Currency Wars - China Robbing Joe To Pay Chan

Economics / Currency War Feb 22, 2013 - 06:17 PM GMTBy: Richard_Mills

Lately there’s been a lot of talk regarding currency wars. Let’s take a look at why competitive currency devaluations – currency wars – won’t accomplish what’s intended and why we’re going to have to see increasing U.S. protectionism (subsidies, tariffs etc.) regarding global trade.

Lately there’s been a lot of talk regarding currency wars. Let’s take a look at why competitive currency devaluations – currency wars – won’t accomplish what’s intended and why we’re going to have to see increasing U.S. protectionism (subsidies, tariffs etc.) regarding global trade.

Currency War - when countries around the world start competing (competitive devaluation) to make their currency cheaper than everyone else’s as a way to boost trade.

So how do currency wars get started? From Wikipedia comes the following:

“Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. As the price to buy a particular currency falls so too does the real price of exports from the country. Imports become more expensive. So domestic industry, and thus employment, receives a boost in demand from both domestic and foreign markets. However, the price increase for imports can harm citizens' purchasing power. The policy can also trigger retaliatory action by other countries which in turn can lead to a general decline in international trade, harming all countries.”

The currency war is going global, joining the currency depreciation race, or at least considering joining are the Euro-zone, Norway, Sweden, South Korea, Taiwan, Columbia, Mexico, Peru, Chile, Venezuela Luxembourg, Switzerland, Brazil and many other regions.

Winners and Loser

“It seems everyone wants to enact budget reform while simultaneously expanding economically. What's wrong with that? Well, the way most G-20 economies plan to expand is through export growth, a strategy that looks to harness foreign demand for goods and services rather than relying on domestic consumption. However, if overall world GDP growth is anemic or stagnant, the only way to achieve export-led growth is at the expense of someone else. In economics, this is often referred to as "beggar-thy-neighbor" policy, and it is a page straight out of the Great Depression's text book.

Beggar-Thy-Neighbor is an expression in economics describing a set of policies that seek to benefit one country at the direct expense of others. In particular, beggar-thy-neighbor policies typically pertain to an international trade policy of competitive devaluation and increased protective barriers instituted at the expense of trading partners. In its most simplistic form, "beggar-thy-neighbor" describes any economic policy that seeks benefits for one country at the direct expense of another. In practice, it generally pertains to the process of competitive devaluation whereby a country depreciates its currency in the hope of increasing exports.” Scott Minerd, The Return of “Beggar-Thy-Neighbor”, Guggenheim

Despite a massive all out effort to make the U.S. dollar worth less, its exports cost less and increase the number of jobs over the last decade, the U.S. is losing the currency devaluation race:

The goods trade deficit with the EU shot up 16 percent to $116 billion in 2012.

The goods trade deficit with Italy is $20 billion, Ireland $25 billion, with Germany $60 billion.

The U.S. goods trade deficit with South Korea soared 25 percent to $16.6 billion last year.

Japan had a $76 billion goods trade surplus with the United States in 2012. Expect it to increase, the Bank of Japan has driven down the yen 20 percent against the dollar over the last three months in an effort to increase exports to America and cut American imports into the country - the U.S. trade deficit with Japan is going to explode.

China will, in response to Japans deliberate yen depreciation, allow its currency the yuan to depreciate forcing all other Asian countries to do the same to keep their exports competitive with China’s and Japan’s.

Last year, the United States ran a goods trade deficit of $32 billion with Canada and $61 billion with Mexico.

China is robbing Joe to pay Chan

But every trade deficit pales compared to the current one with China….

The U.S. trade deficit in goods with China for 2012 was all-time record - $315 billion. China exports over six times as much in manufactured goods to the United States, $417 billion’s worth, as the U.S. exports to China.

“So it is now that by reason of the abundance of foreign wares brought into this realm from the parts of beyond the seas, the said artificers are not only less occupied, and thereby utterly impoverished … [but] divers cities and towns within this realm greatly endangered, and other countries notably enriched.” British Protectionist Act of 1562

The Chinese government, in an effort to maximize exports and minimize US imports, prints their Yuan to buy dollars. This prevents their currency from rising and the dollar from falling.

According to Tyler Duran over at zerohedge.com China pumped $11 trillion into its economy between January 2005 and January 2013. The amount of newly increased money supply peaked in 2012 hitting US$4.1 trillion (over 26 trillion yuan), with China accounting for almost half.

China also:

- Puts in place purchasing restrictions

- Permits piracy

- Permits cyber industrial espionage

- Delays legitimate items from entering the country

- Provides massive direct subsidization of export production in many key industries

- Maintains strict non-tariff barriers to imports

xe.com

Many estimate China's currency is undervalued by up to 40 percent. An undervalued yuan means that Chinese products are cheaper for U.S. consumers but American products cost more for Chinese consumers.

