End of the Debt Supercycle and a Coming Massive Devaluation of the Yen ...

Economics / Global Debt Crisis 2012 Dec 20, 2012 - 04:56 AM GMTBy: Mike_Shedlock

... Most Difficult Time to Invest; The Belief Bubble

... Most Difficult Time to Invest; The Belief Bubble

Late last month, Kyle Bass, managing partner of Hayman Capital, shared his thoughts in a video at the University of Virginia Darden School of Business Investing Conference with Professor Ken Eades.

It is a fantastic interview that echoes many of the things I have been saying about Japan for quite some time.

Interview Snips

Ken Eades kicks off the interview welcoming Kyle Bass mentioning that over the past few years his investment thesis has been then same. Eades then asks Bass to recap and review. what follows is Bass' reply.

Thematically, the bottom line is the total credit market debt-to-GDP globally is 350 percent. It's 200 trillion dollars' worth of debt against global GDP of roughly 62 trillion.It's of our belief you are going to continue to see lower global growth, and you're going to see certain countries hit the proverbial end-point or wall where they have to restructure their debt. We've been particularly dogmatic with our view there.

Investing around that particular idea is very difficult. As Dick Mayo [Chairman, Mayo Capital and Founding Partner of GMO] said today, it's actually the most difficult time in the world to invest in his lifetime, and I would echo his comments. Investing in the environment that I am describing to you is the single hardest thing to do as far as investing is concerned over the last few decades.

So this is a debt super-cycle that is coming to an end at various end-points for different countries. We think you are going to continue to see yield compression in the developed world. We think the US and Europe could actually see negative nominal rates over the next 12 months which is something that as an academic is very hard to understand, as a participant really hard to understand. But it seems we are seeing enough rhetoric and research done on the subject that it's actually a real possibility. Maybe it's only a 20% possibility but the fact that it's even on the white board is something that's worthy of paying attention to.

A lot has happened in Japan in the last 12 months. In fact, in the last 2 months we believe Japan has crossed that proverbial Rubicon. We think that you've seen 20 years of conjecture regarding Japan's eventual demise. And now we see a point where, in the last couple months what you see is a continued deterioration in their balance of trade. It's actually running at about negative $100 billion or close to 10 trillion Yen. And we think given this resurgence of Chinese nationalism over the Senkaku crisis [disputed islands], you're going to see that move another 1.5 to 2 percent or another $100 billion. Put that in perspective. What that means is we could see full current account negativity in Japan in October. That's something nobody is ready for.

Think about it. You have a secular decline in the population, you have a balance of trade that is literally being rewritten and falling off a cliff, and their GDP is now tracking negative 3.5 or 4 percent.

So what has to happen in Japan. Now their backs are against the wall. They have a full crisis, and they absolutely have to change the manner in which they deal with their currency. And so we think over the last couple of months they have crossed the final Rubicon that turns the whole situation around and weakens the Yen from a currency perspective. Then you are going to start to see, we think, in the next 12-18 months a move in their rates.

Basically Japan is entering its final checkmate phase of the game.

[Ken Eades asked when will the October numbers come out]. ... That data gets released mid-December. I'm not focused on one particular data set. It's naive of me to think that I can call the end of the 70-year debt super-cycle with any kind of precision whatsoever.

What I'm telling you is when you look at all the inputs, look at their balance of trade, look at their full current account, look at the fact they have had 10 finance ministers in six years. You have the BOJ [Bank of Japan] independence somewhat usurped or revoked in the last few weeks when there is a press release put on the BOJ's website, a joint press release from the MOF [Minster of Finance], the BOJ, and the government, that analogous to Bernanke, Geithner, and Hillary Clinton issuing a joint press release saying we're going to end deflation.

This is how it begins to happen. You start to revoke the independence of the central bank and let the politicians run monetary policy, well this is how it falls apart.

So you have Shinzo Abe coming in, the elections in Japan will be around December 16, and Abe we think is a shoo-in, and he is saying they are going to do everything possible to get to 3 percent inflation. He doesn't even know what he wishes for. Because if he gets there, he detonates his debt-bomb.

[Ken Eades asked, next year is it possible you will be going long?] It's possible. Again, I don't want to be naive to say that it's going to happen in the next 12 months. All of the ingredients are there to have this viscous cocktail fall apart. I think that it could probably take a little longer. But to the extent that we see a bond crisis in the Yen that has a massive devaluation? Yes.

Current Account Update

Updated current account and trade balances were posted on December 9. Japan's current account balance surprised to the upside, but do not expect it to last.

Nasdaq reports Japan Current Account Stronger Than Expected.

-

Japan posts current account surplus of Y376.9 billion

-

Figure is higher-than-forecast but still down 29.4% from last year

-

Separate revised GDP figures show no change in overall contraction of 0.9% for third quarter

-

Second-quarter GDP revised to show small contraction

TOKYO--Japan's current account surplus fell in October from a year earlier, as the nation's trade deficit continued to expand, while separate revised gross domestic product figures showed that the economy may have already entered a recession.The finance ministry said on Monday that the current account surplus narrowed to Y376.9 billion in October before seasonal adjustment. That was slightly larger than the Y218 billion surplus expected by economists surveyed by Dow Jones Newswires and the Nikkei.

