Record Dollar Value Gold Demand In 2012 - India, China and Central Banks Buy

Commodities / Gold and Silver 2013 Feb 14, 2013 - 01:23 PM GMTBy: GoldCore

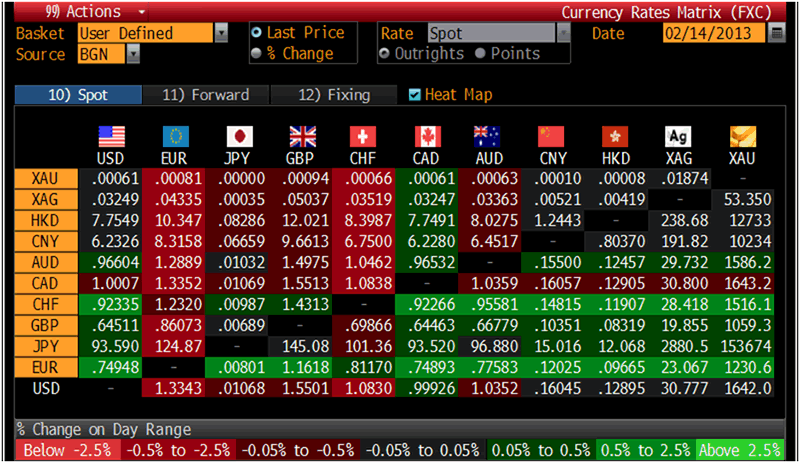

Today’s AM fix was USD 1,644.00, EUR 1,233.22 and GBP 1,060.37 per ounce. Yesterday’s AM fix was USD 1,648.00, EUR 1,223.55 and GBP 1,054.59 per ounce.

Today’s AM fix was USD 1,644.00, EUR 1,233.22 and GBP 1,060.37 per ounce. Yesterday’s AM fix was USD 1,648.00, EUR 1,223.55 and GBP 1,054.59 per ounce.

Silver is trading at $30.85/oz, €23.24/oz and £19.98/oz. Platinum is trading at $1,730.84/oz, palladium at $765.00/oz and rhodium at $1,200/oz.

Cross Currency and Precious Metal Table – (Bloomberg)

Gold fell $8.50 or 0.51% yesterday on closing at $1,643.00/oz. Silver slipped to as low as $30.72 and ended with a loss of 1.09%.

Gold edged up on Thursday, as bargain hunters showed buying interest and gold was particularly strong in euro terms after data from Europe confirmed the continent remains very vulnerable to economic shocks.

The euro area recession deepened and data showed that the euro area economy shrank the most since 2009 and its three biggest economies, Germany, France and Italy, suffered slumping output.

G20 nations should take a stronger stance against currency manipulation the Russian Finance Minister said this morning after G7 conflicting statements about currency wars in recent days.

Hong Kong opened trading today and is seeing the physical jewellery demand pick up, but the bulk of Asia is still closed for the entrance of the Year of the Snake for the lunar New Year.

U.S. weekly jobless claims are reported at 1330 GMT.

The world's largest gold-backed ETF, SPDR, said its holdings edged off 0.07% to 1325.99 tonnes on Wednesday from 1326.89 tonnes on Tuesday, but remains near record highs.

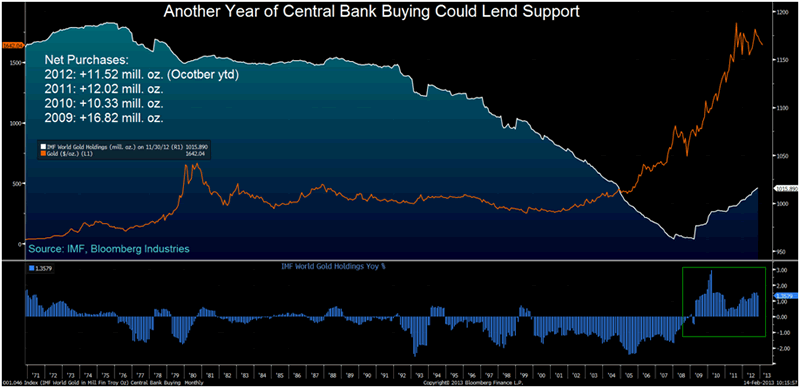

Central Bank Gold Demand (1971 to Today)

