Euro-zone Prisoner of Bureaucracy, The Good, the Bad, and the Greek

Economics / US Economy Feb 07, 2013 - 12:47 PM GMTBy: John_Mauldin

“The euro will not survive the first major European recession.” – Milton Friedman, 1999

“The euro will not survive the first major European recession.” – Milton Friedman, 1999

“It seems to me that Europe, especially with the addition of more countries, is becoming ever-more susceptible to any asymmetric shock. Sooner or later, when the global economy hits a real bump, Europe’s internal contradictions will tear it apart.” – Milton Friedman, 1999

“… there will be asymmetric shocks hitting the different countries. That will mean that the only adjustment mechanism they have to meet that with is fiscal and unemployment: pressure on wages, pressure on prices.” – Milton Friedman, 1998

“Barry Eichengreen (1990b), in a detailed analysis of the potential lessons for EMU from the U.S. experience, concluded that monetary integration would limit fiscal independence. He argued that the extent of fiscal transfers in the European Union would have to significantly exceed the extent of fiscal transfers in the United States to be successful, as regional shocks were likely to be significantly greater in EMU countries than in the states of the United States.” – From a lengthy (and exhausting) paper at the Econ Journal Watch, analyzing the writing of scores of US economists about the euro from 1989-2002. The paper was humorously titled “It Can’t Happen, It’s a Bad Idea, It Won’t Last: U.S. Economists on the EMU and the Euro, 1989-2002.”

Greece was (and is) the first real test of the euro. Until the Greek crisis, there was no real need for any eurozone country to actually write a check for any other member. Ireland obligingly shouldered the responsibility for its own bad bank debts, paying off mostly German, French, and British bankers. But Greece required someone else to take the losses and write the checks to bail the country out. The European Central Bank had to agree to allow the Bank of Greece to create euros to bail out its banks (with the fig leaf that somehow Greece will pay them back). As the Greek economy collapsed in the aftermath of the recent crisis, it became evident even to European bankers and regulators that Greece could not pay its debt. Money began to flee Greek banks.

Greece is a small country with large implications. Last week we began to explore what I learned from my recent trip to Greece. In this week’s letter we will finish those observations and in particular look at some of the comments from my meetings with over 40 people: owners of small businesses and large ones, billionaires, taxi drivers, politicians, central bankers, investors, ex-patriots, wives, and mothers. I believe we can arrive at some small understanding of the problems Greece faces. Then we will consider the broader consequences for Europe.

Save the Dates: May 1-3

But first, I take great pleasure in announcing the speaker line-up for my 10th annual Strategic Investment Conference, May 1-3. Here they are, in alphabetical order: Kyle Bass, Mohamed El-Erian, Niall Ferguson and his wife, Ayaan Hirsi Ali, Lacy Hunt, Charles and Louis Gave, Jeff Gundlach, Anatole Kaletsky, David Rosenberg, Nouriel Roubini, and Gary Shilling. We are finalizing a few other well-known names as well. Seriously, where else can you see a roster like that? Those who come regularly know that the real value is in meeting the other attendees. The conference is cosponsored by my longtime partner Altegris Investments.

Invitations have been sent out to past attendees and those who are members of the Mauldin Circle. We are now going to open up registration. Because of security regulations, we do have to limit attendance to accredited investors and those in the securities/investment business.

If you think you should have had an invitation or missed it, call or write your Altegris representative. Otherwise, you can start the process by going to http://meetings.StrategicInvestmentConference10. There is a significant early-bird registration discount. The conference always sells out in a few weeks, so I suggest you register at your earliest convenience.

Prisoner of the Bureaucracy

As I noted last week, I visited Athens with my friend Christian Menegatti, who is head of research for Roubini Global Economics. Between the two of us, we stayed very busy with meetings. Below is some of what I learned. (I will put generalized quotes in italics, and the commentary after them will be mine.) Let’s start by recalling the story we finished with last week:

The next night offered quite a contrast. In the evening we walked to the base of the Acropolis, found what looked like a promising venue, and entered. It was early by Greek standards, but a performer was playing a guitar and singing Greek tunes to a table of six (ahem) older gentleman, clearly old friends eating and drinking together. (Later we found out they had been gathering once a month like this for 20 years.) As the evening went on and the wine kept flowing, they began to sing. A second guitar appeared. The aromatic cigars came out and were smoked directly beneath the no-smoking sign, with no sense of irony. One patrician gentleman stood a few times to have his picture taken with locals who dropped by that evening.

The singer sang on for three hours without a break, clearly into the moment. Evidently, you cannot sing certain songs without using your arms. At first it was just one participant providing the counter-melody, but then others joined in a multi-part chorus of practiced harmony.