"Speaking generally, exports have been the weakest link in recent data, and the direction exports take will be key for economic recovery," said Jun Kawakami, market analyst at Mizuho Securities.

Balance of Trade and Current Account

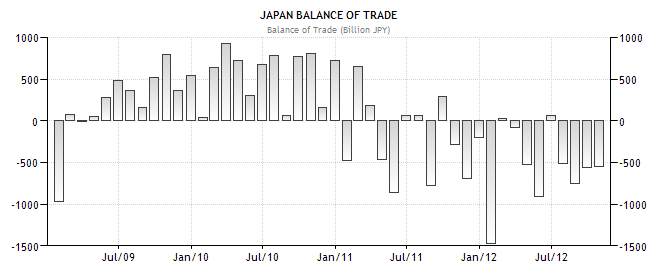

Please consider the trend in Japan's Balance of Trade

Japan recorded a trade deficit of 548.90 Billion JPY in October of 2012. Historically, from 1979 until 2012, Japan Balance of Trade averaged 635.3 Billion JPY reaching an all-time high of 1608.7 Billion JPY in September of 2007 and a record low of -1476.9 Billion JPY in January of 2012.

Balance of Trade Since 2009

Starting in 2011, Japan's balance of trade has been consistently negative.

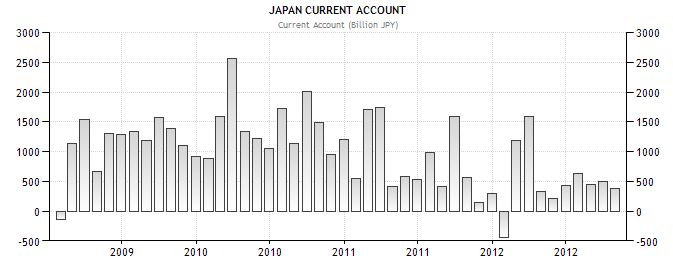

Please consider the trend in Japan's current account.

Japan recorded a Current Account surplus of 376.90 Billion JPY in October of 2012. Current Account in Japan is reported by the Ministry of Finance Japan. Historically, from 1985 until 2012, Japan Current Account averaged 1106.53 Billion JPY reaching an all time high of 3287.90 Billion JPY in March of 2007 and a record low of -437.30 Billion JPY in January of 2012. Current Account is the sum of the balance of trade (exports minus imports of goods and services), net factor income (such as interest and dividends) and net transfer payments (such as foreign aid).

Current Account Since 2009

The trend in Japan's current account has been in serious decline starting 2011.

Japan will be in serious trouble as soon as its current account stays negative. That has not happened yet, but it will. As soon as it does, Japan's debt-bomb goes off.

For more on the Yen please consider Spotlight on Japan: Return of 'Abenomics', More Militarism, Tougher China Line; Outlook for Yen and Nikkei

For more on the conflict with China regarding disputed islands, please see China Skips IMF Meeting In Japan; Taiwan Claims Islands Too; What's the Dispute Really About?Most Difficult Time to Invest

I wish to conclude with the statement by Kyle Bass "As Dick Mayo [Chairman, Mayo Capital and Founding Partner of GMO] said today, it's actually the most difficult time in the world to invest in his lifetime."

I endorse that statement 100%. Moreover, I would like to add that many now find investment decisions relatively easy. They look at monetary easing by the Fed, by the ECB, by China, etc., as a perpetual green light.

Clearly Kyle Bass does not see it that way, nor do I, nor does John Hussman. Indeed, I believe the only ones who find investment decisions easy are those who do not understand the risks.

Belief Bubble

As I have pointed out on many occasions, if the Fed could have prevented a collapse in 2008, it would have.

If Japan's central bank had an easy cure for deflation, it would have found it long ago. Instead Japan has a massive amount of debt, with nowhere to hide.

If the ECB had an easy solution to the crisis in Greece, Spain, and Italy, there would not be endless meetings followed by endless bickering.

Yet, for whatever reason, there is a bubble in the belief that central banks are in control.

Problem is Debt, With No Easy Cure

The problem is debt. As Bass pointed out "the total credit market debt-to-GDP globally is 350 percent. It's 200 trillion dollars' worth of debt against global GDP of roughly 62 trillion."

The 70-year debt super-cycle is coming to an end. It could have happened last year, or the year before, but it didn't. It may or may not happen in 2013.

Those fully loaded in equities are either ignorant of these facts or they do not care. Those of us who are aware, but also aware the end cannot be precisely timed are the ones who look overly cautious. We are the ones who think "this is a difficult time to invest".

Prudent to be Patient

I am comfortable in my position that better times are ahead for those willing to be patient, even if I cannot precisely say when that will be. In the meantime, I am willing to sit with a position in gold, cash, and various hedges until better opportunities present themselves.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.