According to the World Gold Council’s Q4 2012 report issued today, Global gold demand in Q4 2012 reached 1,195.9 tonnes, up 4% from Q4 2011. In value terms gold demand for the quarter was 6% higher year-on-year at $66.2bn marking the highest ever Q4 total and driving annual demand in 2012 to a record value of US$236.4bn.

Gold demand ended a challenging year on a strong note, with a level of demand in Q4 2012 second only to the record level in Q3 2011, highlighting gold’s ongoing attraction and resilience to economic uncertainty. Overall gold demand remains above the five year average with demand in Q4 2012 driven by India, China and the official sector.

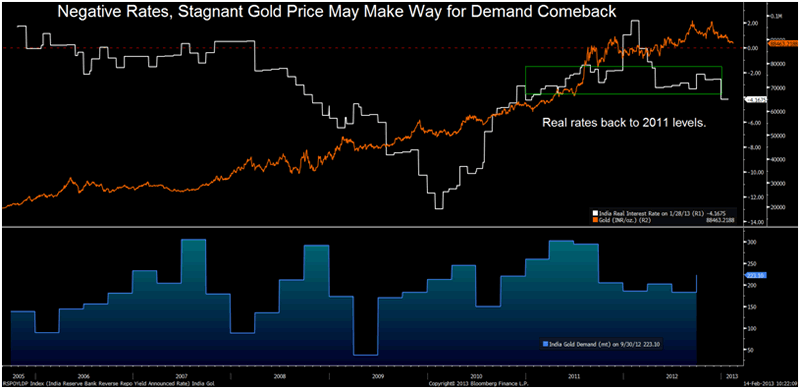

In India, investment and jewellery demand reached their highest levels for six quarters with overall demand up 41% on Q4 2011. China recovered from a difficult start to the year, with strong demand in investment and jewellery, both up marginally on the high levels from the final quarter in the previous year.

Indian Gold Demand (2005 to Today)

Central bank purchasing was up 29% on Q4 2011 marking the eighth consecutive quarter of official sector net purchasing, with full year 2012 seeing the highest levels of central bank purchasing since 1964.

The key findings from the report are as follows: • Whilst Indian full year demand was down 12% on the previous year, the market performed strongly in the final quarter with total demand at 261.9t, an increase of 41% on the same period last year. Both jewellery and investment demand reached their highest levels for six quarters. Demand for jewellery was up 35% year-on-year to reach 153.0t, and strong retail demand led to 108.9t of investment buying. In India the prospect of duty increases, which came in to force in January 2013, may have added to strong buying in the final quarter to beat the anticipated price rises.

• Chinese demand was flat year-on–year, reflecting the impact of economic slowdown. However looking at Q4, total demand was up 1% on the previous quarter to 202.5t. Jewellery demand was137.0t up 1% on Q4 2011 and investment demand was 65.5t, up 2% on the previous year. These increases may reflect the fact that the economic slowdown in China appears to have been shorter than expected.

• Central bank buying for the full year rose by 17% compared to 2011, totaling 534.6t, the highest level since 1964. Central bank purchases stood at 145.0t in Q4, up 29% on the corresponding quarter in the previous year, making this the eighth consecutive quarter in which central banks have been net purchasers of gold.

• Global investment in ETFs in 2012 was up significantly by 51% on the preceding year, though Q4 was down 16% to 88.1t when compared with the high levels recorded in Q3 2012.

The World Gold Council’s Gold Demand Trends report for Q4 2012 and full year 2012 is now available to download from here.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.