The young owner of that tavern came by, and we started out as we had the night before, asking questions. When he found out what we were looking for, he went to the table and pulled one of the elderly gentlemen away and introduced us. It turned out that he was an economic journalist and chairman (emeritus) of a Greek journalism society. I quickly borrowed a pen and began to take notes on a paper placemat.

He was an odd mixture of pessimism and hope, a perfect living metaphor for what I found from top to bottom in Greece. This was the best government he had seen in his life: “I trust this government.” But when asked if he was optimistic, he shook his head wearily and said no. When we pressed him as to why – and we had heard variations on this throughout the trip – he said, “The government is the prisoner of the bureaucracy. We have 4,021 associations and 6,200 codes. You simply cannot change things. There are 600,000 tax elements. No one really knows who pays what.”

Another of the gents added, “The problem is a problem of laws: you get new laws and yet the old laws don't go away; who knows what to do? If you don't know what laws to follow, that becomes the biggest problem. Actually there are two problems: the number-one biggest problem in Greece is the legal system – there is no rule of law. Number two, the legal system is slow; you can't get a ruling.” A lot of heads nodded in agreement with this statement.

The first guy continued, “Remember the spectacle a few years ago, when a new government came in and found massive debts and accounting irregularities? They blamed all the problems on the old government as they negotiated for new loans from the EU. Of course, the people they were blaming were bureaucrats they themselves had appointed, the last time they were in power.

“The government still to this day does not know how money is spent. They will try to change. But even if they pass new laws, under the rules a minister does not have to enforce them.”

It seems the bureaucracy is the prisoner of the associations – what we refer to in the US as regulatory capture. This results when a regulatory agency, “created to act in the public interest, instead advances the commercial or special concerns of interest groups that dominate the industry or sector it is charged with regulating. Regulatory capture is a form of government failure, as it can act as an encouragement for firms to produce negative externalities. The agencies are called ‘captured agencies.’” (Wikipedia)

And that is a common theme we heard in meetings with businessmen. There is general agreement that the bureaucracy must become smaller and some frustration that it has not: “We lost time by not restructuring. The most important problem is the inefficiency of the public sector; it simply costs too much money start a business.”

The Greek banking system has collapsed. Banks simply have no money to lend. First they had to take huge losses on their Greek government debt. Then they incurred large losses on their regular bank portfolios, as Greek GDP shrank 20% and businesses had no ability to pay and went bankrupt. Finally, their deposits dropped significantly (€86 billion fled), either converted to cash or sent to banks in other countries, as Greeks worried that the country would leave the euro and return to the drachma.

Depending on what document you read (or who you listen to), Europe has arranged up to €50 billion to help recapitalize the Greek banks. €27 billion has been injected to capitalize the four largest banks; but they have to be able to come up with about 10% of the money from private sources, and that money is just not showing up. The Financial Times writes this weekend: “Greece’s banks have begun a frantic lobbying of the bodies behind the country’s bailout, in an effort to ease the conditions imposed on their recapitalisation and avoid full nationalisation.” (Sound familiar? Shades of TARP!)

The only other option on the table right now, other than laying hands on the rather paltry amount of private money, is full nationalization. “One banker who declined to be named said Greek banks’ books were worse than many realise, given that asset valuations and recapitalisation estimates date back to 2011. ‘Greece has performed worse than in the adverse scenario,’ the banker said. ‘The macroeconomic contraction was much bigger in 2012 than forecast. Loan portfolios are still deteriorating.’” (FT)

All the other, smaller banks will be nationalized outright. This will certainly help. More than one businessman told us he or she was no longer worrying about profits but simply managing for cash flow and survival, hoping that at some point a stable banking system would return. “New investment laws, maybe the approval of some large project, must give people a reason for money to come back. Greek investors and citizens must be assured that Greece will be a part of the euro. We must do things to make long-term money feel safe. There is a dilemma: money has left because of fear of leaving the euro, and now it is not coming back because of concern about taxes. But if we grant amnesty for repatriation, it will create ill will. This is not easy to do.”

And taxes are on everybody’s mind. They have gone up, and there are serious efforts to collect them. But there is still suspicion everywhere that others are not paying. I heard from numerous sources that the worst offenders are doctors and lawyers, the upper-income earners.

A Deep Sense of Injustice

And that opinion was echoed by the leader of the left-wing SYRIZA parliamentary group, Alexis Tsipras, who spoke to Wall Street Journal columnist Bret Stephens last week:

But Mr. Tsipras takes a dimmer view of health delivery in his native land. “Why in a public hospital, in order to have an operation, do [patients] have to slip [doctors] an envelope with a certain amount of money?” he asks. “Why indeed? ” I ask back.

