U.S. Housing Market Recovery Faces a Brick Wall - Flippers Flopping

Housing-Market / US Housing Jan 31, 2013 - 08:12 PM GMTBy: EWI

In 2005, a mania for residential real estate reached such a fever pitch that a series of cable television shows became entirely devoted to house "flipping."

In 2005, a mania for residential real estate reached such a fever pitch that a series of cable television shows became entirely devoted to house "flipping."

Flipping involves buying a worse-for-wear house, making the minimum repairs necessary, then turning right around and selling it - ideally for a fast and handsome profit.

Two years before the housing bust became painfully obvious to U.S. homeowners, EWI's publications warned subscribers that the housing market had reached extremes and was about to bust.

There's no mistaking it now: Extreme psychology ... has taken up residence in real estate. ...

A significant percentage of the population does not know that a return to earth is implicit in [real estate's] pole-vault to record heights.

The Elliott Wave Financial Forecast, July 2005

That issue published around the time the S&P Supercomposite Homebuilding Index peaked.

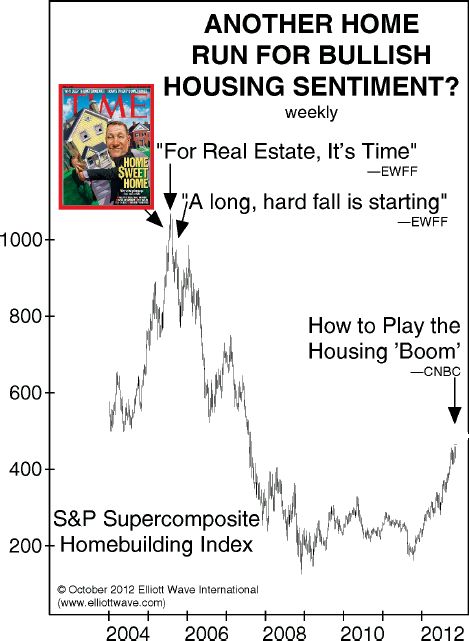

The index bottomed in late 2008. Since then, the index moved sideways into late 2011 and in 2012 staged a modest rebound. Take a look at this chart from the November Financial Forecast (wave labels removed):

The outburst of over-the-top enthusiasm for home buying turned out to be a great sell signal. The Homebuilding Index lost more than 85% over the next 40 months. The rise from its November 2008 low appears to be a ... countertrend rally. ... Near-term excitement has definitely risen.

Financial Forecast, November 2012

As you might expect, the rebound is accompanied by a rise in expectations for a real estate recovery.

The head of the world's largest asset management firm sees more than just higher home prices ahead; he sees a return to 2005 levels.

As the inventory of unsold U.S. homes drops to a more manageable level, the U.S. housing industry is inching closer to a complete rebound, [said] BlackRock CEO.

CNBC, Oct. 4

By looking at the chart, you can see how much farther prices have to climb before achieving a "complete rebound."

What's more, home flippers have returned.

Property Flippers Are Back as Housing's Middle Men

Yahoo Finance, Oct. 15

Is it safe again to speculate in U.S. real estate? How should you handle loans and other debt? Should you rely on the government agencies to protect your finances? You can get answers to these and many more questions in Robert Prechter's Conquer the Crash. And you can get 8 chapters of this landmark book -- free. See below for details.

8 Chapters of Robert Prechter's Conquer the Crash -- FREE This free, 42-page report can help you prepare for your financial future. You'll get valuable lessons on what to do with your pension plan, what to do if you run a business, how to handle calling in loans and paying off debt and so much more. |

Robert Prechter is the founder and president of Elliott Wave International, the world's largest financial forecasting firm. The rest of EWI's 40-page report, The State of the Global Markets - 2013 Edition: The Most Important Investment Report You'll Read This Year, is available for download. Follow this link to download the full report - for free. |

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.