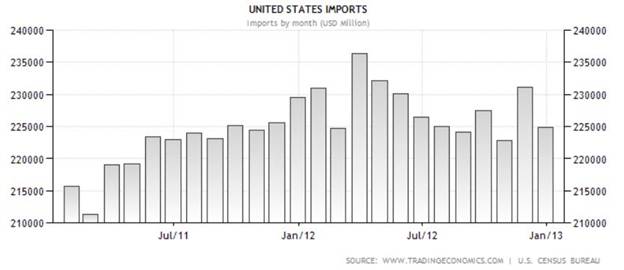

For goods, total U.S. 2012 exports were $1,563.6 billion and imports were $2,299.3 billion, which means America’s overall trade position in 2012 was a global trade deficit in goods of $736 billion – that’s five percent of the U.S. economy.

If the goal is to revive the U.S. economy by a planned currency devaluation driving export and job numbers higher it’s not working. Nor will it by printing more dollars. Every country that exports into the United States has a printing press (a computer keyboard) and will use it.

Income and Jobs

“This Heritage Foundation analysis shows that over half a million American jobs are supported by imports of clothes and toys from China alone. These jobs are in fields such as transportation, wholesale, retail, construction, and finance. Understanding the positive role of imports with respect to jobs, in addition to their other benefits, is critical to adopting the correct trade policy and thus to bolstering the economy.” Trade Freedom: How Imports Support U.S. Jobs, By Derek Scissors, Ph.D., Charlotte Espinoza and Ambassador Terry Miller

According to the Federal Reserve's Survey of Consumer Finances, from 2007 to 2010, a typical US family lost 39 percent of its wealth - in 2007, the median family net worth was $126,400, in 2010, it was $77,300.

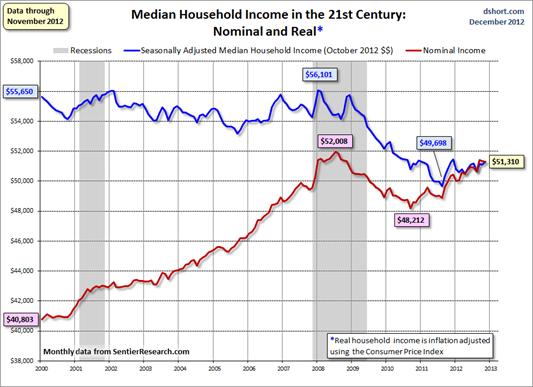

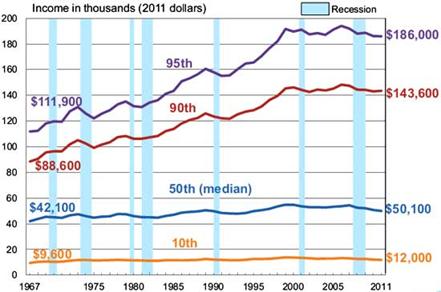

From 2000 to 2011, median income for working-age households fell from $63,535 to $55,640, a decline of $7,895, or 12.4 percent.

Median household income declined by 1.5 percent to $50,054 in 2011 from $50,831 in 2010. Median income in 2011 was down almost nine percent from the recent peak in 1999.

Income inequality, between 2010 and 2011, increased as measured by changes in the shares of aggregate household income by quintiles, the Gini index, the Theil index, and the Atkinson measures. The Gini index showed a 1.6 percent increase from 2010. Since 1993, the Gini index is up 5.2 percent.

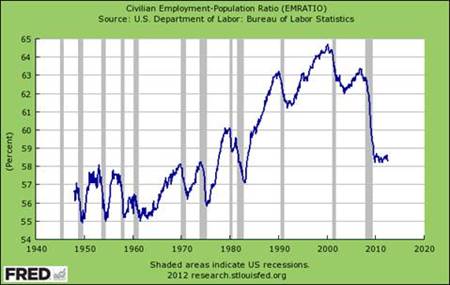

U.S. overall workforce participation rate looks dismal.

Source: Dshort.com, nominal and inflation adjusted household income growth

Adjusting for inflation, Americans are much poorer than they were in 2000.

mybudget360.com

The U.S. began a continuous run of ever-expanding trade deficits in the mid-1970s (the decline in manufacturing’s share of US GDP dropped from 19.2 percent in 1988 to 14.1 percent in 2001, a decline of 27 percent) and it’s no coincidence that at the same time U.S. median income stopped growing.

“While the recovery of the labor market and the broader U.S. economy depend critically on job growth, equally important is the quality of those jobs.” Lila Shapiro, Trading Down, Huffington Post

PNTR

“Until recently first world capital and technology were confined to the first world, no area of which had a massive labor cost advantage that would convey an absolute advantage and suck in capital and technology from other first world areas. The Internet, changes in Asian receptivity to foreign investment, and the willingness of first world corporations to make high-tech investments in third world countries are new developments.

It is irresponsible to assume that the US will not be affected by these new developments or to assume without careful thought that the impact on the US will be beneficial.” Paul Craig Roberts, More On The Trade Wars

In 2001 the U.S. lost 1.5 million jobs in the manufacturing sector. It was the first full year U.S. policymakers had instituted Permanent Normal Trade Relations (PNTR) with China. They did so because they were promised unrestricted access to a booming domestic market for U.S. exports and an improvement in the communist regime’s human rights record.

Of course neither happened – human rights abuses worsened and the Chinese continued with nontariff import barriers.

