U.S. Winning the Currency Wars

Currencies / Fiat Currency Feb 20, 2013 - 04:16 PM GMTBy: Axel_Merk

Currency Wars will most importantly play out at the heart of investors’ portfolios rather than in the blogosphere or on TV. While the focus may currently be on Japan’s efforts to weaken the yen, U.S. investors might be particularly vulnerable. Let me explain.

Currency Wars will most importantly play out at the heart of investors’ portfolios rather than in the blogosphere or on TV. While the focus may currently be on Japan’s efforts to weaken the yen, U.S. investors might be particularly vulnerable. Let me explain.

Currency Wars start at home because the value of the greenback relative to other currencies may be key to investors’ purchasing power. We know the Federal Reserve (Fed) has been busy buying Treasuries and Mortgage Backed Securities (MBS) through their Quantitative Easing (QE) programs. To pay for what is now a portfolio worth over $3 trillion in such securities, the Fed has deployed its “resources” – a fancy name for a computer keyboard, colloquially referred to as a printing press. Intentionally or not, the Fed has helped finance U.S. deficits as the more securities the Fed has purchased, the greater the interest it has earned, allowing it to most recently transfer close to $90 billion in annual “profits” to the Treasury. Of course much of that interest comes from Treasury securities held by the Fed, interest that is then transferred back to Treasury, effectively eliminating the interest the Treasury pays on the portion of outstanding debt held by the Fed (much of it higher yielding longer-term debt). Janet Yellen, current Fed Vice Chair and potential Bernanke successor, recently remarked in a February 11th presentation to the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) that the current (ultra accommodative) policy “is a policy that is not only good for output and employment and American workers, but also for the federal finances overall,” leaving the interpretation open that today’s policy is, at least in part, justifiable on the basis that it helps government finances.

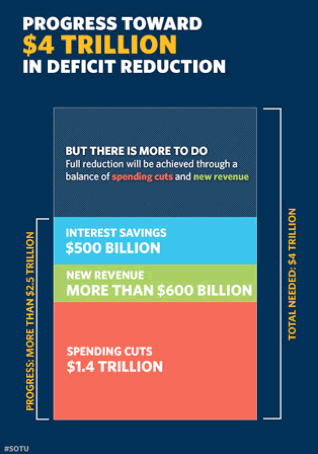

Indeed, as the Fed’s actions have contributed to lower interest rates across the yield curve, the Administration banks on easy money curing its deficit woes: President Obama’s State of the Union Address, presented a slide claiming $500 billion in interest savings, a key contributor to $2.5 trillion in deficit reduction:

It is correct that the cost of borrowing for the U.S. has been declining and may continue to decline in the short-term as higher coupon paying debt matures and is refinanced at lower interest rates. However, in our analysis “Hidden Treasury Risks?”, we showed that the tailwind can easily turn into a substantial headwind.

Last week, I had the honor of moderating a roundtable discussion featuring Philadelphia Fed President Charles Plosser. I asked him whether he is concerned that U.S. deficits might become unsustainable should interest rates rise. Plosser pointed out that deficits at current levels are already unsustainable. To add to the pessimism, in a cover page article published last weekend, Barron’s warned, “if we fail to rein in spending and increase taxes – starting now – the U.S. in 22 years could be in worse shape than Greece is today.”

So why do I refer to Treasuries and interest rates when such talk is not necessary to realize that trillion dollar deficits are not sustainable? And if I may add in that context: policies, no matter how good their intentions may be, that “don’t add to the deficit,” may not be good enough to make deficits sustainable. The reason to consider interest rates is because of the topic at hand: Currency Wars. Consider the following:

- The Eurozone experience showed that the only language policy makers might be listening to is that of the bond market. That is, only when pressured by the bond market do policy makers engage in meaningful reform; the moment the pressure abates, the motivation to implement reform abates. In my assessment, U.S. policy makers will only tackle entitlement reform, urgently necessary to make deficits sustainable, once pressured to do so by the bond market.

- Unlike the Eurozone, the U.S. has a large current account deficit. While the euro suffered at the peak of the crisis, the main risk in the Eurozone was breakup risk, causing those concerned to prefer German or Finnish euros over Italian or Spanish euros (in the form of buying their respective Treasuries). However, the Eurozone’s current account balance as a whole is roughly in balance, which means that net investment inflows from abroad are not necessary to sustain the value of the currency. Conversely, the U.S. requires foreign demand for U.S. dollar denominated assets to sustain the dollar’s exchange value. As such, should there be a selloff in the bond market to pressure policy makers to engage in reform, the U.S. dollar might be under far more pressure than the euro has ever been.

Because of our current account deficit, the U.S. dollar may be vulnerable, from catalysts both inside and outside the U.S. This risk may be reduced, but not eliminated, should the U.S. indeed reach energy independence, i.e., cease to be a net importer of energy over time. While deficits attributable to energy imports and exports have historically been large, they only cover part of the overall trade deficit.

What could trigger a selloff in the bond market? After all, ever since former Fed Chair Paul Volcker convinced the market the Fed is serious about inflation, owning Treasuries has generally been a winning proposition. Consider that the credit crisis was not triggered by a specific corporate failure (the Bear Stearns failure came only as the crisis had started), but simply by a return of risk (volatility) to the markets that forced levered players to de-lever. As an ever-increasing number of market participants de-levered, those that did not have liquid collateral had a problem. Similarly, while a surge in inflation expectations could unhinge the bond market, it may not be the obvious. Notably, we expect the biggest threat to the bond market may be economic growth. As we saw a year ago, good economic numbers can cause havoc to bond investors. In many ways, we have been lucky that all the money that has been “printed” hasn’t stuck. Initially, good economic data are likely to be touted as good news. Historically, however, in an economic recovery, the U.S. dollar tends to fall as the bond market turns into a bear market, causing foreign investors that hold large amounts of Treasuries, to stay on the sidelines. Staying on the sidelines is not good enough for the U.S. dollar that depends on billions in daily inflows to cover the current account deficit.

To learn more how to survive the currency wars, please join us in our webinar on Thursday, February 21, 2013. Please also sign up for our newsletter to be informed as we discuss global dynamics and their impact on gold and currencies.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.