U.S. Housing Market Mania Makes a Comeback, Bidding Wars in Washington D.C.

Housing-Market / US Housing Feb 22, 2013 - 06:27 PM GMTBy: EWI

Home-bidding wars have erupted in Washington D.C., a reminder of the days of the real estate frenzy.

Home-bidding wars have erupted in Washington D.C., a reminder of the days of the real estate frenzy.

While much of the nation is still struggling to emerge from a historic housing-market meltdown, the District is reliving its boom days. High rents, low interest rates, low inventory, and a flood of new residents in their 20s and 30s are making parts of the city feel like it's 2005 again.

Washington Post, Dec. 20

The article mentions a run-down home within walking distance of Union Station. The list price was $337,000 --but 168 bids later it sold for $760,951.

Prospective home buyers have bid up other Washington D.C. homes; a resurgence of the old real estate mania is also evident in Seattle, Boston and Palo Alto, Calif.

Will these new, highest-bidder home buyers have the price rug pulled out from under them in the same way buyers did in the mid-2000s?

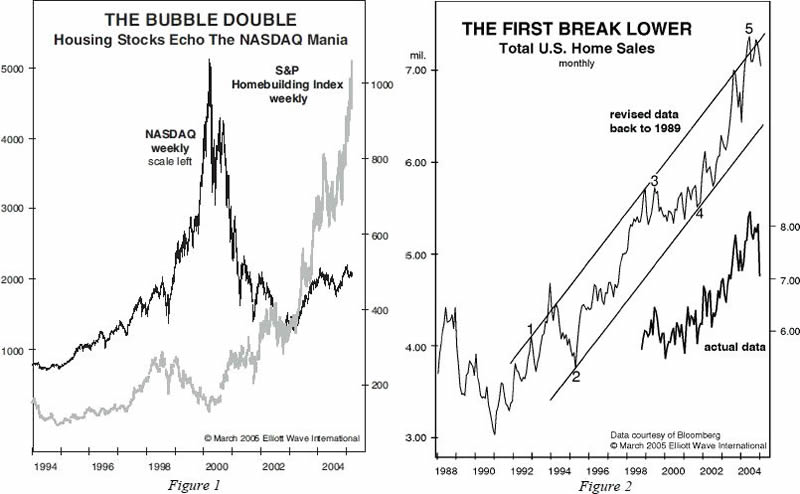

In March 2005, The Elliott Wave Financial Forecast plainly said the real estate market was a bubble about to burst. That issue presented a special section titled "The Real Estate Bust Begins." With the accompanying two charts below, the issue noted:

As shown in Figure 1, the transference of focus from stocks to property began four days after the NASDAQ's March 10, 2000 peak, when the S&P 500 Homebuilding Index bottomed. Since then, the index has soared to more than a 700% gain, which resembles the NASDAQ's October 1998-March 2000 ascent. ... The five-wave pattern from 1990 in Figure 2 says that the January drop in home sales is the beginning of a much steeper long-term decline.

Remember, this analysis was published before the historic crash in real estate values.

Indeed, in most parts of the country, residential real estate prices remain well below their peak highs. Yet the resurgent bidding wars in some markets suggest that the lesson about bubbles remains unlearned.

Keep in mind what Robert Prechter wrote in the second edition of his book, Conquer the Crash:

"Real estate prices have always fallen hard when stock prices have fallen hard." (p. 152)

"At the bottom, buy the home...of your dreams for ten cents or less per dollar of its peak value." (p. 157)

Is it safe again to speculate in U.S. real estate? How should you handle loans and other debt? Should you rely on the government agencies to protect your finances? You can get answers to these and many more questions in Robert Prechter's Conquer the Crash. And you can get 8 chapters of this landmark book -- free. See below for details.

8 Chapters of Robert Prechter's Conquer the Crash -- FREE This free, 42-page report can help you prepare for your financial future. You'll get valuable lessons on what to do with your pension plan, what to do if you run a business, how to handle calling in loans and paying off debt and so much more. Get Your FREE 8-Lesson "Conquer the Crash Collection" Now >> |

This article was syndicated by Elliott Wave International and was originally published under the headline Real Estate Mania Makes a Comeback. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.