U.S. Labor Market – One Step Forward, Two Steps Back

Economics / Employment Dec 07, 2012 - 01:10 PM GMTBy: Andy_Sutton

Just when you think things can’t get any more ludicrous or obscene in terms of insulting the truth, out comes the BLS with its monthly jobs numbers. I’m going to break those down in a minute. But wait! There’s much more. We’ve got the fed, which had been promising to raise rates starting in 2010, then 2011, then ’12, and now they’re all the way out in 2015. Double that for the monetization (not just asset purchases). Those programs were supposed to be exited, starting this year. Now those exit plans are going to be redrawn. I’d say at this point they should just drop the charade.

Just when you think things can’t get any more ludicrous or obscene in terms of insulting the truth, out comes the BLS with its monthly jobs numbers. I’m going to break those down in a minute. But wait! There’s much more. We’ve got the fed, which had been promising to raise rates starting in 2010, then 2011, then ’12, and now they’re all the way out in 2015. Double that for the monetization (not just asset purchases). Those programs were supposed to be exited, starting this year. Now those exit plans are going to be redrawn. I’d say at this point they should just drop the charade.

Anyone with a pulse and two brain cells knows that ZIRP (zero interest rates in perpetuity) and monetization are both here to stay. And that will remain the case until the next monetary scheme – whether it ends up being regional or global – is concocted. And then there is the ongoing ‘fiscal cliff’ disaster. Which is not new, but is merely a by-product of the last compromise a whole 16 months ago. Our leaders created the cliff; now we get to jump off of it. Or be pushed, whichever you prefer. Buckle up folks, its’ going to be a raucous and wild column this week.

The Labor Market – One Step Forward, Two Steps Back

The propaganda meisters at Bloomberg were out in full force early this morning as BLS reported the November employment situation. 7.7% unemployment is the headline number and that’s what you’ll get when you turn on the daily soap opera, aka ‘news’, this evening. This might have been the worst report yet, but you won’t get that from the press. Now there are probably a lot of folks who are going to accuse those of us in the alternative media for having a permanent case of cynicism. I wouldn’t go that far. It certainly isn’t good that our economy is in such a shambles that we have to rely on seasonable, part-time, and lower-paying service jobs to get by, but looking at the shopping mall parking lots, things can’t be that bad. Right?

On to the BLS and its’ monthly edition of the statistical circus. ‘Officially’, 146,00 new jobs were ‘created’ in November and the unemployment rate fell to 7.7% Let’s break that down. First, don’t forget that the US needs to create around 150,000 new jobs each month just to keep up with population growth. So before we go any further, November is a wash. But let’s play it out, shall we?

In November, the CESBD (birth/death) model of new businesses actually subtracted 29,000 jobs from the total, not added, which has been customary. A first look indicates that this could very likely be due to the massive hurricane that hit the East Coast last month. Ironically, the NY Times spun the failure of Sandy to hit the jobs report as a sign that the economy is moving into super-strong mode. Not so fast guys.

Goods-producing jobs saw the second decrease in 4 months, shedding a total of 22,000 jobs in November, and for the previous quarter, the goods-producing sector lost 21,000 jobs. This is a principle case where the government’s own data bucks its assertions that manufacturing is returning to America. The manufacturing sub-section is down 13,000 jobs in the same period.

As usual, the majority of jobs ‘created’ were on the service side. I’ve been asked many times why this is a sticking point economically and a big deal. Generally speaking, if this situation were reversed we most likely would be looking at much smaller trade deficits at a minimum, and would perhaps even have surpluses. Nearly all goods can be exported. It is impossible to export a haircut for instance.

The big winners in November were predictable. Retail trade (52,000), leisure and hospitality (23,000), healthcare and social assistance (22,000), education and health service (18,000), and temporary help (18,000) were the big winners. With the possible exception of certain healthcare jobs, at least 133,000 of the 146,000 jobs allegedly created were of a subsistence nature in terms of pay and benefits. Goods-producing jobs, which generally pay more, disappeared in November in the aggregate.

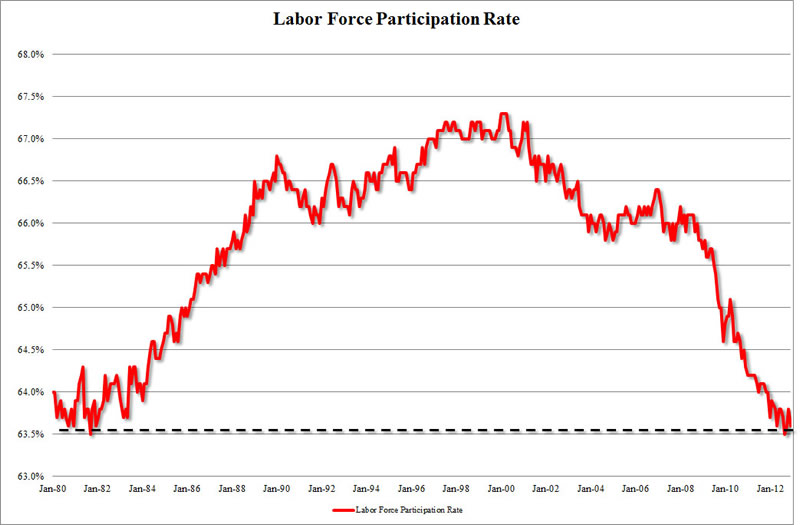

The biggest piece of data, which got marginal attention, is the fact that another 540,000 people LEFT the workforce. This is the number one biggest reason why the unemployment rate has been falling. In idiotic BLS logic, if you have fallen off the unemployment wagon and have given up looking for a job, then you must have found one and are no longer counted as unemployed. Workforce participation is at multi-decade lows and this tells the story better than anything else BLS is reporting.