“Because the state gives low wages to doctors, thinking it’s completely natural for them to add to their salary” by accepting those cash-stuffed envelopes.

I suggest to Mr. Tsipras that maybe the difference between Greek and American doctors is that the latter have so far operated in a mainly private market, though that’s about to change. He demurs and instead says something about the need to have a “revolution in conscience” by Greek citizens, plus “the will of the state” by Greek leaders. It sounds like the sort of thing you’d expect from someone who names Karl Marx and Antonio Gramsci as sources of intellectual inspiration – romantic in its impulses, repressive in its implications.

But I don’t think Mr. Tsipras is the budding totalitarian or demagogue his detractors say he is. He talks of the “deep sense of injustice” that pervades Greek society, the sense that they have been systematically used and betrayed by their own economic elites and elected officials.

The short article is well worth reading. Stephens is a very good writer.

That sense of betrayal Tsipras mentions, palpable to me while I was there, is also part of the system. In the ‘70s a leftist government came in and began to put “cousins and nephews” of their supporters into jobs in the bureaucracy. And when a conservative government came to power they did the same thing. I kept hearing that 30% of government workers don’t even show up for work. (I’m not sure where that actual stat came from, but it gets repeated.) Some bureaucrats even hold down jobs in the private sector while they continue to collect a government pay check. And because the government is such a large sector of the economy, everyone has someone in the family or a friend’s family who is part of the problem. If you change things, they lose their jobs. Up until recently, the impetus for change was just not there. But that may be changing:

“In the ‘60s every Greek wanted to own his own business, in the ‘80s they wanted to be public servants, and now they want to be in business again.”

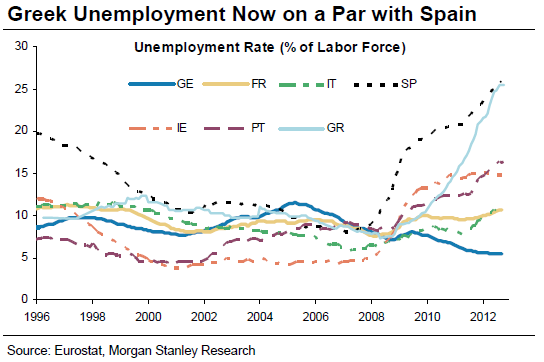

But the problem is that there are no jobs. Unemployment is 27% (the government’s number); and the Chairman of the Council of Economic Advisors, Panos Tsakloglou, told us he was worried it could rise to 30% before it finally begins to turn around.

Tsakloglou was quite candid. He said that the IMF, ECB, and EU would have to accept some form of debt forgiveness and not just put it all on the private sector. Greece still has too much debt for the private sector to be able to service.

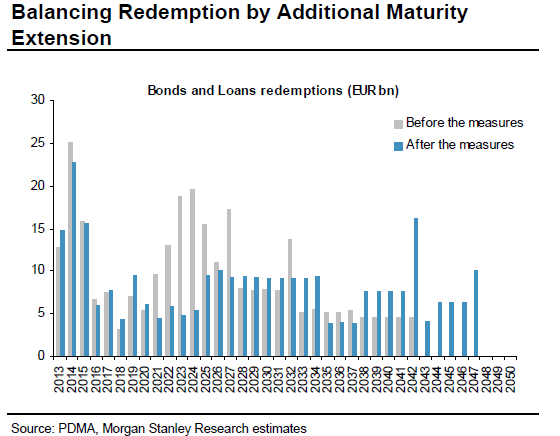

Evidently, more is needed than just debt extension. That has happened already. The chart below shows extensions out for 35 years. I invite my US readers to think back to 1978 and ponder the notion that the US national debt was extended for 35 years from that point, and then try to imagine what the dollar would be worth by now if it had been.

Unemployment among Greek youth is over 50%. That worries Tsakloglou, because young people are leaving the country. If things turn around quickly, they can come back. But if you stay away long enough, you have kids, and then it’s harder to come back. That was echoed in other meetings: “The problem is, young people are leaving as salaries are going down. There is opportunity if these guys leave and then come back, but in five years we’ll need to repatriate the Greek diaspora.”

Greeks think about Europe a lot. Many are ready to see a stronger Europe, with less sovereignty for their own government. “But something must happen about the trade imbalances.”

Remember that quote from Econ Journal Watch at the very top of the letter? It noted Barry Eichengreen’s conclusion that “monetary integration would limit fiscal independence. He argued that the extent of fiscal transfers in the European Union would have to significantly exceed the extent of fiscal transfers in the United States to be successful, as regional shocks were likely to be significantly greater in EMU countries than in the states of the United States.”

