading at $32.47/oz, €25.60/oz and £20.54/oz. Platinum is trading at $1,585.00/oz, palladium at $637.00/oz and rhodium at $1,150/oz.

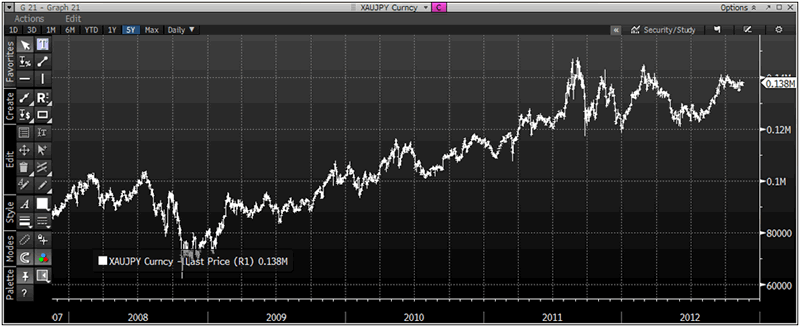

Gold is marginally lower in all fiat currencies today except for Japanese yen which has fallen nearly 1% against gold and is close to reaching record nominal highs in yen terms (see table and chart).

Gold edged down $3.40 or 0.20% in New York yesterday and closed at $1,724.50. Silver saw odd aggressive selling which saw the price fall sharply to $32.128 prior to an equally sharp price recovery as buyers took on the sellers leading to silver finishing the day with a gain of 0.12%.

Gold Prices/Fixes/Rates/Vols – (Bloomberg)

Gold inched up on Wednesday as the euro recovered against the U.S. dollar, and platinum ramped up its highest gain in the past three weeks on real concerns that supply will not meet the demand due to output issues because of the striking mine workers this year.

President Obama will hold his first solo news conference since November today and is expected to take questions from reporters at 13:15 EST. Comments about the “fiscal cliff” may have a short term effect on gold bullion.

China needs to add to its gold reserves to ensure national economic and financial safety, promote yuan globalization and as a hedge against foreign- reserve risks, Gao Wei, an official from the Department of International Economic Affairs of Ministry of Foreign Affairs, writes in a commentary in the China Securities Journal today which was reported on by Bloomberg.

China’s gold reserve is “too small”, Gao said and while gold prices are currently near record highs, China can build its reserves by buying low and selling high amid the short-term volatility, Gao wrote.

The People’s Bank of China is accumulating significant volumes of gold under the radar of many less informed market participants which is bullish.

The Chinese government is secretive about its gold diversification and buying and does not disclose gold purchases to the IMF.

Therefore, there has been no official update to their holdings since the barely reported upon announcement four years ago that Chinese gold reserves had risen from just over 500 tonnes to over 1,000 tonnes.

In 2009, State Council advisor, Ji said that a team of experts from Shanghai and Beijing had set up a task force to consider expanding China’s gold reserves. Ji was quoted as saying "we suggested that China's gold reserves should reach 6,000 tons in the next 3-5 years and perhaps 10,000 tons in 8-10 years”.

China is likely to have been quietly accumulating another 1,000 or 2,000 tonnes in recent years and astute market participants realise that the announcement by China of a dramatic increase in gold reserves could lead to sharp price gains.

The very low level of the People's Bank of China's gold reserves vis-à-vis their massive foreign exchange exposure and compared to western counterparts gold reserves will continue to be a source of significant gold demand in the coming months which will support gold and may contribute to higher prices in 2013.

XAU/JPY Currency – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.