Why the Fed Needs Golden Handcuffs

Commodities / Gold and Silver 2013 Jan 30, 2013 - 05:58 PM GMTBy: Jan_Skoyles

Jan Skoyles looks at how 100 years of the Federal Reserve system has affected asset prices, from the Dow Jones Industrial Average to the gold price. Read on to find out what happened in the last century to cause prices to rocket and what the Federal Reserve had to do with it.

Jan Skoyles looks at how 100 years of the Federal Reserve system has affected asset prices, from the Dow Jones Industrial Average to the gold price. Read on to find out what happened in the last century to cause prices to rocket and what the Federal Reserve had to do with it.

This year the US Federal Reserve System will celebrate its 100-year existence thanks to the signing of the Federal Reserve Act in December 1913.

The Federal Reserve System was set up in response to a series of financial crises and ‘panics’, in the hope that it would redress the financial system’s shortcomings.

Following the First World War many countries sought to follow the US and set up an independent central bank. So successful was the US set-up perceived to be that ‘money men’ such Edwin Kemmerer of Princeton University travelled the world ‘preaching the gospel of the gold standard and the independent central bank’.

Since that time, the Federal Reserve’s role has become far more varied to include ‘fostering a sound banking system and healthy economy’ whilst upholding the three key objectives to monetary policy: maximum employment, stable prices and moderate long-term interest rates.

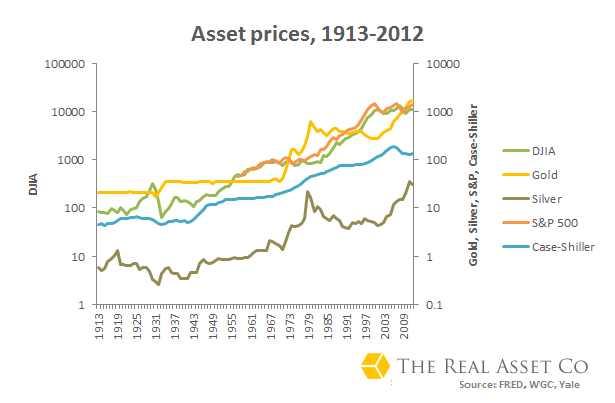

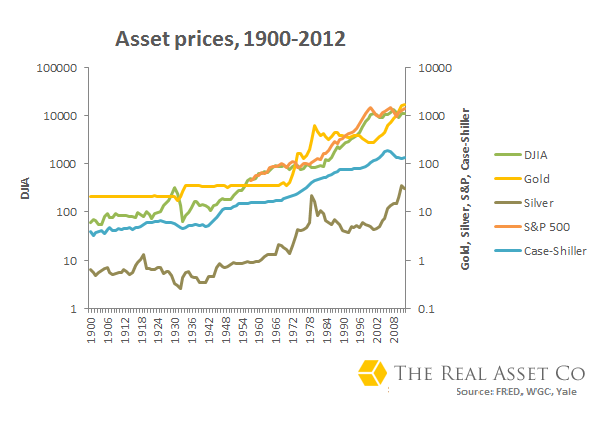

Given that the Federal Reserve’s ever growing role includes maintaining a healthy economy and stable prices, we have looked into the price behaviour of gold, silver, the DJIA, S&P 500 and Case-Shiller housing index, over the Fed’s life time.

The research shows up some interesting results. Namely that the Federal Reserve is unable to manage stable prices if the ‘golden handcuffs’ of a gold-backed dollar are no longer in place.

Clear asset price inflation

First up let’s look at the big picture. The Federal Reserve Act was passed in 1913 and since then we have seen, quite clearly, asset price inflation. It begins to creep in around the start of the Bretton Woods agreement which was signed in 1944.

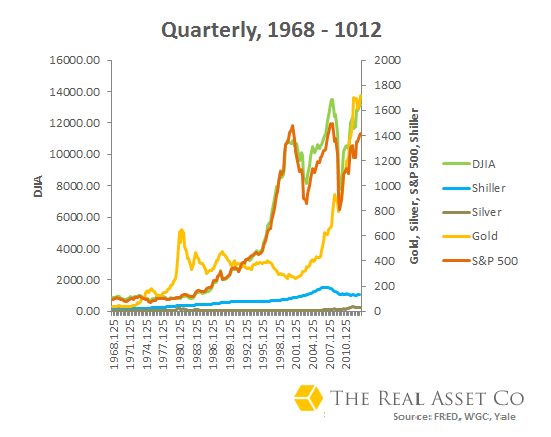

However, it then takes off in two stages. The first, upon the closing of the gold window, in 1971 which we can see more closely if we look at it on a quarterly basis (below) followed by the arrival of Alan Greenspan in 1987 and again in the handover from Greenspan to Bernanke in 2006.