(I met Barry in South Africa last year when we spoke at the same conference. Really thoughtful on a very wide set of topics.)

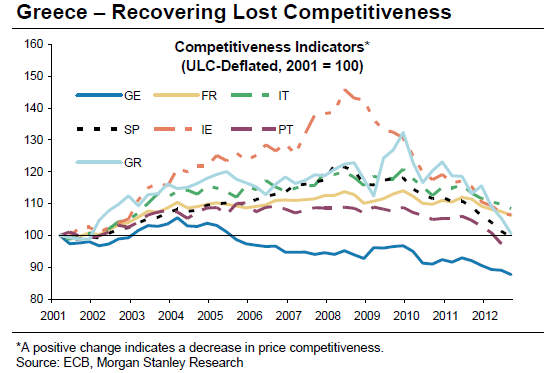

I was already writing a few years ago about the extremely unfavorable balance of trade that Greece endured. That imbalance is going away (that happens in depressions, as there is no money to buy imports), as is the wage differential with the rest of Europe. Estimates are that by the end of 2014 the wage gap will be nearly gone. One business manager said that his Greek plant was as productive as his German plant. The cost difference came in dealing with the bureaucracy. “Not just the cost of bribes, but even worse is incompetence.”

Let’s look at another chart from Morgan Stanley:

There was general agreement on the need for foreign investment. There is no domestic saving to speak of, which limits deposit growth, which means banks will be tight-fisted, even with the new European money to help recapitalize them.

The Good, the Bad, and the Greek (Risks)

Even with all the problems, there was a hint of tempered optimism in the air. One formerly highly placed government official said, when asked if he was willing to invest his own money in Greece, “In six months if things go well.” And that time frame was on everyone’s lips.

There is more austerity coming, and it will have to be agreed to. It will not be popular. The coalition government has already seen defections and is left with a majority of only 13 votes out of 300, with 16 lost since last May. They can’t take many more breakaways.

There is worry about political unrest this spring, which could cause some coalition members to withdraw support. New elections would have economic consequences. It is the lack of certainty that is one of the biggest problems in Greece. Everyone seems to expect that the tourist season will be robust and things will begin to turn around by summer. But getting there is risky, and that has people focused.

Many were candid that their optimism was based in part on the prospect of the government having to give in to the Troika on reducing bureaucracy and the size of government. They welcome the new controls on the government and worry that they might go away.

And to its credit, Greece may be that rarity in Europe, a government that actually hits it budget targets. They are close to a “primary surplus” (a surplus if you ignore debt service), which is the first step in recovering access to the bond market. With increased tax collections, major new austerity measures may be avoided.

We met with Notis Mitarachi, the Deputy Minister of Development. Two years ago he was a private investment banker in London. He came back to Greece and ran for parliament and won. For his sins (for working in finance), he was given a very important post, one that requires him to sort through the bureaucracy and help foreign investors put money to work in Greece. He brings that experience with him and wonders why Greece can’t become as easy to do business in as London. He dreams of structural reforms but is not waiting for a committee to act. He is there to help larger investors cut through the issues. Greece needs foreign investment if the government is to survive, and that is his current mission. If there are more like him, then Greece has a chance.

The risks inhere in something old and something new. While Europe has so far been willing to write checks in return for significant budget cuts, if there is “Greek fatigue” in some capitals of Europe that results in demands for even more austerity, it would be difficult to sell to the populace. Greece is going to be on some type of support program from Europe for a long time.

One source of risk that kept coming up seemed odd to me on first hearing, and that is tiny Cyprus, whose banking system is also bankrupt – but those banks are four times larger than the country, financially. And there is considerable political turmoil in Cyprus, with elections due in two weeks (February 17). While the cash problem amounts to only about 10 billion euros, the procedural problem is challenging. When you deal with Cyprus, you will be establishing a precedent for dealing with the rest of Europe. Ireland will be watching very closely, wondering why it too doesn’t get debt forgiveness. There is no consensus on what to do about Cyprus among the nations of Europe. Russia would like to be a player (and hopes to gain a foothold in the banks, I assume) and is offering the possibility of money to what might be a communist government. If the Cypriot government takes on enough debt to address its banking problem, then the government becomes insolvent. Bo ttom line: Cyprus is closely tied to Greece and will affect the Greek economy.

The good news on Greece is that I see little reason or even any serious movement on its part to leave the euro. I have long been a euro-skeptic from a pragmatic economic viewpoint. At the same time, I hope the euro experiment succeeds, as I think the world is better off with a united and strong Europe, and the fledgling eurozone is part of that process. In any case, I am not the one who has to write checks to bail out the various and sundry countries; but among those who do write them – the citizens of the eurozone – the sentiment is distinctly pro-euro, and they seemed to be prepared to pay the costs.