The labor force participation rate hasn’t been this low since 1980. While the average onlooker might quibble and say we’re only talking about a few percentage points worth of change over that time, it translates into literally millions of people that have left the labor force. Granted, some are retirees. The baby boomers will skew this number a tad, but their exit presents a fiscal cliff of a genuine nature, not the manufactured, cheap show that we’re getting right now from Congress and the press.

The take-home conclusion from the BLS report is that our economy is continuing the fundamental change that has been ongoing for the past decade or so as more people will be working lower-paying service jobs. Couple that with the blowout in housing and it is easy to understand why household net worth is at 43-year lows. Expect that to get worse. Also, watch for revisions (most likely downward) in November’s numbers. September and October were revised downward a total of 49,000 after the fact – with no media coverage of course. Expect the same to happen again for November.

The Saver’s Death Sentence – Continued, Not Commuted

The federal reserve made a point of giving savers a death sentence when it reduced its fed funds rate to near 0% what seems like a thousand years ago. But it was going to be short in duration. It wasn’t going to last very long we were promised. We’ll raise those rates as soon as the economy starts growing again. Now, four years into ZIRP there is still no light at the end of the tunnel and the window for keeping rates buried continues to get pushed further into the future.

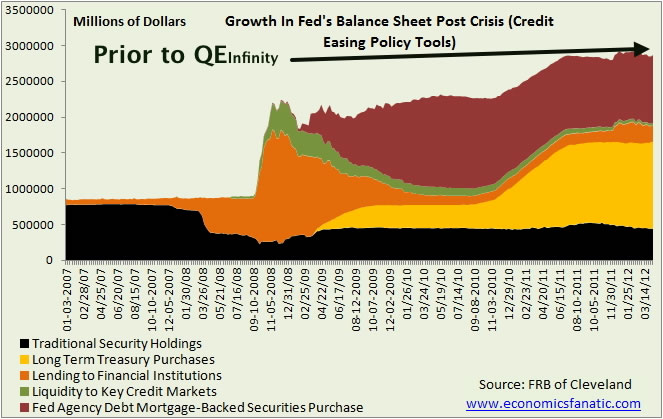

The same can be said of the fed’s various asset purchase programs which I’ve analyzed ad nauseum on several prior occasions as serious encroachments on private property rights as opposed to being economic stimulus programs – the ridiculous notion pushed by the fed and in the press.

There is increasing speculation and likelihood that the fed will expand its asset purchase programs when it meets next week. The cover for doing so will be the flagging economy and a weak labor market. Justifying this move will be the assertion that inflation is tame as measured by the CPI, which has about as much relevance to the average American as the price of vacations to Mars. Few people seem to be making the connection that the fed taking ownership of everything from car loans to USGovt debt is doing nothing to help the economy, nor was it ever intended to.

Under existing fed ‘strategy’, the goal was to start selling assets in mid-2015 – around the same time as they’d begin to raise interest rates. There are two certainties here. All else equal, if the fed sells an appreciable amount of bonds into the open market (without buying them back on the sly or through intermediaries), it’ll crash the bond market. Nobody wants a bunch of debt from a country that isn’t even remotely interested in protecting its creditors from default and inflation risk. Secondly, should the fed raise interest rates by any appreciable amount, it’ll crash the USEconomy. Period. Many are calling for another Paul Volcker type to come in and replace Bernanke. If those same people believe that an economy hooked on inexpensive debt can tolerate even a 5% fed funds rate let alone a 20% one, then I’ve got a couple of bridges and some oceanfront property I’d really like to unload. Once again, these folks (and most policymakers, Congressfolks, and the like) are ignoring the debt and pretending it doesn’t exist and/or doesn’t need to be repaid. While the USGovt will undoubtedly default on its debt either in a de facto manner (hey China, you’re not getting paid) or an in situ manner (inflation), the average person doesn’t have that luxury and a Volcker-esque move would incinerate anyone that relies on debt for consumption. Based on my own research, client experiences, and metrics, the fed funds rate would need to be in the neighborhood of 7.5%-9% for the average saver just to break even on a vanilla bank savings account after taxes and cost of living increases are figured into the equation. The short answer for savers is don’t expect help in this regard any time soon. The USEconomy cannot survive such a move.

