Dow Gold and Gold Silver Ratio Charts Remain Bullish

Commodities / Gold and Silver 2013 Jan 03, 2013 - 10:30 AM GMTBy: GoldCore

Today’s AM fix was USD 1,684.50, EUR 1,285.09 and GBP 1,039.69 per ounce.

Today’s AM fix was USD 1,684.50, EUR 1,285.09 and GBP 1,039.69 per ounce.

Yesterday’s AM fix was USD 1,681.50, EUR 1,270.11 and GBP 1,031.22 per ounce.

Silver is trading at $30.92/oz, €23.70/oz and £19.20/oz. Platinum is trading at $1,571.00/oz, palladium at $701.00/oz and rhodium at $1,150/oz.

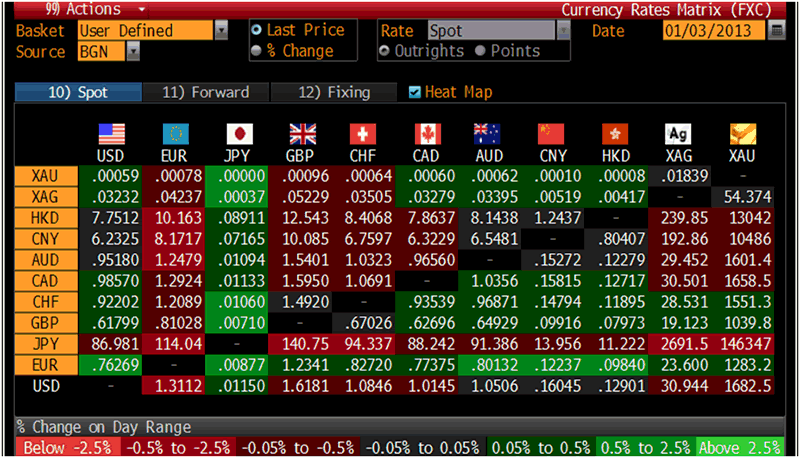

Cross Currency Table – (Bloomberg)

Gold climbed $11.60 or 0.69% in New York yesterday and closed at $1,684.70/oz. Silver surged to a high of $31.48 and finished with a gain of 1.98%.

Gold edged up today and hit its highest range in two weeks in the prior trading session on the heels of the deal forged that avoided the U.S. fiscal cliff disaster.

The far more substantial risk from the pending budget negotiations remains as does the appalling US national debt and unfunded liability situation – both of which offer long term support to gold and silver.

The market lustily greeted the deal that U.S. Congress passed to raise taxes on the wealthy and spare the middle and lower income earners.

However, the very necessary cutting of budgets in various sectors, military and domestic, will no doubt fuel many more political battles as the nation’s finances continue to deteriorate.

In India, the central bank has required restrictions be placed on gold imports by banks and agencies, while the finance minister said he was evaluating further tax increases on gold imports to help rein in a current account gap that touched an all-time high in the Q3 2012.

U.S. weekly jobless claims for 12/20 are released at 1330 and expected at 365,000 and at 1900 GMT the FOMC Minutes from the fed’s December 12th meeting are released.

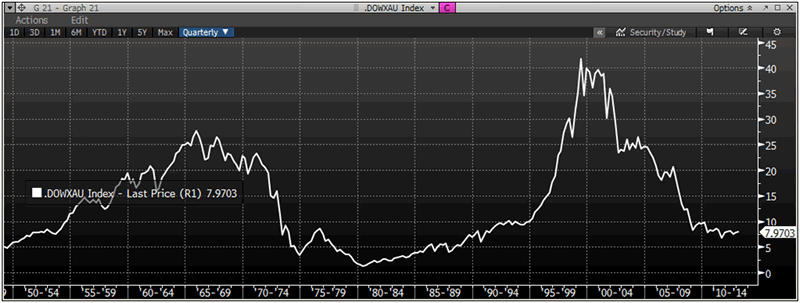

Dow/XAU Index – (Bloomberg)

We continue to favour the Dow Gold Ratio chart as a good indicator as to when the gold bull market might end. It is likely to reach the levels seen in 1980, close to 1:1 or the Dow at 5,000 or 10,000 and gold at between $5,000/oz and $10,000/oz.

This will be an indication that the gold bull market will be in its final innings. Provided of course we do not return to some form of gold standard whereby gold bull markets and bear markets will again become confined to history.

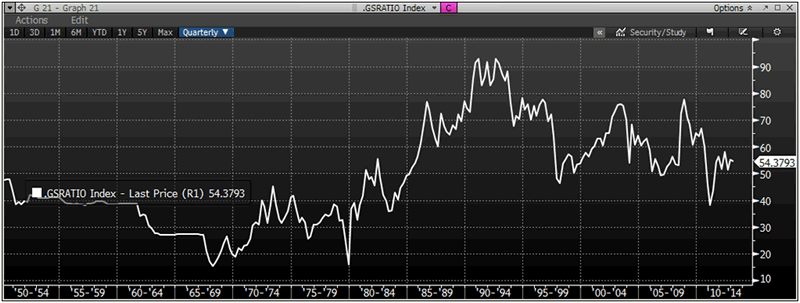

Gold Silver Ratio Index– (Bloomberg)

We continue to be more bullish on silver in the long term and believe the gold silver ratio should fall back to the geological 15:1 level as was last seen in 1980. This means that silver continues to be more attractive from a return point of view.

For the latest news and commentary on financial markets and gold please follow us on Twitter.GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.