What did happen was an invitation was printed - ‘come one come all our doors are wide open’ – it was a golden opportunity for U.S. multinational companies to shift their manufacturing facilities to China and they did.

Millions of American manufacturing jobs were lost in the search for cheaper production and enhanced profits.

"On average, 1,276 manufacturing jobs were lost every day for the past 12 years. A net of 66,486 manufacturing establishments closed, from 404,758 in 2000 down to 338,273 in 2011. In other words, on each day since the year 2000, America had, on average, 17 fewer manufacturing establishments than it had the previous day. In fact, in January 2012 there were more unemployed Americans (12.8 million) than there were Americans who worked in manufacturing (just under 12 million). In reality... U.S. manufacturing has been in a state of structural decline due to loss of U.S. competitiveness, not temporary decline based on the business cycle." Information Technology & Innovation Foundation (ITIF) report

“The rapid increase in U.S. imports of Chinese goods during the past two decades has had a substantial impact on employment and household incomes, benefits program enrollments, and transfer payments in local labor markets exposed to increased import competition. These effects extend far outside the manufacturing sector, and they imply substantial changes in worker and household welfare.” David Autor and colleagues, Massachusetts Institute of Technology, The China Syndrome: Local Labor Market Effects of Import Competition in the United States

Protectionism

“A number of emerging economies are the ones who instigated the so called currency war a decade ago, through their export-backed forex reserve accumulation strategy. By keeping their currencies artificially low, they managed to attract domestic and foreign corporations to invest in export focused production capacity and thus steal jobs that would not have been lost in other countries had exchange rates been driven by the markets.

The rise in protectionism in the years after the credit crisis began is disguised by currency manipulation and bailouts of banks and corporations, because even though these are a form of protectionism, WTO rules are ambiguous on them. In a fiat currency system it is increasingly difficult to devalue a currency if everyone tries it at the same time, as demonstrated by the fact that most major currency pairs have not moved much on an average over the last four years as a result of constant interventions through quantitative easing and other actions by central banks.

Frustrated by this failure, the Swiss National Bank and the Bank of Japan have fired the first open shots and others are likely to soon follow suit as falling global trade leads to a rise in protectionist sentiment across the globe. Once central bank action fails in this covert trade war through currency manipulation and bank bailouts, governments will be forced to take direct action through subsidies, tariffs and other trade barriers.” Humayun Shahryar,Forget currency wars, we are in the middle of a trade war, ft.com

Middle Class Disappearing

The U.S. is hemorrhaging jobs and wealth, the effects of the U.S. trade deficit is financially wiping out the middle class - defined as those with annual household incomes in 2010 between $39,000 and $118,000 for a family of three. According to a report released in August of 2012 by the Pew Research Center the U.S. middle class has been steadily shrinking, dropping from 61 percent of all adults 40 years ago to a bare majority, 51 percent, now.

"The notion that we are a society with a large middle class, with lots of economic and social mobility and a belief that each generation does better than the next — these are among the core tenets of what it means to be an American. But that's not necessarily the case anymore." Paul Taylor, Pew Research Center

The U.S. has become a service economy with too high a proportion of part time, benefit free, low paying jobs…

For services, exports were $632.3 billion and imports were $437.0 billion, resulting in a services surplus of $195.3 billion, $16.8 billion more than the 2011 surplus of $178.5 billion.

Please Sir, Can I Have Some More?

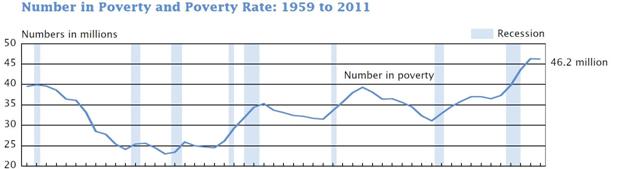

More than 46 million people now live below the poverty line. Tens of millions more are at risk as median incomes continue to decline. The US Census Bureau has set the poverty threshold for a four-person household at $23,000, its latest figures show that in 2011 46.2 million people, or 15 per cent, lived in poverty.

Nearly half of them live in 'extreme poverty' with an income below 50 per cent of the poverty threshold. The Census Bureau also estimated that an additional 51 million people are near the poverty line, with incomes less than 50 per cent above the threshold.

The U.S. population, as of July 2012, was 313,914,040. That’s almost a third – 97 million people - of the U.S. population living in, or almost living in poverty.

Food stamp rolls have risen to more than 47.69 million people in America, that’s a million more people than the entire population of Spain.

The real median earnings of men and women who worked full time, year round declined by 2.5 percent between 2010 and 2011.

Conclusion

Does it sound to you as if trade deficits and ‘jobs supported by imports’ are a good thing? Seems to this author that the opposite is true, that a goods trade surplus shows a country with economic strength and fully employed prosperous citizens. Trade deficits show economic weakness and a lack of prosperity.

What makes a country great is exploiting its natural resources, making things and selling them.

The race to worthless is a fool’s game you can’t win. A rise in U.S. protectionism is on my radar screen, it doesn’t yet seem to be on politicians screens but is it on yours?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2013 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.