If an extra-terrestrial being came down and looked at a graph of the selected asset groups between 1900 and 2012 they would want some kind of explanation as to what had happened.

Is it just the Fed to blame?

We can’t blame the existence of the Fed on the inflation of asset prices. If you look back to asset prices in the decade before then there is very little change from one decade to another.

This was, of course the period when the world operated either within or in the peripherals of the Classical Gold Standard. Between 1800 and 1914, the value of the US dollar remained relatively unchanged. However, as we see from the graphs above and below, this can no longer be the case.

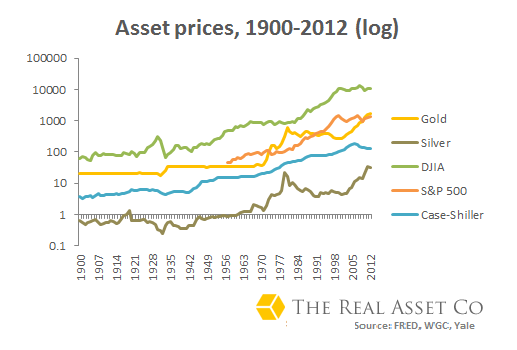

When we look back on the last 113 years using a log-scale we see very clearly that the introduction of Bretton Woods and then the closing of the gold-window, led to an on-going increase in asset prices.

Whilst the Bretton Woods agreement was a half-attempt at a gold-standard, it was nowhere near as strict a control as the central banks needed to prevent them from inflating the economy.

The issue with Bretton Woods was that it failed to limit the discretionary Federal Reserve issuance of the dollar’s convertibility into gold, therefore it was unable to stabilize the long-term price levels. As Hazlitt wrote, ‘The system [seemed] to relieve every other country but the United States from strict monetary discipline,’

The Bretton Woods System was designed to assure stability and reduce the need for gold reserves. Currencies were tied to the Dollar and only the Dollar remained convertible to gold. The Bretton Woods agreement left the US as the only country able to determine its own monetary policy as they were left with the highest gold reserves at the end of WWII.

International cooperation was a significant strength of Bretton Woods, however the strict discipline a classical gold coin standard had offered, was absent. Countries still wished to grow their gold reserves and maintain a balance between their exports and imports; but the US did not have any incentive to balance their trade, as they had done when operating under a full gold-standard. According to Bretton Woods the US could pay their debts in Dollars which, as the sole provider of Dollars, they could print themselves – thanks to the Federal Reserve.

Confidence in the Dollar fell as foreign central banks perceived currency mismanagement, causing gold-reserves to flow out of the country. Nixon closed the gold window in 1971 to stem the run on US gold reserves.

Since then countries have operated a system of floating exchange rates, which Milton Friedman agreed would only be successful ‘if the Federal Reserve does not tamper with the rate of growth’ as would have been the case under the golden-handcuffs. However, as we have seen through repeated easy monetary policies the Federal Reserve does tamper with the rate of growth.

The golden handcuffs and golden rules

In simple terms, since 1971 the number of dollars in circulation not need to equal the amount of gold in the bank. Since then easy money is issued for the ‘benefit’ of an economy where rising prices, whether stocks or housing is deemed to be beneficial.

Yet, look at how volatile this policy approach makes asset prices. As we know (now) from experience, Keynesian economics and central bank currency and economy management creates bubbles. If you look at the years surrounding the year 2000, there is a sharp decline in the Dow Jones and S&P 500. Following on from the Dot-Com bubble burst, Greenspan had raised interest rates.

Shortly after, in 2001, he began an initiative which would see interest rates reduced down to 1% by 2004. Like clock-work gold and silver, as you can see from the graph, began to climb like warning flags of the dangers of this ultra-loose monetary policy which was just beginning.

Since then the US Federal Reserve, now under the leadership of Ben Bernanke, has seen an unprecedented series of quantitative easing rounds. Whilst asset prices are on their way to breaking new records, the price behaviour of assets since 1971, cannot be referred to as ‘stable prices’, nor can an unemployment rate of 7.8% or a federal funds rate of 0.25% be considered as the Fed fulfilling their mandate.

After 100 years, and most specifically the last 50 years, the burden of proof appears to rest with the Fed to justify their existence, policy responses and economic theory.

What do you think? Has the Fed got some questions to answer? Let us know in the comments below.

Want protection from inflationary central banks? Buy gold online in minutes…

© 2012 Copyright Jan Skoyles - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jan Skoyles Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.