I look at how difficult it was to get the US government to release aid to victims of Hurricane Sandy. I would have thought that would go through easily. The votes were, however, highly regional, and it took way too long. Then again, I think about what will happen when Illinois comes to DC hat in hand, asking for a bailout. I don’t think many states will want to help it address its lack of budget discipline with US taxpayer money.

And that is the larger lesson of Greece. Europeans wrote a check for Greece. You know they were not happy to do so. They had to wonder why they let Greece in. Yet they looked at the mess that was Greece and held to their vision and found the money, even if it was from anonymous taxpayers. Such decisions can only be made through strong general agreement. The consensus in Europe is to do what is necessary. If that means austerity for some and taxes for others, then that is the price.

Merkel’s opposition is even more pro-European than she is. The determination on the part of Europe to “hang together” is strong. I applaud it. I hope it can stay that way when it is time to call for France to deal with its own budget imbalances. We shall see.

The challenge for Greece is not to become Germany or the Netherlands. Every country and region in Europe has its own personality. The challenge is for Greece to become a better Greece. That means changing its systems and cleaning up its bureaucratic mess.

Greeks are renowned for their patriotism. It is time for them to move past being just Greek patriots and become Greek citizens, working together to build their future.

Chris Kyle, R.I.P.

I first met Chris Kyle a few years ago at an economics event at Kyle Bass’ ranch in East Texas. That was before he had written his book, and Kyle Bass pulled me aside and briefed me on who would be taking me out that afternoon for my first ever attempt at skeet shooting. Chris had recently retired from the Navy SEALs. He had been in all the major Iraq confrontations and had the most confirmed kills of any special-operations soldier in the history of the US, as a sniper. His longest shot was a 2,100-yard strike against a man armed with a rocket launcher.

We went out to the range, where he patiently worked with a few of us. Despite being from Texas, I did not grow up with guns. They were around, just not around me. Chris was soft-spoken and polite – the best that West Texas breeds. I recognized the roots that ran deep in him. We wandered over to the pistol range, where I shot a real pistol for the first time in my life. I was rather surprised by the kick of the gun –it was hard to hold it on target. It looks so much easier in the movies. I remember expressing my frustration.

Chris came over, gave me a few pointers, and then showed me how it was done. He took the gun from me, slipped in a new magazine, and turned to the target. He emptied the gun as fast as he could pull the trigger, which was fast. The target had one small, round hole in the middle where every bullet had gone. I may never again personally see such skill with a weapon. Later that day he worked with us on rifles, showing us some of his skills. Governor Rick Perry came by, and Chris set him up to shoot the 50-caliber sniper rifle, treating the governor in the same manner as he did everyone else.

That night I heard a few stories about Fallujah that amazed me. They sounded a lot like those of my son-in-law Allen, who was a very young Marine when he went into combat there. Chris was one of the snipers who kept Allen and hundreds of others like him alive.

Chris went on to write a searing story of life, family, and combat called American Sniper, which became a major best-seller. I read it last year and shuddered at what we put our young men through and the courage it takes to do what they do. The book gave me insights into battle, combat, and the mind of a warrior that I had never experienced.

There were two times when Chris was literally counting down the seconds until he ran out of ammo and his site was overrun, yet he kept protecting his fellow soldiers. The cavalry did show up at literally the last second, so he survived; but I marvel at a man who could calmly do his duty right up till the moment he thought was his last. And then go out and do it again the next day.

Chris took no pleasure in killing, but of course there was tremendous satisfaction in saving the lives of “his boys.” His regrets were for the lives he could not save. And he was the best at what he did. There are a lot of young men like my son-in-law, the father of my next granddaughter, who are alive today because of Chris. I looked forward to getting to meet him again from time to time.

Chris was tragically murdered this weekend while helping another soldier with post-traumatic stress disorder. They were at a gun range, where he would go with soldiers and ex-soldiers to help them out. It was one of the ways he gave back. There are many accounts in the news today, if you want to know more.

I and all those who knew him are shocked and profoundly saddened at something that is so seemingly senseless. My heart goes out to his family (he leaves a wife and two children) and to his friends. He was an American hero and a true Texan. And now he is legend. R.I.P., Chris Kyle.

I am sure there will be a charity to which you can donate to honor his life. Drop me a note at warrior@2000wave.com and I will let you know when I find out. And with that, I will hit the send button.

Your marveling at how life works analyst,

John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2013 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.