U.S. Dollar Rally Reason for Falling Gold Price

Commodities / Gold and Silver 2013 Feb 18, 2013 - 12:06 PM GMTBy: Donald_W_Dony

Gold's recent decline has brought into question, with many investors, why the price of the metal is falling and where it will find support.

Gold's recent decline has brought into question, with many investors, why the price of the metal is falling and where it will find support.

Over the last few days, gold has dropped through a key support level at $1650 and descended quickly down to the next lower level at $1600-$1595 (Chart 1).

The main reason appears to be because of the advance in the US dollar. The US$ has risen from $0.789 to its present $0.805 in just two weeks. Commodities, which are priced in US dollars, lose some of their value when the American currency goes up.

But why is the dollar going up?

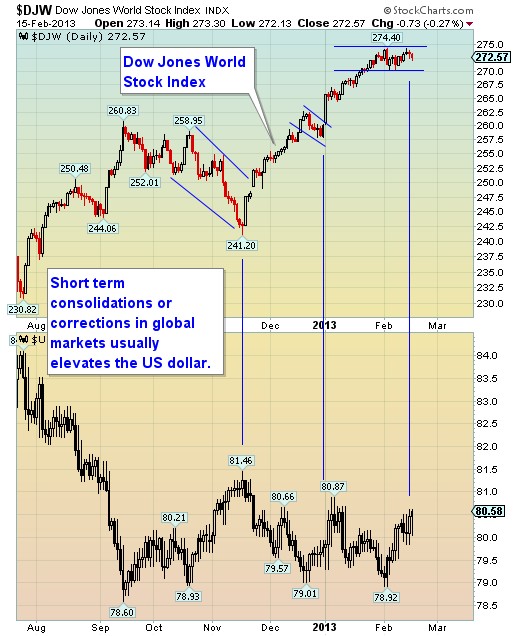

A lot of the explanation appears to be in global equity markets. When world markets consolidate or correct, even for a short time, money flows to the safe haven US$ pulling it higher (Chart 2). Currently global equity indexes are consolidating. This is the second pullback since the new up leg began in November. The first brief correction (December 2012) in the Dow Jones World Stock Index had a similar effect on the dollar moving it up from $0.790 to $0.808.

The longer term view of gold is still bullish. It remains in 12-year climb with no technical signs of weakness. The trading pattern of the metal does suggest that gold goes through periods of consolidation before advancing to the next level (Chart 3). A move above $1800 would indicate that the current consolidation is finished.

Bottom line: The trigger for gold's recent drop appears to be the rise in the US dollar. This was brought about by the current consolidation/correct in world markets. However, these upticks in the dollar are generally short lived and usually only last a few weeks. The dollar remains in a long term downward trend.

Models suggest that the current correction in world stock markets is expected to extend into the second half of February. The dollar should decline once the bull market in world indexes begins again.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2013 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.