U.S. Treasury Bond Market Yields Update

Interest-Rates / US Bonds Dec 09, 2012 - 06:45 AM GMTBy: PhilStockWorld

Courtesy of Doug Short. I’ve updated the charts below through today’s close. The S&P 500 is now 3.25% off its interim high of 1,465.77 set on September 14th, the day after QE3 was announced. The interim low since then was 1,353.52, a decline of 7.66% a month later on November 15. The 10-year note closed today at 1.64, which is 24 basis points off its interim high of 1.88, also set the day after QE3 was announced. The historic closing low was 1.43 on July 25th. The latest Freddie Mac Weekly Primary Mortgage Market Survey puts the 30-year fixed at 3.34 percent, three basis point above its historic low set two weeks ago.

Courtesy of Doug Short. I’ve updated the charts below through today’s close. The S&P 500 is now 3.25% off its interim high of 1,465.77 set on September 14th, the day after QE3 was announced. The interim low since then was 1,353.52, a decline of 7.66% a month later on November 15. The 10-year note closed today at 1.64, which is 24 basis points off its interim high of 1.88, also set the day after QE3 was announced. The historic closing low was 1.43 on July 25th. The latest Freddie Mac Weekly Primary Mortgage Market Survey puts the 30-year fixed at 3.34 percent, three basis point above its historic low set two weeks ago.

--------------------------------------------------------------------------------

Here is a snapshot of selected yields and the 30-year fixed mortgage starting shortly before the Fed announced Operation Twist.

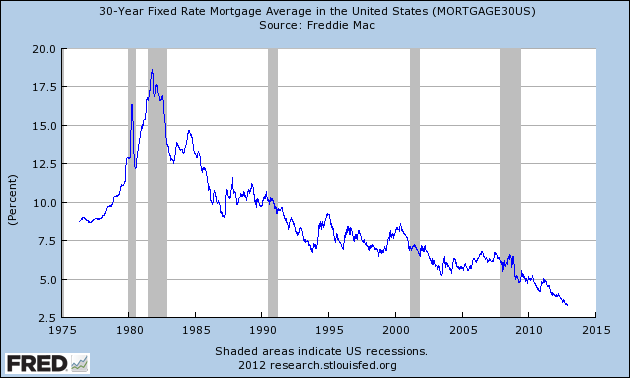

For a eye-opening context on the 30-year fixed, here is the complete Freddie Mac survey data from the Fed’s repository. Many first-wave boomers (my household included) were buying homes in the early 1980s. At its peak in October 1981, the 30-year fixed was at 18.63 percent.

The 30-year fixed mortgage at the current level is a confirmation of a key aspect of the Fed’s QE success, and the low yields have certainly reduced the pain of Uncle Sam’s interest payments on Treasuries (although the yields are up from recent historic lows of this summer). But, as for loans to small businesses, the Fed strategy is a solution to a non-problem. Here’s a snippet from the latest NFIB Small Business Economic Trends report:

Access to credit continues to be low of the list of small-business owner concerns. Twenty-eight (28) percent reported all credit needs met, and 52 percent explicitly said they did not want a loan (64 percent including those who did not answer the question, presumably uninterested in borrowing as well).

A Perspective on Yields Since 2007

The first chart shows the daily performance of several Treasuries and the Fed Funds Rate (FFR) since 2007. The source for the yields is the Daily Treasury Yield Curve Rates from the US Department of the Treasury and the New York Fed’s website for the FFR.

Now let’s see the 10-year against the S&P 500 with some notes on Fed intervention.

For a long-term view of weekly Treasury yields, also focusing on the 10-year, see my Treasury Yields in Perspective.

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2012 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.