Most mainstream Keynesian economists and financial types agree with Richmond fed president Jeffrey Lacker, who pines about the size of the fed’s balance sheet and that the bigger it gets, the harder it will be to unwind it. Thank you, Captain Obvious. An Oppenheimer director of fixed income said the fed ‘needs to shrink its balance sheet without selling assets into the marketplace’. That ought to be a good one. Hey, here’s an idea. The fed creates trillions of dollars from nothing. How about just making the assets vanish into nothing? A situation this devoid of common sense deserves all the sarcasm that can possibly be mustered.

The ‘Fiscal Cliff’ Follies Show

Last but certainly not least this week is the comedy act being played out in Washington, DC, otherwise known as the Fiscal Cliff Follies Show. This is a man-made situation, pure and simple. Sure, there was a fiscal cliff, but the US went over it years ago with almost no fanfare. One might argue it was when the federal reserve took control of the stewardship of the dollar. Others might argue that we went over the cliff in 1933 when the government called in the gold, or even in 1971 when we went off the gold standard (albeit a very weak standard at that time) for good. It really doesn’t matter. Greece had a fiscal cliff too and has gone over it; probably well in advance of all the upheaval and turmoil that has taken place in that country.

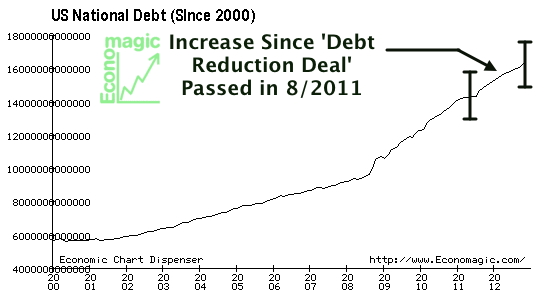

Let’s rewind back to late July and early August of 2011. Congress had its backs to the wall on raising the debt ceiling. Part of the compromise agreement that included raising the debt ceiling (of course!) was the creation of the ‘super’ congress. Remember that one? They were supposed to come up with a list of spending cuts. If they couldn’t, then automatic cuts (mostly Dept. of Defense) would take place. That’s where we are now. I’m being overly simplistic, but the above is what it boiled down to. So in short, we are now at the man-made cliff and the Fiscal Cliff Follies have begun. The biggest affront to decency and common sense of the 2011 compromise is that it was deliberately designed (and agreed to by both major parties) to push the situation out past the 2012 elections. Couldn’t call the Congress back from campaigning to tend to the business of the people, now could we? CNN reported at the time:

“The debt ceiling deal passed by the House on Monday and by the Senate Tuesday will keep the country out of default and reduce deficits by at least $2.1 trillion over a decade. [This is one of those deals where it doesn’t actually cut the deficits, but is alleged to trim the rate of increase. A big difference, but it’s all in the semantics]

Whether the deal might also avert a first-ever credit downgrade for the United States is not clear, since ratings agency Standard & Poor's indicated it was looking for a credible, bipartisan plan that had at least $4 trillion of debt reduction.

The plan includes no tax or entitlement reform measures up front, although theoretically it leaves the door open to both. [Obviously wide open; at least on the tax side]

A debt ceiling increase of between $2.1 trillion and $2.4 trillion: The framework will raise the debt ceiling immediately by $400 billion, then by another $500 billion after September.

After deep cuts are enacted by the end of the year, it will be increased by another $1.2 trillion to $1.5 trillion. All told, the increases should cover the Treasury's borrowing needs until 2013.”

So here we are, just weeks from the deadline in Washington’s own version of reality TV. And the rhetoric is getting more and more ridiculous. Someone is going to end up paying an awful lot more in taxes that’s for sure. The poor want it to be the rich. Some of the rich say it should be the rich (but only if they themselves are exempt). Ring any bells Mr. Buffett? Some folks, like Howard Dean, now say it should be all of us.

But the one thing you don’t hear much of is a cry for government to get cut down to size and dumped back into its proper role as well. Spending is out of control and the emphasis throughout the Fiscal Cliff Follies show has been on who should pay for the largesse rather than questioning the validity of the largesse itself. Few seem to care that the government is borrowing 46 cents of every dollar it spends. Few see that as a problem.

These same people see the government as the most efficient allocator of resources, rather than the marketplace. These folks believe that government, not the marketplace, should control the factors of production. Their philosophy is embodied in the failure of the Chevy Volt. Nationalize a company, force it to produce something that almost nobody wants, lose a ton of money on the deal, then have the government buy up all the excess to make it seem like it was a good idea to start with. People, this philosophy has a name. And no, it has nothing to do with little red men sneaking around looking for nuclear missile silos either.

Which brings us full circle with the point of the last several columns. This is a moral problem – or a lack of a moral compass – whichever you prefer. It is the perpetuation of the ideology that you can spend what you didn’t earn, consume when you didn’t produce and, in general, derive your own sustenance from the sweat of another’s brow. The fact that roughly half the country now identifies with the above ideology is the real cliff, not the fiasco that is the Fiscal Cliff Follies show.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.